It was one of those sound bites you hear so many times it becomes background noise: China's never going to agree to limit its emissions, so why should we? And at the global level: Sure, some countries are taking action on climate change -- but if the U.S. and China aren't doing their part, what's the point?

Last week, the presidents of the U.S. and China changed that conversation, with a joint announcement that both countries are setting concrete targets for reducing emissions. That announcement is a big step forward for climate action. And it also underlines another point that often gets lost in the climate change debate: Reducing emissions can also benefit the economy.

Moving to low-carbon energy can benefit the global economy

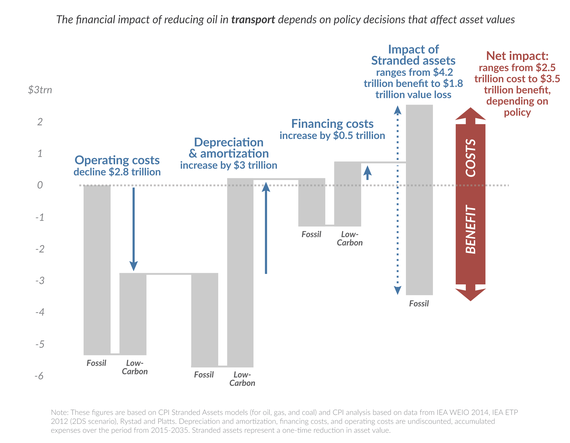

In two papers recently published by Climate Policy Initiative, we look at the low-carbon transition through a financial lens and demonstrate that there are big opportunities to reduce emissions that bring economic benefits at a global scale. For example, if economies that import oil -- like the U.S., Europe, China, and India -- all implemented policies to reduce their usage of oil for transportation, they could see trillions in economic gains. This wouldn't require a binding global agreement -- just a recognition among the big importers that buying less oil can both reduce emissions and save money. Our analysis suggests that the U.S. economy could benefit by more than $300 billion over 20 years in the transition from oil to lower-carbon transportation (for example, adding more electric vehicles), and China's economy could benefit by more than $1 trillion.

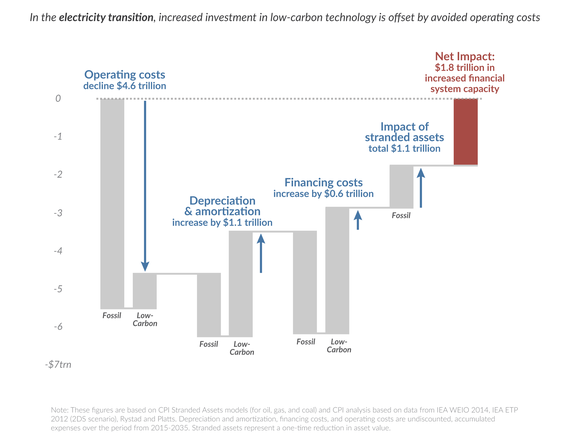

Transitioning to low-carbon electricity generation could also net a financial benefit for the global economy. Renewable energy costs more to build but brings huge savings in operating costs compared to fossil fuels. Mining and transporting coal is expensive, while wind and sun arrive on-site free of charge. And a typical fossil fuel power plant is much more complicated and expensive to operate than a wind turbine or solar array. Over time, these operating savings are larger than the additional capital and financing costs for renewable energy. Looking at the full financial picture -- including operating costs, depreciation of capital, financing costs, and lost value in fossil fuel assets -- we estimate that a global transition to a lower-carbon electricity mix would benefit the global economy by as much as $1.8 trillion over the next 20 years.

It's not just our organization that has come to this conclusion through detailed economic analysis. A commission of policy and business leaders chaired by former President of Mexico Felipe Calderón recently released the New Climate Economy report, which estimated that a set of policy measures with significant economic benefits could achieve 50-90% of the emissions reductions we need to limit warming to 2°C. In its most recent report, the Intergovernmental Panel on Climate Change (IPCC) took a different approach to estimating economic impact and came to the same conclusion: The world can make this transition without a major hit to the global economy.

Smart policy choices are needed to minimize lost value in fossil fuels

Of course, the fact that a low-carbon transition has an overall economic benefit doesn't mean that it will be easy. There will be both winners and losers in a transition to low-carbon systems. As global demand for fossil fuels decreases, their price will also decrease, and the value of existing fossil fuel assets will decline. In our assessment of what losses to fossil fuel assets might look like (so-called "asset stranding"), one major take-away is that policymakers can choose pathways that maximize economic gains and minimize asset value loss.

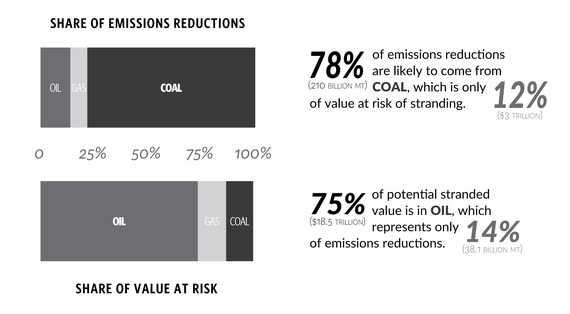

For example, coal appears to offer the biggest bang for buck -- big emissions reductions with limited risk of value loss. Globally, coal accounts for 80% of the emissions reductions in the International Energy Agency's (IEA) analysis of a "two-degree scenario," but we find that it only accounts for 12% of the economic value at risk. Further, the U.S. can largely avoid losing value in coal-fired power plants if these plants are retired at the end of their intended lives, rather than being repowered. When it comes to oil, we find that reducing demand is critical, whether that comes through subsidy reduction, taxes, innovation in low-carbon alternatives, or a combination of all of these. Restricting supply from a few sources won't have the same impact -- in fact, this would mainly result in higher profits to other producers and higher costs to oil consumers, unless demand is reduced as well.

The work's not done yet -- countries need to act quickly

The agreement between the U.S. and China is a big step in the right direction for both emissions and the economy. But there is much more work to be done. Today, China has plans to build hundreds of gigawatts of new coal-fired power plants that don't fit in the IEA's two-degree pathway, and congressional leaders in the U.S. are vowing to stop any progress toward reducing emissions from power plants.

The IPCC's latest assessment confirmed that the world needs to transition from fossil fuels to low-carbon energy systems -- quickly -- to avoid the risk of dangerous climate change. The longer we wait, the more additional fossil fuel value will be at risk -- and the harder it will be to transition to a low-carbon future. Presidents Obama and Xi wouldn't have made those commitments if they didn't think moving to low-carbon energy systems could make economic sense for their countries. Let's work so that policies going forward can meet not only the climate challenge, but the economic one as well.

To learn more about the research mentioned in this article, register for a webinar on Friday, Nov. 21 on how moving a low-carbon economy can free up trillions.