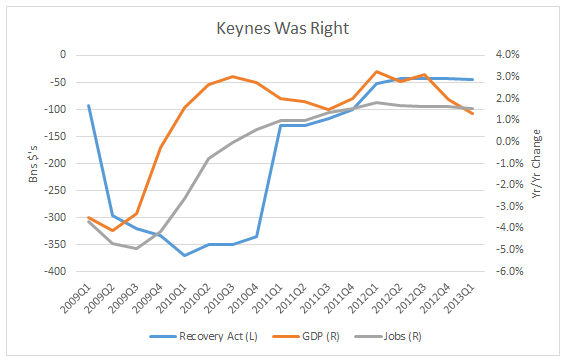

Back when we used to argue about the Keynesian stimulus known as the Recovery Act, I posted charts like those you see here: very simple pictures showing that real GDP started growing shortly after the Act's implementation at the same time that job losses decelerated.

I'll be the first to admit that there's lots of moving parts to these economic relationships and that this is far from detailed statistical analysis, though such analysis has also found compelling evidence that the Recovery Act had its intended effect.

I now see that the Bureau of Economic Analysis has helpfully posted their own analysis of the Recovery Act on the national accounts, thus enabling me to do a little better than just drawing a vertical line through the GDP graph, e.g., when the Act became law (February, 2009). A nice thing about having the BEA time series is that you can get a feel for how key targets of the Act, like real GDP and jobs, responded as stimulus faded.

On that point, I've frequently opined that the problem with the Recovery Act was less that it wasn't big enough and more that it faded too soon. The picture below arguably supports this view.

On the left axis, I've plotted the total impact on the deficit of all the different pieces of the Act, the state fiscal relief, safety net expansions, tax cuts, infrastructure, and so on (these are annualized quarterly data -- if you add them up and divide by four, you get $787 billion, the cost of the stimulus). On the right, you've got annual real GDP and job growth.

When the stimulus was kicking in, adding significant demand to the economy, real GDP and job growth quickly turned less negative, with GDP turning positive later in 2009, and job growth beginning in early 2010. Moreover, as the stimulus flattened, so did they.

Like I said, this is simplistic analysis, but I'm shaving with Occam's razor here: private demand fell off a cliff, a strong dose of Keynesian stimulus helped to reverse some of the damage, but when we pivoted away from stimulus and towards deficit reduction too soon -- before the private sector was fully back up and running -- that progress faded.

Source: BEA, BLS

This post originally appeared at Jared Bernstein's On The Economy blog.