The US government spends $3 for every $2 it takes in in revenue. This would pretty much be our own business if our citizens owned the debt that the US incurs as a result, as is the case in another high-debt country, Japan. But our debt is bought by lots of other people. The imminent failure of the bi-partisan Congressional "Super Committee" which was charged with finding $1.3 Trillion in budget cuts to ameliorate this situation is dismaying. After three months, knowing how high the stakes were, they should have been able to figure something out - why didn't they?

The answer is of course that the US budget debate has been highly politicized. Now it is the time to take a fresh look at the numbers, and the realities behind them. We should be able to solve this frustrating crisis. If we can be technological innovators, why can't we be economic innovators? How did we find ourselves in such a rut, and how can we extricate ourselves quickly?

I have identified a number of politically practical ways in which we could raise revenues in order to diminish our shortfall while maintaining or increasing our growth rate, ranging from taxation of purchases on the Internet to monetizing immigration. I won't try to spell out every aspect of the suggestions on my list, but I will give you some hard facts and numbers to begin the discussion.

By analyzing the figures rather than the players away from the blare of the MSM (mainstream media) a clearer picture of the US budget debate emerges. In spite of all the hype, the Republicans and the Democrats are really not that far apart in their 2012 budget proposals. The difference is only about 106 billion dollars, which shouldn't create gridlock.

Here are the overall budget numbers, which I acknowledge are moving targets:

The Obama Administration proposes $3.729 Trillion in expenditures, and expects $2.627 in revenues. The Republicans propose $3.529 Trillion in expenditures, and expect fewer revenues, $2.533 Trillion, because they don't want to raise taxes. Obama's deficit would therefore be $1.102 Trillion, and the Republican deficit, if they got everything they wanted, would be $996 Billion. The difference: $106 billion dollars. Another perspective on this is that both sides agree that something in the neighborhood of a trillion dollar deficit is unavoidable.

Why is that, the Tea Party wants to know? The answer is that surprisingly, the US does not have much discretionary spending. According to Bruce Bartlett, "aside from defense, social security and Medicare, the US doesn't spend much." We are sort of like a homeowner with a huge mortgage--not much room for extras.

This is a breakdown of what is considered mandatory and discretionary in the most recent federal budget prepared by the Obama Administration:

The Iraq War and the War in Afghanistan are not included in the Department of Defense regular budget, but are included in Overseas Contingency Operations. (Source: United States Federal Budget: Wikipedia)

Here are some ideas to create at least $106 Billion in combined revenues and spending cuts that I believe both parties could agree on:

1. Internet Commerce Federal Sales Tax ($16B)

There is no federal tax on e-commerce in the US, a legacy of the Clinton days when the Internet was in its infancy. There is legislation pending which would allow states to recover sales tax, but we need to target revenue for the US Treasury. E-commerce sales were about $761 Billion. Let's say that a 5% tax begins on January 1, 2012. Online sales are increasing, so we could easily forecast $16B in taxes could be collected electronically. Administration of this tax would require IT expenditures, but it wouldn't mean the creation of a major new bureaucracy. And by and large, it would tax the wealthy and the middle class who buy online.

2. Social Security Tax Credit ($12.5B)

Social Security costs $761 Billion per year, and rising. 25% of benefit recipients have no other source of income at all, but some consider Social Security to be miscellaneous income. There has been a lot of discussion about means testing, which is a bad idea for a number of reasons. Instead, why not offer an incentive to well-off retirees to forgo social security benefits? There is now no way to do this-you receive the benefits whether or not you want or need them. If no more than 3% of the wealthiest Americans (who also receive larger payments based upon lifetime earnings) decided to forgo benefits in exchange for a tax credit that would be worth 50% of their value, this would mean a savings of $25B in exchange for $12.5B in tax credits, for a net savings of $12.5B.

This could be a politically acceptable reverse tax on the wealthy that could take some of the pressure off other tax increases. Affluent people might feel that this would be a way they could elect to contribute to the elimination of the national debt, instead of being penalized through other types of taxation that might dampen investment.

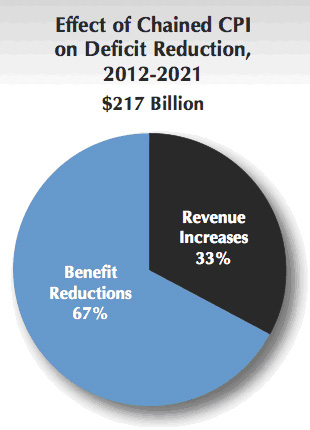

3. Social Security Cost of Living Adjustment ($21.7B)

This appears to pretty much be baked into the budget cake, but I am including a COLA adjustment as an example of a change that simultaneously decreases expenditures and increases revenues, with an adjustment level of only .03%. This would be the result of adopting the so-called chained CPI instead the current CPI measure. The chained CPI takes into account substitution effects. For example, if beef becomes expensive, then people might switch to buying chicken, but they still will have protein to eat and their overall standard of living is theoretically unaffected. The market offers options that will allow consumers to overcome price increases for individual items. See an excellent fact sheet on this issue.

(Source: National Academy of Social Insurance)

(Source: National Academy of Social Insurance)

4. Monetize the High Demand for US Immigration ($25B)

The US admits about 1 million legal immigrants each year. If they were each charged $10,000 for the privilege of US citizenship, the total amount of revenue would be $10B. This is in addition to the increased economic benefits that immigrants bring to the US. Part two: charge the 15 million or so illegal and mostly poorer immigrants $1000 per year for ten years as part of a one-time (until the next time) immigration amnesty for a total of $15B the first year. Start to collect payroll and social security taxes on their earnings as well. Variations on this theme could be a sliding scale for new immigrants based upon their means. I personally think you could find 100,000 Chinese who would pay $100,000 for a green card in no time flat. We have a program that grants visas now based upon investments in US companies. Why not focus on direct revenues to the US Treasury?

5. Medicare: End-of-Life Counseling Bill ($16.5B)

Newt Gingrich, who has rebounded lately in the presidential election polls, in 2009 suggested that Medicare could save $33B a year if reimbursement were granted for end-of-life counseling, citing a Wisconsin hospital group, Gunderson Lutheran, as an example. A large percentage of Medicare costs are incurred in the last two months of life. Evidently, when people are given information and choices, they decide to spend less on heroic efforts. The current healthcare reform proposal (H.R. 3200, Section 1233) would allow reimbursement for advance care planning and consultation. This makes eminent sense to me, but since these are Newt's calculations, let's give his $33B a 50% haircut.

6. Kicker: Cut Contingency Spending Abroad ($29B)

Almost everyone in America agrees, particularly under current economic circumstances, that we cannot afford full-scale engagement in conflicts abroad unless they are in our direct national or humanitarian interests. Cutting the budget that includes direct costs for Iraq and Afghanistan by 25% would save $29B. This by the way would leave the US Defense budget untouched.

The Final Tally

My six suggestions to increase revenues and cut spending net $ 120.7B. More than the $106B required in order to reach a consensus, with a 14% contingency. If implemented, both savings and revenues would increase positively throughout the decade, and in the case of the chained CPI, the effects would be cumulative. I have omitted suggestions for taxes that I think are total political non-starters in the current environment, like a VAT tax. Others, such a tax on services rather than just goods, the sale of federal real estate, and a Tobin tax would also meet resistance.

The point is, if we had the will, a deal could be done. We are the richest and most creative country on earth. Based upon the state of the rest of the developed world, it is essential for the US to get its fiscal house in order, or we risk another recession the world cannot afford. More economics, and less politics, can get us there. And please, not another committee!

This post originally appeared at the Yale Books blog.

This post originally appeared at the Yale Books blog.

What's Next? Unconventional Wisdom on the Future of the World Economy by David Hale and Lyric Hale is available now from Yale University Press.