BEIJING -- The global debate has focused on the rising inequality across individuals. But a different form of inequality has emerged in China -- the inequality between the household on the one hand, and the corporate sector and government on the other.

For decades, China has been one of the fastest growing countries in the world, lifting hundreds of millions of people out of poverty. At a time when industrialized economies have seen greater inequality within countries, China's accumulation of wealth has contributed to a significant decline in global inequality. But exactly how much of the benefits of that growth has accrued to its rightful owners -- the Chinese households, the bedrock of society?

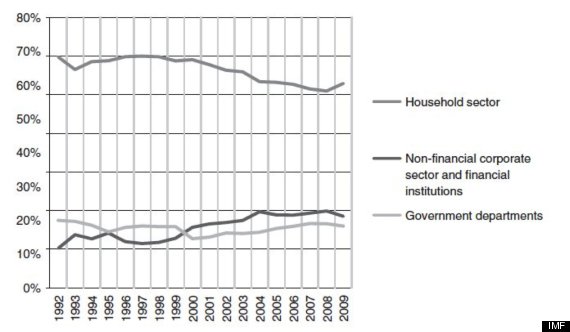

A glaring fact that brings this into question is the rapidly declining share of household income in China's GDP. Between 1990 and 2009, it fell from 70 percent to 60 percent, while the share of household income in the U.S. has remained stable at around 80 percent of GDP. This decline in the share of household income is roughly three times more rapid than even the decline in the global labor share, which has been the key metric of the global inequality debate.

The ways in which Chinese households have been the subject of implicit suppression are plentiful. Some are more explicit, others less obvious.

WAGES THAT DON'T KEEP UP

One example: Wages have been growing at a modest rate in spite of the rapid economic growth. The 17 percent average labor productivity growth in manufacturing since 1997 has only translated into a real wage growth of 10 percent on average over the same period. The reality is that households have not been able to reap the full gains to their productivity improvements.

ZERO PERCENT BANK DEPOSIT INTEREST

While households have missed out on rapid wage growth, they have not been compensated with lucrative returns to savings, either. Perhaps one of the most severe forms of wealth transfers away from households is through "financial repression." In the last decade, the average real return on deposits has hovered around 0 percent -- negative in many of the years.

The mere fact that 80 percent of Chinese household savings is placed into bank deposits earning in negative real returns in many years points to a rather large implicit tax on savings -- above and beyond the only other tax burden imposed -- the personal income tax.

Some back of envelope calculations suggest the implicit tax on these deposits can be as large as RMB 255 billion ($36 billion) -- the equivalent of 4.1 percent of GDP. And yet, the low rates are put in stark contrast to the high rates of returns to capital of on average 20 percent for firms. The wedge between deposit rates and lending rates have, moreover, enriched Chinese banks -- most of them state-owned.

NO CREDIT

Chinese households are also severely credit-constrained. China's financial development has in general, significantly lagged its economic development. But household access to financing is the least developed. As the McKinsey Global Institute reports, China's household debt stands at around 12 percent of GDP in 2008, in contrast to 95.2 percent in the U.S in the same year.

Over the past 20 years of rapid economic development, the household credit market has improved only moderately. It is conceivable that young people would ideally like to borrow against their future higher income for education investment, and also for housing and other consumer durable purchases. But the market is still virtually non-existent.

Young Chinese can't borrow, while the average young American borrowed heavily in the course of the last two decades -- culminating in a 10 percentage points decline in the saving rate for those under the age of 25.

The same can be said about household access to investment opportunities. Savings cannot be invested abroad except through government intermediation, which often directs it to low interest-bearing assets.

Domestically, households are often limited to choosing between deposits and property, with the highly volatile equity markets an undesirable place for parking one's savings.

The inability to diversify risk, a low interest income induced by financial repression, and an inability for the young to borrow, have together lead to a compulsion of ever higher saving rates -- the mirror image of which is a weak consumption demand.

VICIOUS CYCLE -- NOT IMBALANCE The weakening of households' economic power is at the heart of the structural problems of China's macroeconomic model. Popular perceptions of an "imbalanced" Chinese economy should be replaced by the more accurate notion of a vicious cycle.

The most commonly identified imbalance -- between consumption and investment -- is only evidence of a deeper and more complex contorted cycle. In this cycle, financial repression and wage suppression subsidize exports and production, at a cost ultimately borne by households. The ensuing weak demand and low consumption of households compels the government to rely ever more on exports and investment to maintain GDP growth -- requiring further distortionary subsidies that appropriate resources away from households.

Low interest rates have not only contained costs for firms, but also curbed sterilization costs for the massive reserve accumulation associated with voluminous exports.

Though seemingly disparate, some of China's most controversial policies -- capital controls, fixed and undervalued exchange rate, managed interest rates, financial repression and wage suppression -- weave a web of distortionary policies interlinked, independent and symbiotic. Together, they thrust the economy into a contorted cycle -- the deeper it plunges, the more difficult it is to get out.

Thus, the most pressing challenge for China's economic model is to release greater resources available for households.

China's unique mode of state capitalism has invariably focused on speed over form, magnitude over quality. The problems that have arisen from it are also somewhat distinct from those in Western societies.

Different from a Europe where Thomas Piketty worries about inheritance-induced inequality -- so far -- is a passing concern, as virtually all wealth was set to zero during the Cultural Revolution.

At the same time, corporatism and its discontents have not yet barged their way into normalcy, and so much of the inequality owing to extreme managerial compensation characteristic of the American economy has not yet become an issue for China today.

But where these forces of divergence are beginning to show vestiges of their own imposition on the Chinese society, the forces of convergence lie very much in the hands of the state.

Knowledge diffusion and skill acquisition is known to provide a forceful counterbalance to the course of inequity to which capitalism may naturally lead us. Yet these drivers of convergence are largely public goods.

The Chinese government can therefore be an agent for divergence, or an engine for equality and fairness. In its indefinite depth of expediency and force, it can have the power to challenge, exalt and transform.