The gravity of the failure of 'free markets' is staggering. But when it comes to confronting the problem we often take a justifiable critique to an extreme conclusion: because markets fail they are bad. The truth however is that markets are what we make them. When it comes to our greatest challenges, including tackling climate change, we have to make markets work for us, not against us. That's exactly what an exciting new start-up, the Social Stock Exchange plans to do.

The SSE was founded by Mark Campanale (you may know him from his other recent venture -- Carbon Tracker -- which provided Bill McKibben with "Global Warming's Terrifying New Math" ) and Pradeep Jethi to develop the world of global impact investing. Impact investing is a relatively new phenomenon that uses markets for a shocking goal -- to make the world a better place. The SSE hopes to support that goal by creating:

A platform that enables wealth managers and social impact investors to find and invest, at scale, in global businesses in sectors such as affordable housing, social transport, ethical consumerism, clean technology and renewables, urban regeneration, public health, education, and businesses overseas that serve the base of the pyramid.

Their vision is essentially to re-embed markets in social structures which they have become increasingly free of since the advent of the industrial revolution. To deliver on their lofty goal the SSE forces companies to prove their commitment by completing a Social Prospectus (SP) that discloses principles of social value creation. That may not sound groundbreaking but can you imagine a coal or oil company attempting to do that? "We plan to create products that will make millions of kids sick with asthma, drive climate change over a cliff, and drive economic inequality to historic levels." Exactly.

So how does this work in the real world? Take the Converging World, a UK-based charity that finances clean energy in India. It needs $10 million to expand the 4.5 MW of clean energy it has installed to 250 MW over the next three years (181 percent CAGR!). The problem is that amounts this small are nearly impossible for development minded institutions like the IFC to finance so despite its positive impact, and profitability, Converging World may not scale. Which means India may not get clean energy for the hundreds of millions who currently lack power.

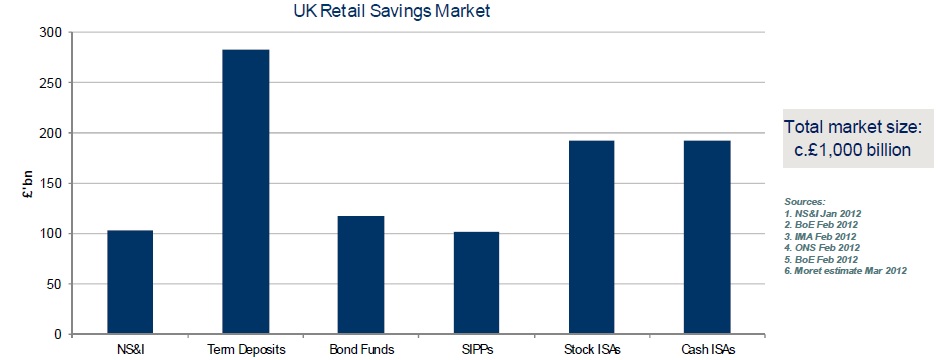

Enter the SSE and the 500,000 ethical investors in the UK investing approximately $13 billion to create the change they want to see in the world. The SSE will act as a bridge to this huge pool of capital by helping Converging World to issue shares on their exchange (just like a traditional corporation would). This bridges the funding gap allowing the company to access funds to support deployment of clean energy.

Which means just like crowdfunding, a social stock exchange can open up society's ability to, by fiat, determine what is 'bankable.' More importantly it can do that based on social values, not arbitrary cost/benefit analyses or the profit motivations of faceless corporations that are unaccountable to anything other than their own greed. Because at the end of the day it's not markets that we need to abolish, it's the power of entrenched interests. And the SSE gives society yet another means of achieving that end.