Robert Putnam tells a resonant and heartfelt story about how his hometown in Ohio has changed since he grew up. It's a microcosm of the economic and social trends that have beset towns and cities across the nation, featuring the impacts of globalization, changes in family structure, inequality, and diminished mobility.

To Putnam, a sociologist, the ultimate cause of our unwillingness to take the necessary steps to push back on these factors, is a "shriveled sense of 'we'":

The crumbling of the American dream is a purple problem, obscured by solely red or solely blue lenses. Its economic and cultural roots are entangled, a mixture of government, private sector, community and personal failings. But the deepest root is our radically shriveled sense of "we." Everyone in my parents' generation thought of J as one of "our kids," but surprisingly few adults in Port Clinton today are even aware of R's existence, and even fewer would likely think of her as "our kid." Until we treat the millions of R's across America as our own kids, we will pay a major economic price, and talk of the American dream will increasingly seem cynical historical fiction.

I agree with that analysis. In fact, it was at the heart of a book I wrote years ago condemning YOYO economics and advocating WITT economics (you're-on-your-own vs. we're-in-this-together). YOYO economics is a health care voucher, a privatized retirement program, an absence of investment to offset disadvantages at the starting gate, no minimum wages, anti-unions, etc. WITT is work supports for the poor, a strong safety net, Keynesian countercyclical measures, full employment as a fiscal and monetary policy goal, manufacturing policies in the face of global competition.

But as I read Putnam's piece, it's that last part that jumped out at me. That is, where things really start to unravel in his telling was in the loss of factory jobs. That's not to say that had the factories not closed, 2013 would be 1950 (with much better television). Large social changes would certainly have effected towns like this no matter what the economics. But globalization -- a word not in his piece -- plays a dominant role in his story.

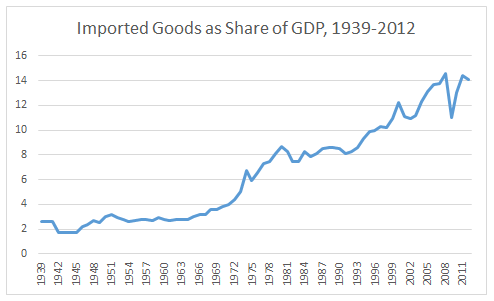

The timing matches up. The figure below shows imported goods as a share of GDP all the way back to 1939. The series starts climbing around the time employment problems enter Putnam's story. And some of the research, nicely reviewed this very morning by economist Nancy Folbre, is also illustrative of the distributional outcomes of the trend shown in the figure.

So how is that increased global trade played such a key role in this story and is yet hailed and revered by policy makers and most economists as a great benefit of modern economies? In fact, for some good reasons. More trade has provided a greater supply of goods and lower prices, of course, but also more fluid supply chains for goods and capital to help moderate supply shortages more common in closed economies. One would be very hard pressed to argue that increased trade has not made most of us better off -- but only in a gross sense, not in a net sense. Let me explain.

At the bottom of the globalization debate is a fundamental error by the policy, political, and punditry community: the assumption that people are first and last consumers, not workers. But when trade effects prices, it also effects jobs and wages. Sure, there are models that tell us how displaced workers from sectors hurt by import competition find their way to shiny new sectors in other parts of the economy, but a) that's not been the case for a lot of folks (see Putnam, or just look around), and b) that's a lot less likely when you run persistent trade deficits, as has been the case in the US for decades.

So does that imply that more globalization in advanced economies necessarily implies outcomes like that described by Putnam? To a small extent, yes. Pre-globalization, there were workers and industries extracting economic "rents" that got squeezed out of the system by more trade. But the much more important answer is: of course not. It's all a matter of distribution. Back to Folbre:

Trade theory emphasizes that those who benefit from free trade should be able to compensate those who suffer, making everyone better off. What trade theory doesn't explain is why the beneficiaries would offer such compensation unless they are forced to do so.

The key is to take some of the benefits of more trade and invest them in WITT-style solutions to the distributional problems caused by globalization. And the problem here is political -- the same one I keep coming back to in post-after-post.

The challenge we face is the interaction of a) a system where politics is deeply infused with private money, and b), where market outcomes, including those generated by globalization, continuously concentrate more wealth at the top of the scale. The beneficiaries of that system will buy YOYO economics and block WITT solutions.

I'm not sure how much of that is a "shriveled sense of we" and how much is unrepresentative political, legal, and economic institutions born of unfettered greed supported by politically biased economic theory.

Source: BEA

This post originally appeared at Jared Bernstein's On The Economy blog.