Social good. It comes in many forms. Consumers feel good when they know that their dollars are being spent on their favorite products and contributing towards a noble cause at the same time.

Corporate social responsibility has continued to increase in popularity and starting to set a new standard in the business world. After all, consumers are more likely to give their dollars to a company who is doing social good in their community.

The question is: How much are companies giving to their community?

The most generous American corporations, Wells Fargo and Walmart, have donated $300+ million to charitable causes. Unfortunately, many of those dollars are not dedicated to the community but are dedicated to issues on a broader scale, which is not confined to the limits of those particular communities.

Many people would argue that giving aid to the wrong areas do not ultimately help the people.

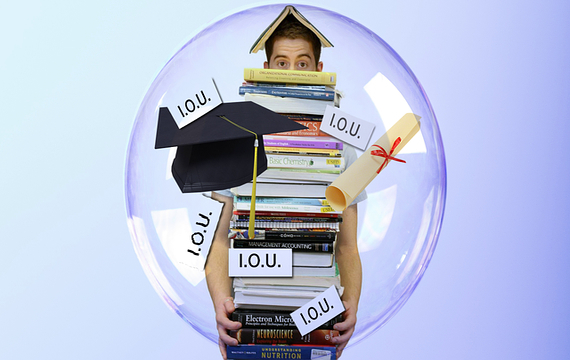

I am one among the many people who agree with that statement. There is one area that I strongly believe deserves more attention. It is the student loan debt crisis!

Did you know that student loans are the biggest monthly household expense?

Did you know that student loan debt have significantly outpaced wage growth?

There are two ways to fight the student loan debt crisis. One way is creating solutions that will help students avoid any debt or minimize the amount (at the very least). The other way is creating solutions that will make it convenient or effortless for debtors to manage their debt.

The Department of Education has programs to decrease or eliminate student loan payments for college dropouts and graduates who are unemployed or underemployed.

Now, the private sector has joined the cause in fighting the student debt crisis. While the number of companies offering help is small, I expect this growing trend to encourage more companies to offer similar solutions.

This is not a complete list of companies offering student loan relief. However, these are a few who are offering some of the best deals.

A small Georgia law firm, Millar & Mixon, is offering three scholarships to high school seniors and college freshmen that write the best essay about distracted driving. The scholarships range from $500 (3rd place) to $2,000 (1st place).

Let's say that you wanted to go to Abraham Baldwin Agricultural College, which is roughly $4,000 a year for in-state residents. If you studied four years for a bachelor's degree, it will cost an estimated total of $16,000. When those costs are offset by biannual Pell grants ($2,865 a semester) and a Millar & Mixon scholarship, it leaves you with no loans to pay back after graduation.

As stated before, one of the best ways to fight student loan debt is to avoid it. Using scholarships and government grants can be a great way to avoid incurring any debt.

The online lender, CommonBond, wants to ease the student loan burden by offering $1,200 a year to their employees. Every employee with outstanding student loans qualifies for the benefit, regardless of their position and longevity at the company.

Chegg is an online bookstore for college students. They care about helping college students with their education as much as helping college graduates with student loan debt.

Any Chegg employee who has student loan debt receives an annual payment of $1,000 towards paying off their debt. Furthermore, the benefit will be extended as long as they remain an employee and still owe student loan debt.

What About Those Universities?

There are many people who want the government to do a better job of regulating the college industry. I do not care whether the government sanctions universities but I do support and appreciate the small businesses, who are easing the debt burden for their employees.

I also appreciate the massive open online courses (MOOCs) that are offered by many accredited universities.

Eventually, more people will become educated about the value of overpriced college tuition and seek other alternatives. I firmly believe that this will no longer be an issue by 2030.

At that point, it is to my belief that education will be either free or extremely affordable. Shai Reshef has already started a trend with his accredited and tuition-free university, University of The People. With a proven and successful education model like University of The People, I am confident that more higher education institutions will follow suit.