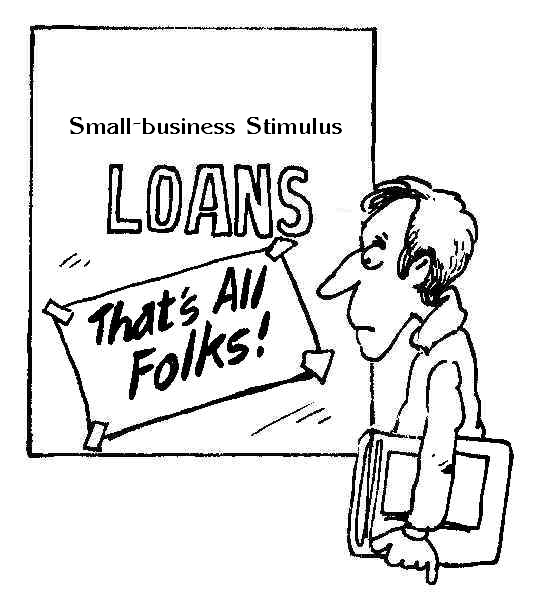

Few Banks Participate

Businesses, Taxpayers Get Shafted

The "America's Recovery Capital Loan Program," known as "ARC," is supposed to be a temporary fix for viable small businesses. It is designed for small businesses that have historically demonstrated their ability to be profitable. But due to the recession, they are having difficulty meeting their financial obligations.

Along comes the stimulus program and the U.S. Small Business Administration agrees to guarantee 100 percent of ARC loans against default.

"These ARC loans can provide the critical capital and support many small businesses need to make it through these tough economic times," said Karen Mills, SBA's administrator, when the program was launched in June. "Together with other provisions of the Recovery Act, ARC loans will free up capital and put more money in the hands of small business owners when they need it the most. This will help viable small businesses continue to grow and thrive and create new jobs in communities across the country."

The loans go up to $35,000 and all SBA-approved lenders are eligible to make them. Using taxpayers' money, SBA pays all the loan fees and interest. Borrowers are only obligated to repay the principal.

I have written about the ARC program extensively but the fiasco is getting worse and I continue to let you know what is happening.

Many business owners want to use it to pay down their credit cards. That is an acceptable use. But they say that they are being rejected even though they fit SBA's criteria. More often they tell me that the bank with which they have an established relationship is not participating in the program. So they hunt for a willing lender to no avail.

Even though the numbers of approved loans are growing, I don't personally know of anyone that has received an ARC loan. I continue to ask my readers and SCORE clients to let me know about their experiences with the program.

An evening news producer with one of the major TV networks was researching small business owners' discontent with the program. He read one of my columns in the Atlanta Journal-Constitution and contacted me for information.

More specifically, he wanted to interview qualified applicants that were turned down. The producer was planning a news report to tell his viewers that SBA's highly publicized loan program was not working.

We traded several emails, discussed the program and I even identified a SCORE client that was angry about being turned down for an ARC loan. The client told me, "I think somebody needs to expose this for what it really is." Her SCORE mentor added that the rejection was a "huge disappointment and waste of time both for me and the client."

Meanwhile, after doing his research, the TV producer told me, "We have thoroughly discussed our options on this story, and have determined for a variety of factors that we do not have enough to move ahead with a nightly news report."

He found that there were problems with the program from its "inception to implementation." But he also noted that there were, "1852 loans approved totaling $60 million with 570 lenders nationwide," and decided to pass on the story since some ARC loans are being made.

But the more opaque problem is that the few banks that are participating in making ARC loans only to their existing borrowers. More unconscionable, ARC loans are being used to pay down the same loans that borrowers are having trouble making payments on. Good money is being used to bolster up bad loans.

In other words, when a bank's existing borrower is having difficulty meeting his or her loan payments, the SBA, using taxpayer money, is rescuing the bank from its shaky loan. Furthermore, the stimulus money allocated for ARC loans will likely run out in the next few months before more stable borrowers get their fair share.

And get this; SBA expects 60 percent of its ARC loans to go into default even though principal payments are not due for 12 months. That will be the second transgression during the next 18 to 24 months. So save this column to help you remember why you should be outraged.

I questioned Mike Stamler, SBA's press office director, about my misgivings regarding who is getting ARC loans and how it is being used. He confirmed that, "In the vast majority of ARC loans, the ARC payments are being used to pay down an underlying loan that was originated by the same bank." More specifically, he says, "ARC loans are supposed to cover six months of payments on the borrower's underlying debt."

The banks are assured of six months of payments on its existing loans whether or not the borrowers eventually default. Other small-business owners are being squeezed out of the process. Taxpayers get pummeled regardless of the outcome.

Jerry Chautin is a volunteer SCORE business counselor, business columnist and SBA's 2006 national "Journalist of the Year" award winner, tenonline.org/sref/jc1bio.html. He is a former entrepreneur, commercial mortgage banker and business lender.