Greece reports that it has secured a second major bailout of $172 billion in an attempt to save it from bankruptcy. This is in addition to an original bailout of $146 billion Greece received in May 2010. In addition, it is estimated that Greece may need another $66 billion between 2015 and 2020 to achieve a debt to GDP ratio of 120% by 2020, still excessive by any measure of financial well being.

This totals $384 billion in planned bailouts to Greece, a relatively small economy compared to others in trouble in Europe. Greece's entire GDP is only $312 billion which puts the magnitude of this total aid package in perspective. And there is no guarantee that more monies won't be called for because nobody can predict how Greece's economy might contract given all the austerity measures it has to implement as a condition of these bailouts.

But Greece is not Europe's only problem. Every major country in Europe is highly leveraged with the exceptions of Sweden and Norway. And, Portugal, and much larger Spain and Italy have exceptionally large debt levels and very weak economies.

The Europeans are ready to announce that they are planning to fund a new European Stability Mechanism with approximately $660 billion to avert any other crises like Greece. In effect, they are taking a page from Hank Paulson's book who claimed that if you had a big enough bazooka, you probably would never have to use it. But, the European bazooka looks more like a pop-gun when you look at the magnitude of the potential problems there.

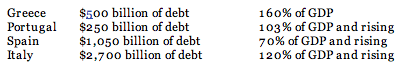

Here are the outstanding public debt amounts for Greece, Portugal, Spain and Italy and what percent of GDP they represent:

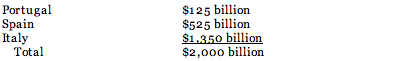

It is unlikely that the bailouts of these countries will cost as much as Greece as a percent of their outstanding debt, but if bailouts equal to just 50% of these countries' debts were required, here is the magnitude of aid we are talking about.

Possible Required Bailout Amount (50% of Current Debt):

That's right, $2 trillion just to bail out these three troubled economies. This is much larger than the newly constructed European bazooka of $660 billion and is large enough to bankrupt nearly every major bank in Europe if they had to face these amounts of write-downs on their European country and bank debt investments. And this says nothing about the support that might be needed by the eastern bloc countries or by countries that are heavily into banking like Switzerland, Ireland, Austria, Denmark, Belgium, the Netherlands and the UK. I don't mention France and Germany only because if the contagion reaches them the game is surely over.

The idea that governments can save countries and large major global banks from defaulting is a farce. It is nothing more than saving bank and country creditors by having taxpayers pick up the cost of their investing mistakes. The world has too much debt in it, on its governments, in its banks and on its people. If we don't begin a worldwide program of debt restructuring we guarantee that these debts will continue to strangle any global economic recovery.

Banks need to be restructured with much less debt and more equity capital so bank executives and bank shareholders have some skin in the game and are motivated to take less risk. Forget giving managements options for free; make them invest some of their cash in their company's stock so they begin to act like true shareholders and not just free riders. Countries need to be restructured to reduce their debt balances, but not until they agree to hard and fast borrowing limits. And homeowners, underwater on their mortgages, have to be given real alternatives to either reduce their debts or to rent their homes rather than own them or to allow them to default without enormous penalties and loss of their credit ratings.

Yes, if we reduce the amount of debt in the world, those holding that debt will appear poorer. Wealthy individual investors, pension funds, banks and insurance companies will all take a hit. But, I would argue, they have already lost that money. It isn't going to be repaid. They just refuse to admit it by not marking their investments down to true value. In so doing, they continue this ruse of keeping too much debt on the world that ends up having a very real impact on our future growth and prosperity.

John R. Talbott, previously a Goldman Sachs investment banker, is a best selling author and economic consultant to families whose books predicted the economic crisis. You can read more about his books, the accuracy of his predictions and his financial consulting activities at www.stopthelying.com