Awhile back, I touted this idea of taking the foreclosed properties owned by government-backed entities -- Fannie, Freddie, Federal Housing Administration -- off of the residential housing market and putting them into the rental market. Looks like it's a go from the White House.

Lots to like about this:

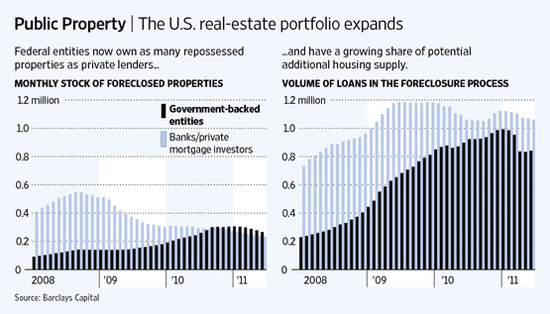

- Fan, Fred, and FHA own about half of foreclosed stock at this point (see graphic on left below), so there's some potential volume here;

How will it work? From the Wall Street Journal:

The Federal Housing Finance Agency, which regulates Fannie and Freddie, will issue the formal "request for information" [RFI] with the administration to solicit proposals that shrink the glut of foreclosed properties weighing on the residential market.

I've heard two arguments against the idea. One is that it's a bad deal for taxpayers -- I mean, we're the "investors" behind these properties right now -- who will get stung by firesale prices. Eh -- maybe, but from what I'm picking up, that's happening anyway. The return on these sales is already lousy. I'd just as soon try something that could help carve out a real bottom on home prices.

Second, investors buying foreclosed properties in bulk make lousy landlords. It's a valid concern, but there's a policy wrinkle in the FHFA/admin's plan that should help: the proposal -- the RFI noted above -- should include requirements regarding property management and the Feds should reject proposals that aren't convincing in that regard.

The risk here is yet another housing program that's undersubscribed and underperforms. But I still think this one makes a lot of sense and good for the administration and the FHFA for trying it.

This post originally appeared at Jared Bernstein's On The Economy blog.