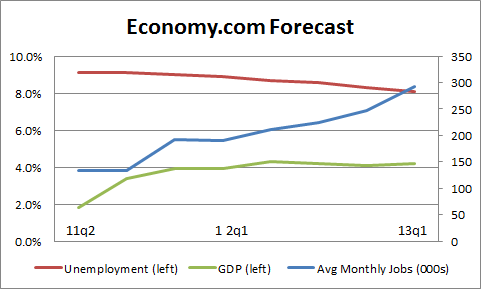

For what it's worth, here's one forecast from 2011q2 to 2013q1, by the estimable Mark Zandi and the Moody's Economy.com team. Like most forecasts right now, it shows slow improvements in GDP, jobs, and unemployment, though the latter glides down slowly to about 8% at the end of the forecast.

Source: Moody's Economy.com, Mark Zandi

Zandi writes:

While hard to see in the current gloom, the economy's fundamentals are improving. Corporate profitability and balance sheets are very strong: The question is not whether businesses can increase investment and hiring, but their willingness to do so. Household debt burdens are easing and credit quality is rapidly improving; delinquency rates among loans other than first mortgages are back to prerecession levels. The financial system has also been recapitalized and is generating significant profits again.

Most forecasts expect this type of pattern because once the "corrections" (e.g., high debt levels) or headwinds (e.g., high gas prices) dissipate, the models assume the natural growth cycle takes over. Investors respond to low interest rates, there's more economic activity (consuming, building, investing), job growth picks up, and you're off and running into an expansion.

And, in fact, this forecast has employers generating around 300,000 jobs per month by 2013, a decent pace that would put faster downward pressure on the jobless rate, so that's the number to watch.

The problem is that so far, the expansion has been jammed by all the factors mentioned here. I don't mean to be gloomy, and I hope Mark and company are right (and even their forecast is for only moderate growth -- more of an upward-leaning L than a V-shaped recovery). But it's just as likely that we'll have to move these three lines forward in time, i.e., we stay stuck in neutral for a few more quarters before these growth patterns kick in.

More to come on this.

This post originally appeared at Jared Bernstein's On The Economy blog.