At Stellar, we believe that increasing access to financial services worldwide hinges on reaching women. Recently I discovered The Girl Effect, a non-profit dedicated to helping young girls break the cycle of poverty.

Why girls? The Girl Effect lists their top three answers to this question:

1.Girls are agents of change

2.People assume girls are being reached [but they're not]

3.The cost of excluding girls is high

From a financial inclusion perspective, these points ring just as true. Most women in the developing world don't have bank accounts. Starting early in a woman's life, there's a long list of factors that hinder financial inclusion: minimum age requirements, lack of formal identification, distance to banks, difficulty securing permission from familial authorities or other cultural gatekeepers.

On top of that, when they do have bank accounts, girls are less likely to maintain hefty balances. Commercial financial institutions are reluctant to design services for small savers, whose accounts they've traditionally viewed as prohibitively costly to administer.

Focusing on girls is a priority for Stellar because we're looking for ways to have a massive global impact on access to financial services. Taking a page from The Girl Effect, this is our (financial-centric) response to, Why girls?

Girls are agents of change

When girls save, they spend their savings in ways that end up generating additional income, furthering their education, and improving the nutrition and health of their families. The resulting ripple effect can lift entire communities out of poverty. Saving not only improves the financial well-being of girls but also nurtures positive attitudes and expectations, building self-esteem and driving productive behavioral changes.

People assume girls are being reached [but they're not!]

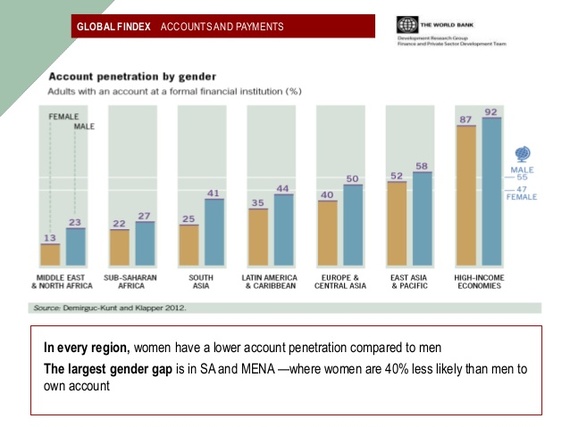

Women are unbanked at rates higher than men all around the world -- this fact alone indicates that girls are not being reached. Mobile devices and the growing availability of mobile money is starting to reverse this trend, but major cultural barriers still prevent women from having access to financial services at the same rate as their male counterparts.

The cost of excluding girls is high

Saving is strongly correlated with increased assets over a lifetime. Girls who hold economic assets have more control over financial decisions and money management skills--and are, it turns out, less likely to succumb to negative health outcomes.

Financial inclusion stands to empower girls in profound ways. In many cultures, it's hard to separate a woman's identity from her economic relationships with others--lack of access to financial services serves to perpetuate gender inequality. Let's change that together.