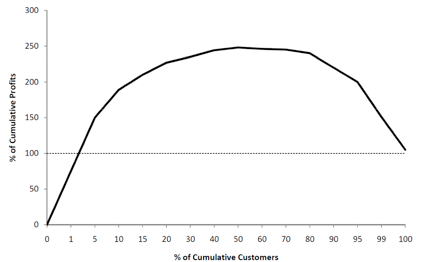

It's called the whale curve -- a schematic representation of profit, replicated below. It illustrates, among other things, how 200 percent of profit can come from only 10 percent of customers. Fifty percent of customers might account for 250 percent of profit. And the bottom half of customers can actually bleed the profits of the firm. Innovation in accounting, called activity based costing of individual customers, has led to this important insight.

What should a manager do with this insight? The more a firm can flatten this hump, the more it will profit from customers who do not bleed the firm. So the question stands: when should a firm fire a customer?

An undeniably strange question, but certain types of customers can prove costly enough that the relationship is worth terminating, as Sprint somewhat infamously demonstrated in 2007. For example,

- A Netflix customer with a 7.99 plan who turns around as many as 10 DVDs per month;

- A bank customer who insists on visiting the bank multiple times a month and never uses ATMs or online services;

- A retail customer who buys numerous items with the intent to return most of them;

- A business customer who exploits free delivery to order small quantities and minimize inventory costs.

There are a variety of solutions available in each case above. Netflix, for example, could slow down its shipment rate; or banks could spend time educating customers about online resources. Generally, firms might raise prices to account for the increased cost of specific customers. But the essential riddle remains whether or not these actions make sense for profitability.

To examine these tradeoffs, I worked with my colleagues at the Yale Center for Customer Insights, Jiwoong Shin and Dae-Hee Yoon, to develop an economic model based on game theory that clarified the relationships between a firm and its customers and aided understanding of how to improve profitability by flattening the whale curve.

We discovered first that most business-to-consumer markets, like direct marketing and online retail, are structured such that every customer tends to be profitable. There is no need to fire any customers because a firm does not spend differentially to serve them; there are essentially no unprofitably high-maintenance shoppers, except those that have a chronic habit of returning items after trying them out. Zappos is famous for the ease with which it facilitates returns, but can be successful only if most of its customers don't make a habit of it.

But in many business-to-business markets, as well as those business-to-consumer markets that demonstrate differential customer costs (as in the examples above), it makes sense to selectively raise prices for high-cost customers, offer lower prices for low-cost customers, and fire the customers who cost more than they expend.

Interestingly, firms can even benefit from selectively firing profitable customers if the cost to serve them is also high.

A common fear of winnowing the customer base is that the average cost will rise for the remaining customers because much of the cost of doing business (e.g., the staff, the office, etc.) remains fixed over the short-term. We find that this is an unfounded fear. Rather, as long as new and profitable customers come in to replace the old, firms will not only be able to cover the cost of doing business, but find it more profitable.

Our modeling approach shows the usefulness of looking at the whale curve from a dynamic perspective, though traditionally accountants look at this model in static terms. Common practice often strives to expand a consumer base, with the intuitive understanding that more customers equal more profit. Unfortunately, intuitive in this case is not also accurate, and selective customer management can flatten the whale curve over time and increase overall profitability.

Not bad when things are lean. It might just be time to hand out a few pink hued receipts.