As we enter the second week of the government shutdown, more and more Americans are starting to believe that the government stalemate won't be just a blip on the economic radar. Simultaneously, there are growing concerns that the impasse could lead to longer-term implications for retail, especially as we enter the early stages of the holiday selling season.

Although the shutdown isn't currently impacting most American workers directly, this, along with the looming debt ceiling debate is casting an unnecessary net of uncertainty across the economic landscape. Just take a look at the stock market -- as the shutdown entered Day 8, the Dow Jones slipped below 15,000 points, and both the S&P 500 and NASDAQ have experienced losses.

However, a more telling economic indicator for holiday spending won't be seen until the end of October, and that is the Consumer Confidence Index, or CCI. As the name implies, the CCI gauges "the degree of optimism on the state of the economy that consumers are expressing through their activities of savings and spending." In other words, it's a strong indicator of consumer attitudes and their related buying intentions.

So how will today's government infighting and the related economic uncertainty impact consumer confidence? Let's look back to a recent and similar government battle, the debt ceiling crisis of 2011. In July 2011, the CCI was at an already-low 59.20. After consumers watched the government edge toward the brink of default and saw the U.S.'s credit rating downgraded, the August 2011 CCI plummeted almost 15 points to 44.50, the sharpest drop of the year.

In other words, after the debt debate of 2011, consumers were less confident in spending their money on goods and services. But how did this decrease in confidence impact retail sales as a whole?

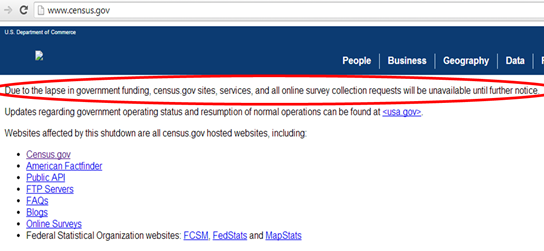

To find out, I tried to find this information from the Census Bureau, but was unable to do so:

All irony aside, with this information unavailable, I turned my focus to ecommerce sales for that year, which was provided by comScore. After the debt ceiling crisis, ecommerce sales in Q3 2011 dropped 3.18 percent as compared to Q2 of the same year. To be fair, ecommerce sales historically decline between Q2 and Q3, but in 2011, the percentage drop was higher than in other years (3.18 percent in 2011 vs. 2.46 percent in 2010 and 2.82 percent in 2012). And while we can't claim a direct correlation, it's safe to say that the economic uncertainty cast by the government impasse had a negative impact for online retail sales.

So will a similar decline take place in 2013? Quite likely, yes. Most likely, worse.

Here's why:

- Consumer confidence has already dropped since the shutdown. Gallup's daily consumer confidence index (different from the CCI referenced above) fell to -35 on Monday, October 7, a 20 point difference from just a couple of weeks ago.

- This round of government-sparked economic uncertainty falls much closer to the holiday season. Whereas the 2011 crisis took place in July and August, the more intense government bickering of 2013 is taking place through at least mid-October, meaning that consumers will have less time to recoup their confidence from the recent uncertainty.

- Economic uncertainty will lead to more price-conscious consumers. Less confident shoppers will be more price-conscious than usual, leading to an increase in comparison shopping and a decline in overall retail revenue. This might lead to a boost for online shopping, but will likely only help the largest online retailers like Amazon, who can afford to take razor thin profit margins.

Despite the government shutdown, The National Retail Foundation still projects that holiday retail sales will increase 3.9 percent this year. But with Democrats and Republicans continuing to dig themselves deeper into their impasse, the ramifications could lead to this ever-important selling season becoming less than the most wonderful time of the year for retailers, both online and off.