Just because we've got the debt ceiling debate behind us doesn't mean we're finished with economic masochism. The president was last seen trying to pivot to the jobs agenda, but the "fiscal consolidation" crowd is never far behind.

So it seemed like a good time to reflect on the costs of acting too soon -- that is, aggressively attacking the budget deficit before the economy is strong enough to move forward without fiscal support. Some new research by Goldman Sachs ("The Speed Limit of Fiscal Consolidation," subscription required) provides a strong warning.

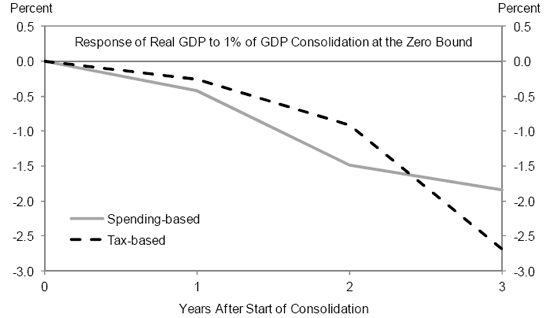

The figure shows the impact on real GDP growth of a 1% of GDP consolidation (which for the US would mean a $150 billion reduction of the deficit) either through cutting spending or raising taxes. What's particularly useful about the Goldman Sachs estimate is that they simulate the Federal Reserve doing nothing to offset the contractionary effect of the fiscal contraction.

Source: GS, The Speed Limit of Fiscal Consolidation, Figure 9

In many cases, when there's risk that deficit reduction would slow growth, the Fed will offset that threat with looser monetary policy (lower interest rates). But what if the Fed has used up that ammo already -- they're at the "zero bound", meaning they've already lowered the interest rate they control to zero (and they're unwilling to use less conventional ordnance, like quantitative easing)?

In that case, as the figure shows, real GDP is projected to fall between 1% and 1.5% after two years, and more after three years. According to the researchers:

For 2012 we expect fiscal restraint of about 1¼% of GDP. Given the zero bound, this adjustment could be expected to lower real GDP by almost 2% by 2014 -- that is, shave off one percentage point off growth for two years.

That's probably about an extra point of unemployment over two years, or another 1.5 million unemployed added to the jobless rolls.

Of course, if growth is much stronger by then, we could perhaps afford to sacrifice some of it to get on a better fiscal path, but it's very hard to imagine it will be, at least for the next few years.

All of which is to say two things: #1, we need a kick-ass jobs plan, and not just on paper but at work in the economy; and #2, we need to hold off on the fiscal consolidation for a few years. That won't make any difference to the long term deficit, but it will make a lot of difference to working families.

And needless to say, we need a very different politics -- one that would accommodate numbers one and two.

This post originally appeared at Jared Bernstein's On The Economy blog.