I'm stumped. If the recession has made one thing clear, it's that Americans understand the importance of well-managed personal finances. Why, then, do the findings of a new poll from Harris Interactive and Lending Club show that Americans still aren't money savvy?

Not only that, they're missing out on some critical moves that could put them on a better financial footing, even as Washington hammers out the details of financial reform.

The survey shows that when it comes to credit, many Americans aren't as savvy as they should be. While Americans are heavy credit card users, many are unaware of their credit scores and interest rates. Also, many still don't understand the impact that certain actions can have on credit scores and, ultimately, the rates they'll pay on car, mortgage and other loans.

- The majority of Americans know the rates they are paying on their credit card and their credit rating

- Despite this awareness, they continue to carry high interest credit card debt and many do not know how to improve their credit scores

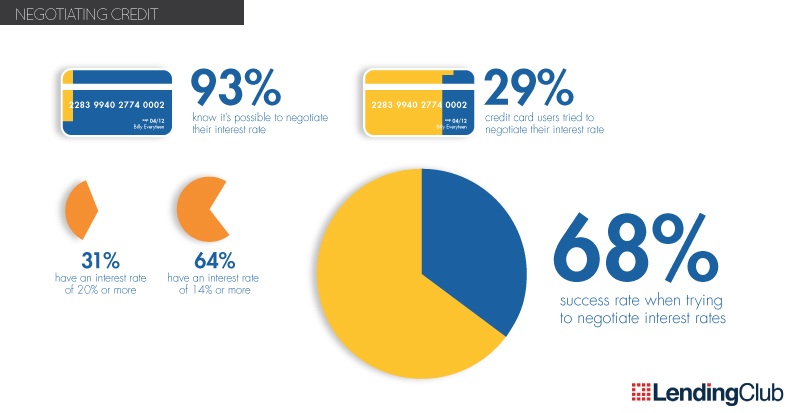

- Of those who know the rates on their credit cards, 31 percent have an interest rate of 20 percent or more and 64 percent pay 14 percent or more

Perhaps the most startling is that only 29 percent of credit card users have ever tried to negotiate their rate, even though 93 percent know it's possible. This is like leaving money on the table, not only for those Americans struggling with a job loss, but also for those needing to build those retirement accounts.

Of those who did negotiate their rates, two-thirds were successful in lowering them. Even from experience -- whether working with Ohio school teacher Kristine Burns on the Dr. Phil Show or knowing the insides of those big banks from my own experience -- I know that more often than not, a request will lead to a favorable outcome.

So, let me share a few tips and strategies that will put a measurable dent in your finances -- your credit scores, the rates you pay, even your bank account.

- Negotiate Your Rate -- If you aren't aware of your card rates, find out. And once you do, take the initiative to ask for a lower rate. Some 68 percent of those who ask, receive -- and build confidence in their financial savvy too. Start with a target rate in mind, be assertive, and ask for the supervisor if necessary.

So, even as we await reform in Washington, at least there are some things consumers can do right now. Not only to get more financially literate, but to boost their savings accounts.

Jennifer Openshaw, CEO of Family Financial Network and Founder of SuperFutures, helping teens discover and build their futures in a new economy.

*Source for overall national average credit card rates: http://tinyurl.com/2cv5vhz