I received a humbling and personally overwhelming response to my debut Huffington Post blog entry that described my recent decision to move myself and my family from Southern California to Michigan. Of the hundreds of emails, phone calls and letters, the vast majority were from Michiganders welcoming me to the state or thanking me for the vote of confidence in Michigan and for reigniting their hope for a better local economy -- thanks for those!

Some responses were a bit on the cynical side, these coming from both from in- and out-of-staters, questioning the quality, quantity or reality of the opportunities that I expressed. The feedback ranged from: "I don't know what you see in this state, because I have been here XX years, and it is as bad as it has ever been -- but I hope you are right!" to the more colorful: "I think you must have inhaled a bit too much of Santa Monica's illegal herbs before buying those one-way tickets to Michigan -- good luck and stay warm!" Though I did heed the warning to buy a quality pair of long-johns, rest assured no herbal influences were involved in my decision to come to Michigan.

In future posts, I will get into more specific examples of the real entrepreneurial opportunities that lie ahead for the state. But in this post, I want to offer a macro-level view of the larger opportunity I see in both Michigan and the Midwest, as a venture capitalist looking for small businesses that have a chance to become much, much bigger businesses.

Before coming to Michigan, I heard anecdotal stories about the untapped innovation and research of the Midwest. It makes sense, right? America's heartland has the country's largest universities, excellent research hospitals like Minnesota's Mayo Clinic, and established industries with heavy R&D investments. Yet the vast majority of America's venture capital investors reside on the coasts. Therefore, even a beach boy VC like me should be able to make something happen in this environment, or so the logic went ...

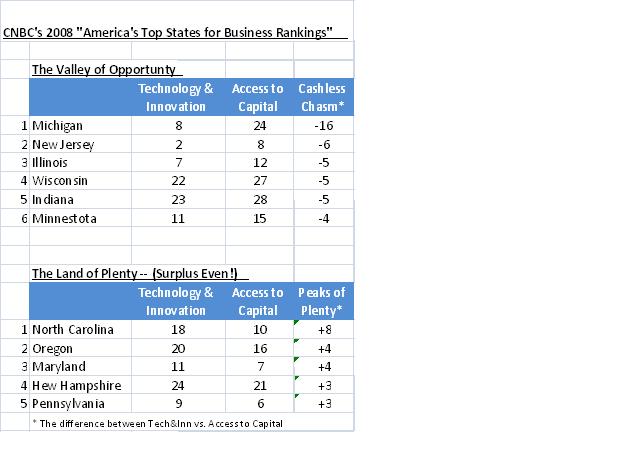

In digging around to qualify my thesis, I came upon a 2008 CNBC report that I believe demonstrates why the Midwest could be called the "Valley of Opportunity." The report is a list that ranks states in a variety of categories, but those I found most interesting were "Technology and Innovation" and "Access to Capital" (Note: I only focused on states that ranked in the top 25 for Innovation -- sorry Rhode Island!).

Unsurprisingly, a quick analysis shows that access to capital is robust for states on the coasts, but not so much for states in the Midwest -- America's "Cashless Chasm." And nowhere is the discrepancy more starkly negative, by a LONG SHOT, than in Michigan, the "King of the Cashless Chasm." No other top 25 state for Innovation is even close:

In an efficient marketplace, one would expect to see some parity in the relationship between rankings for "Technology & Innovation" and rankings for "Access to Capital" -- and for the most part, except for the Midwest, there is. On the top end of the scale, states like California and Massachusetts are #1 and #4 respectively in Tech & Innovation, and #1 and #2 in Access to Capital. On the lower end, states like North Dakota and Wyoming are #47 and #48 in Tech & Innovation, and #46 and #47 in Access to Capital.

However, as the tables above clearly demonstrate, those states with the greatest negative relationship are here in the Midwest. The comparison in the rankings paints an interesting geographic image: mountains of cash on the coasts, for the most part, keeping in line with opportunities that follow innovation; and deep valleys -- capital voids -- in the middle of the country where investors' capital is not in sync with the local opportunities.

Critics will point out that assumptions reliant on these rankings would not withstand rigorous statistical scrutiny. Certainly, the rankings are the quantification of a subjective classification, which inherently will have some flaws or room to quibble. But methodology quibbles aside, the clear big picture image of the Valley of Opportunity is undeniable: many Midwestern states -- Great Lakes states, in particular -- are home to strong technology and innovation, yet the local dollars for taking these advancements to the next level likely do not sufficiently match the scope of the opportunity (and venture capital dollars often do not travel far from the zip codes of VC partners, especially if the phrase "wind chill" is involved in the travel plans!).

This analysis does not tell the whole the story, but it does provide some evidence of the opportunity for the VC who is willing to invest in a more robust winter wardrobe -- notably a sweet pair of long johns ...