September turned in strong jobs numbers as payrolls were up 248,000, surpassing expectations (sort of; see below), and the unemployment rate ticked down to a six-year low of 5.9 percent. August's initially disappointing payroll count of 142,000 was revised up to a more respectable 180,000, and the average work-week ticked up to 34.6 hours, a post-recession high and a clear sign of an improving labor market.

Analysts expected 215,000, but the BLS pointed out that about 20,000 grocery store workers were back on the payrolls in September after a work stoppage in August. Netting out this number, payrolls only slightly surpassed expectations.

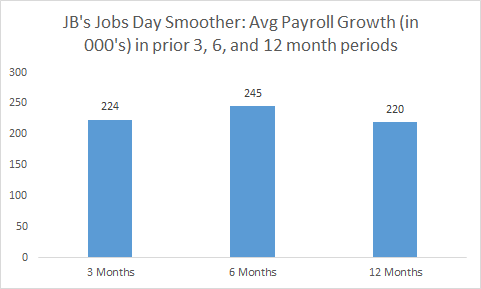

You know my methods, Watson. It's useful to average out the monthly bips and bops in payrolls, so below I give you this month's version of JB's Jobs Day Smoother, showing average monthly job growth over the past three, six, and twelve months.

Source: My analysis of BLS data

The underlying pace of payroll job growth is around 220,000 per month, with a very slight deceleration in recent months. That's a solid, if not breakneck, pace that will continue to gradually tighten up the job market.

The last time the unemployment rate was below 6 percent was in July 2008. Moreover, while the labor force fell slightly (though statistically insignificantly) last month, the decline in the jobless rate over the past year has come for the "right" reason: more people finding work, not leaving the job market (you're only counted as unemployed if you're actively looking for work).

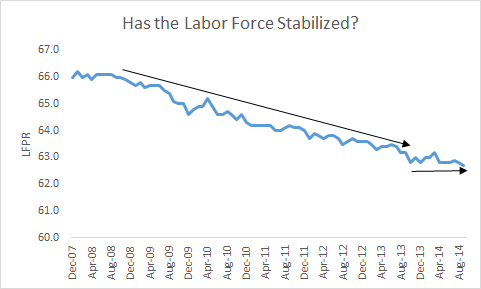

Let me unpack this observation a bit. The labor force participation rate (LFPR) -- the share of the 16 and up population either working or looking for work -- is a key variable to watch these days. It ticked down slightly last month, as noted, but as shown in the chart, has generally stabilized over the past year. This has two important implications.

Source: BLS

First, it suggests a strengthening job market as part of the decline in the LFPR over the recession and weak recovery was due to discouraged job seekers giving up hope. Second, as noted above, it means that recent declines in the jobless rate are due to more people getting jobs versus giving up the search.

While the report and the revisions clearly reflect an economic recovery that is reliably reaching the job market, I see at least two trouble spots to watch, both highly significant.

First, wage trends remain flat at 2%, just about the rate of inflation, implying a) stagnant buying power for most workers, and b) the tightening job market hasn't done much for workers' bargaining power.

Second, in a point I'll return to later in the morning, manufacturing employment has slowed notably over the past few months, adding zero jobs on net in September and October. This may be an early reaction to the strengthening of the dollar in recent months, which makes our manufactured exports more expensive in foreign markets (and imports cheaper).

This post originally appeared at Jared Bernstein's On The Economy blog.