While the stock market swings like a trapeze artist -- "for my next death defying trick, I'll plunge from even greater heights..." -- many investors are busy locking in losses, selling low after having bought high. This kind of self-defeating behavior is what behavioral economist Dan Ariely would call "predictable irrationality." It's not what people would do if they were thinking rationally, but it's what people do when their emotions get in the way of rational thought. We've seen it happen time and again.

David Swensen, of Yale's endowment, wrote last month a commendable piece in The New York Times criticizing this behavior and the "mutual fund merry-go-round," which does little to protect investors' long-term interests.

Swensen makes a compelling argument for revolutionary change in the mutual fund industry, with aggressive regulation and fiduciary standards for brokers. These are great ideas that would help investors. He also advises individual investors to abandon over-priced, under-performing mutual funds and "take control of their financial destines, educate themselves, and invest in a well-diversified portfolio of low-cost index funds."

This second part, about individual responsibility, sounds charmingly idealistic. It's a little like saying the solution to healthcare costs is for people to eat better and exercise more. No doubt true, but unlikely to happen.

The reality? Even with the best of intentions, many of us are still going to panic and chase returns at the wrong time.

To highlight this, consider a simple comparison of two investors:

(1) A typical buy and hold strategy put into place by a "typically irrational" investor

(2) An ideal buy and hold strategy put into place by an "idealistically rational" investor

Let's say that the typical investor and the ideal investor both start off with the same portfolio: a diversified portfolio of 8 low-cost funds (6 equity, 2 bonds). Both portfolios start with a mix of 75% equities and 25% bonds, the kind of allocation that might be appropriate for a young professional with a long horizon and conservative risk tolerance. Equities are 35% international and 65% domestic.

What does the typical investor do?

He buys stocks when they seem to be going up, sells them when they're going down, and reacts twice as strongly to declines. Let's assume that the typical investor moves 10% of his portfolio into stocks for every 20% market increase and 20% into bonds for every 20% market decline.

How much does the typical investor pay?

Aside from the fund fees, the typical investor must pay trade fees. Let's assume an average commission of $10 per trade, four deposits or withdrawals and two trades per year, each time trading three funds. This activity would cost $180 -- or, about 1.80% of a $10K portfolio.

What does the ideal investor do?

He rebalances on a quarterly schedule, or whenever the markets move allocations more than 5% from their target. He contributes money regularly over time, enjoying the benefits of dollar cost averaging and a lower overall cost for shares over time. He diversifies every penny, re-investing dividends at his set allocation. And, perhaps most important, he remains focused on the long term. He does not buy or sell because of daily market activity. He is a passive investor.

What does the ideal investor pay?

Time, discipline, and money for all of the transactions to re-balance, deposit regularly, and automatically re-invest dividends. Let's assume there was a service that empowered the ideal investor to do all of these rational things without paying transaction or trade fees. Let's assume that this service charged an annual fee -- say 0.90% of assets.

What are the returns?

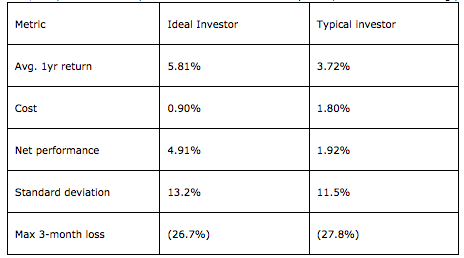

Assuming the rational and irrational behaviors and the costs for a $10K portfolio for the period of December 2003 to July 2011, we'd see the following performance:

The analysis shows a striking 3% annual performance gap between the ideal investor and typical investor. In case that seems insignificant, this could mean a performance difference of more than 250% over 40 years, or more specifically, $2.5mm vs. $1mm.

And the underperformance of our "typical investor" may be conservative -- studies by DALBAR, Morningstar, and others shown that the average investor may underperform the funds he invests in by as much as 5% per year.

So what can we learn from this? Swensen advocates for low-cost above all. But, cost-obsessed self-directed investors in most cases do worse than those in managed accounts. That's why we think it's time for a renewed focus on real human behavior in investing.

Investing is not always as simple as focusing on costs alone, much as we might like it to be. Sure, it's easy to hate on investment advisers and their fat fees. We feel the same way! We hate fat fees too! Especially 2-and-20! But the advice and discipline that good investment managers provide -- to rebalance, to stay the course in wild times -- has real value. Many might try to do it on their own, but it's expensive and easy to forget or ignore -- and those predictable mistakes are incredibly costly.