It's funny. Whenever someone asks what I do, I explain that "I help students learn how to pay for college without taking on student debt".

I cannot tell you how many times the person responds with "Oh wow. I wish you were around when I went to college!" Or "Geez. Where were you _5, 10, 15__ years ago!?" I say it's funny because those that value what I do the most are the ones who feel the pain and the burden of student loans.

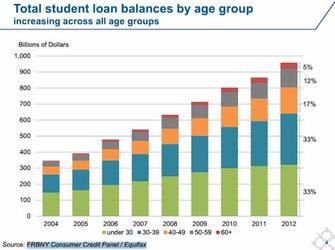

Many adults, including parents, feel the pain of student loans because a lot of them are still paying off their own degrees (or they just recently finished paying them off). The average student loan borrower will take 21+ years to pay back their debt so this is not going to change anytime soon.

We already see situations where parents are still paying their own loans off when their child is getting ready for college. Heck, there are Americans that are over the age of 65, collecting social security, that still have student debt (and you can see below that the number of people in this situation are increasing as well).

So the biggest challenge for parents is figuring out a way to stop their children from following this trend. They need to know how to help their child avoid taking on student loans, even as the student debt is growing at about $3500 per second.

So what can you do to help your child avoid student loans (without paying for college for them)?

Here are 3 solutions to help your student along.

1. Get them involved in activities and organizations that they are passionate about.

Students often join activities because they are told to, not because they are passionate about them. While it's great to have your student be open-minded, having them pursue activities they are passionate about can truly pay off. For example, this will give them plenty to talk about when it comes to scholarship essays.

Speaking of scholarship essays, feel free to download my 3-step guide to writing creative (and reusable) scholarship essays for your student. Download your resource guide here.

It can also make them well-rounded, especially if what they are passionate about is unique. Now perhaps they are passionate about something that doesn't exist (i.e. guitar but there isn't a guitar club at school). This is an excellent opportunity for them to come up with unique ways to tie their passion in with other involvements such as volunteering to play guitar at a retirement home or Ronald McDonald House. Or even better, this can lead them to create the club themselves (which admissions officers and scholarship committees LOVE to see).

2. Stress the importance of college being an investment, NOT an entitlement.

Many students are told to go to "the college of their dreams" versus the one that makes the most sense financially. This has led to students with 6 figures in debt, yet a college degree that only gets them a $35k salary per year. While students should be open to all types of schools, the final decision needs to be based on the return on investment.

If they still want to go to an expensive school, challenge them to find different ways to make it more affordable:

- Can they get college credit while in high school, enabling them to shorten the years they need at the college?

- Can they do a bridge program for their general ed courses and then transfer to their dream school?

- Can they secure scholarships to help cover the costs?

Which leads me to my final point...

3. Provide your student with resources to increase their chances of getting college paid for (without student loan debt).

Many parents invest in an ACT/SAT prep course which is great for bringing up the test scores; however, students are getting less and less funding based on their test scores and more on other competitive advantages.

This means that in addition to test prep, students should become competitive in soft skills (leadership, community service, etc.). This is something I especially focus on with our students so that they are well-rounded and competitive for scholarships, versus strong in 1 key area and lacking in others.

One resource you can take advantage of is our free online training on how to secure scholarships for college. This 1-hour webinar is a great training for you and your student to watch together and jump start the process of finding the billions of dollars out there. If you want to attend, grab your spot today at http://www.thescholarshipsystem.com/free-webinarhf.

Overall, there are many steps involved in students getting their college paid for. Starting with these 3, your student can be well on their way to avoiding the student loan debt scenario that 47 million Americans face every day.

Jocelyn is a best-selling author, public speaker, and founder of The Scholarship System, an online educational platform to help students and families fund college with scholarships and other free money. For more tips on scholarships and funding, visit www.thescholarshipsystem.com. To join her free online training that was mentioned, grab your spot at http://www.thescholarshipsystem.com/free-webinarhf.