First, my fans tell me I've got a face for radio, so I'm headed for the the Diane Rehm show tomorrow AM to talk what else... sequestration. With that in mind, I've been listening to some of the noise over the weekend and... OMG, what a mess.

The blame game continues, as both sides try to position themselves to avoid blame if it turns out as bad as some reports suggest. There should be no question in anyone's mind that this was a bipartisan agreement -- both R's and D's signed on to the deal with lead R's enthusiastically endorsing it -- and squabbles about who thought of it first strike me as about as relevant as whose idea it was to form a mob and burn the village. The mob has demonstrably signed on, and at this point, the problem is the burning village.

The White House just released state reports providing their guesstimates of the impact. And while the truth is no one knows how this is going to play out, I strongly suspect it will be rough at both macro and micro levels.

Re: macro, estimates are that it shaves 0.5 percent off of GDP growth and loses hundreds of thousands of jobs -- that's off of an economic baseline that's already too weak. My guess is that if the sequestration hits and sticks, the unemployment rate will stay about where it is -- stuck around 8 percent.

Re: micro, the layoffs and furloughs I'm reading about sound real to me, and I suspect their impact will be felt by many people if this drags on for more than a few weeks. Disappearing Head Start slots and WIC cutbacks are exactly what low-income households don't need to be struggling with right now, and for anyone who travels a lot, like I do, the TSA and FAA furloughs are... um... worrisome. Defense contractors, military civilians, the FDA (food inspectors), health researchers... all face furloughs and/or spending cuts.

Meanwhile, the failure of Congress to compromise over a plan to offset the automatic cuts was due to the refusal of Republicans to accept tax revenues as part of the deal. Their argument amounts to "been-there-done-that" since they already allowed revenues to increase in the fiscal cliff deal.

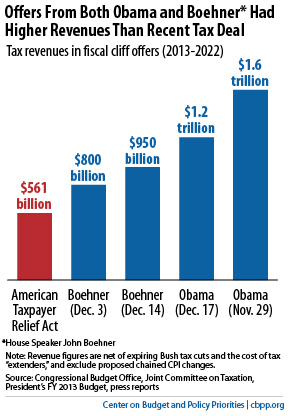

There are, however, numerous strange dimensions to this gridlock inducer. First, note this chart from my colleague CC Huang. It shows all the revenue increases offered during the cliff negotiations, including the $600 billion increase finally enacted when they defused the last fiscal time bomb. No less than Speaker Boehner himself was offering significantly higher revenue increases than were ultimately enacted.

Source: CC Huang, CBPP

Second, spending cuts legislated so far, having nothing to do with sequester, amount to about $1.5 trillion, way more than the tax increases. So if it's OK for R's to say been-there-done-that on taxes why can't D's say the same on spending?

Their response -- the R's -- tends to be that because the tax increases were implemented in January and the spending cuts way back in 2011, it's too soon for more revenues. So there's some undisclosed timing restrictions driving the R's position. Which begs the question: at what point does clock run out on their "no-new-taxes" position? Any chance it could be before March 1?

If you're headed to the airport next week, bring a good book. A good, long book.

This post originally appeared at Jared Bernstein's On The Economy blog.