Can someone -- anyone -- tell me why the Republicans in Congress keep saying 'no new taxes'?

It can't be because they think our economy is improving. It's clear to everybody -- Democrats and Republicans alike -- that our economy is wheezing and mired in a nearly four-year-long jobless recovery with still more than 29 million real unemployed workers.

It can't be because of economic theory. Economists are notorious for their disagreements, yet almost every single credible economist, including Republican favorites like Reagan economic advisors Martin Feldstein and David Stockman, believes we need a combination of revenue increases and budget cuts to get our fiscal house in order. Most also believe we need more -- albeit this time much more effective -- stimulus, to be paid for out of those new revenues.

It can't be because they are trying to represent the will of the people. Sixty-three percent of voters clearly support raising taxes on households earning more than $250,000 a year (New York Times, 8-06-11).

And it's disingenuous to suggest that it is better for the vast majority of Americans if we balance the budget without any new revenues from taxing the extremely wealthy and closing egregious tax loopholes, but rather only further cuts of Defense spending and more insensitive slashing of our nation's core social programs. Any honest analysis of respective tax burdens would show that we have so grotesquely distorted our once-progressive tax system that it now hugely over-benefits extremely wealthy individuals and multinational corporations.

So, how can any member of Congress miss what the polls are saying? The answer has to be -- again -- self-interest of the member and/or his being beholden to the campaign finance largesse of the nation's wealthiest taxpayers and multinational corporations, for no one else in the country benefits from this insensitivity.

Resolution of the "new revenues plus cuts" versus "only more cuts" debate is certainly not going to be found in whether or not one course of action is going to 'double dip' the Great Recession of 2007 and the other is not. Even the 'economic literalists' who still look only to GDP growth as the only measure of economic vitality, rather than to the more meaningful measure of real unemployment, have to concede that, as The Economist recently commented (8-06-11), "Output has not regained its pre-Recession peak and the feeble recovery is petering out." In fact, over the past six months the U.S. has eked out annualized growth of only 0.6 percent, when 3.0 to 3.5 percent annual GDP growth is for our economy no more than stasis.

By only cutting government expenditures, no less a profound expert than Mohamed El-Erian, the CEO of the market-moving bond firm Pimco, says that: "Unemployment will [now] be higher than it would have been otherwise, and growth will be lower. Withdrawing even more spending at this stage will make [the economy] ever weaker." (New York Times, 7-31-11)

It should be possible for members of Congress -- and for the president -- to appreciate the gross insensitivity of a cuts-only approach to the current economic crisis simply by focusing on what we will lose as a nation and as citizens if we only cut further and don't raise new revenues.

The specific responsibility placed on the 12 appointed members of the special Congressional committee is to find, between now and November, at least $1.2 trillion in additional net savings out of the federal budget over the next decade. Yet some of the Republicans on this super committee have already declared their firm opposition to any new revenue from tax changes or reforms, so by the rules established for it, unless the Republicans moderate their positions this means further cuts only.

However, to put the prospect of 'further cuts only' into perspective, as the New York Times editorialized on August 6, the special committee could entirely eliminate (not just cut) the whole of the FBI, Pell Grants for college students, the Centers for Disease Control and Prevention, the National Institute of Health, and the Head Start program for at-risk young children and it would still not eliminate the $110 billion of government spending annually that is needed to aggregate $1.2 trillion of net savings over the next 10 years.

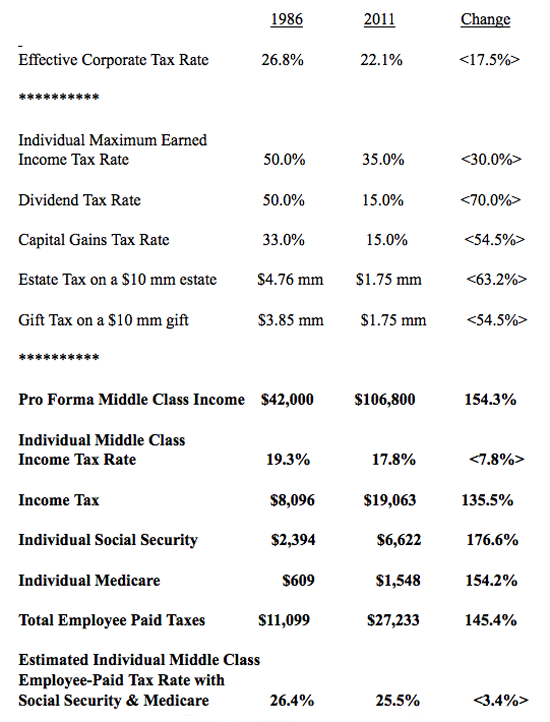

Resolution must, quite obviously, therefore be found in some meaningful amount of new tax revenues. The following summary of various federal tax rates and taxes under President Reagan after passage of his personal hallmark Tax Reform Act of 1986 and here now in 2011 clearly shows why. (These figures were ably put together by my colleague Roger Smith, who shares my concerns -- the highlighting of the estimated individual middle class taxes and tax rates are entirely mine.)

Can't responsible members of Congress, not to mention our president, look at these figures over the last 25 years and see precisely what destruction has been wrought to this country's tax fairness toward the middle class? Destruction that has turned our progressive tax system on its head, to the benefit of the extremely wealthy and big corporations. (See "The Tax Man Cometh -- Just Not For Everybody," Huffington Post, April 12, 2011)

Does not the imperative of sensitively seeking new revenue from tax changes and reforms resound and echo in these figures? And echo as well in the analysis that shows that while federal taxes were 14.9 percent of GDP in 2009 and 2010 and an average of 18.2 percent during the administration of President Reagan (and about 18.5 percent over the entirety of the postwar period), they are this year -- 2011 -- likely to be only 14.8 percent of GDP, are estimated by the non-partisan CBO (Bloomberg Businessweek, 8-18-11).

What do the Republicans in Congress not see and hear when they say that we can't and shouldn't sensitively raise taxes now in order to stimulate our badly stressed economy?

How about if we start such reforms with the embarrassingly obvious step of eliminating the Bush tax cuts for the extremely wealthy and the various tax breaks which otherwise enrich them? Included in this obvious step must be finally taxing carried interests in partnerships as the ordinary income which it is rather than as capital gain which it isn't. This reform alone would bring upwards of $10 billion a year to the Treasury (not the much lower $3 billion 'scored' by the Congressional Budget Office and others), and would cease the charade of investment professionals, who now earn what is in essence ordinary fee income investing other people's money at no risk to their own capital, unfairly receiving the lower capital gains rate aimed at stimulating investment.

On the corporate side, Congress should immediately eliminate the massive subsidies now going to the oil industry while enacting incentives for American multinationals to attribute less not more of their profits to their foreign operations. And as a matter of new law, accumulated overseas earnings should become immediately taxable whenever they exceed some reasonable percent of a company's debt capitalization.

Congress should also consider cutting the corporate income rate to, say, 26 percent while (i) increasing the capital gains rate to 28 percent (the rate adopted in the Reagan-advanced bipartisan Tax Reform Act of 1986), (ii) taxing dividends as ordinary income, and (iii) eliminating unwarranted business tax breaks.

Most important for our long-term economic health, the administration and Congress should consider a value-added-tax or VAT on the order of 5 percent that reduces both corporate income and payroll taxes and includes thoughtful exemptions. Perhaps more than any other single systemic initiative, this combination would spur investments, help America grow its way back to good economic health, and materially reduce the deficit. Replacing growth-choking taxes with a modest VAT while eliminating the incentives to move production out of the U.S. would also be the basis of a new grand bargain between progressives, who must always oppose slashing programs that millions of Americans depend on, and pro-business conservatives, who seemingly always favor lower corporate and payroll taxes.

President Obama often says that we have to "retool our economy" in order to "win the future." A key pillar of any conceivable "re-tooling" must be truly progressive individual taxation (again) and a corporate tax policy that helps U.S. corporations grow and prosper, incentivizes job creation here at home, ensures that corporate America makes their fair contributions to the fiscal needs of our country, and encourages the kind of responsible corporate leadership that will allow this country to responsibly lead the worlds' economies in the future.

Leo Hindery Jr. is chair of the Smart Globalization Initiative at the New America Foundation and an investor in media companies. He is the former CEO of AT&T Broadband and its predecessors, Tele-Communications, Inc. and Liberty Media.