Our national debate on taxes and the national debt is increasingly unhinged. We have reached a point so absurd that America is fast becoming a satire of herself. If you are not a comedian or an entropy fan, this is painful to watch. It is, and will become, more painful to live. We seem hell bent on having the same debates with declining insight and clarity. Fierce rhetoric and vicious attack substitute for innovation and understanding. When more is needed we debate how much less. When it is clear we desperately need to cut back, more is on the way. Nearly all wrong, nearly all the time, policy is fed into an all irrelevant, all the time, 24 hour news cycle. What comes out the south end of this process is fed to ideologically divided and incensed partisans. Amazingly, this is not producing wisdom and solution.

Virtually all agree that the relationship between the spending outflow and revenue inflow of the US Government are dramatically out of step with one another. That is where agreement ends. Some contend that disaster is near or arriving. Others are certain we have several years -- or more -- before past and present imbalances wreak havoc. Many see the size and spending of government as the issue. Others are sure that low taxation of multinational corporations (MNC) and wealthy individuals are to blame. In short, answers and positions on tax and budget issues are ossified and deeply ideological. This is too bad as these are issues of vital national and global import. Our government is taking in a bit over $2000 billion a year. We are spending over $3300 billion a year. We stand nearly alone among developed nations with a largely dilapidated infrastructure, no real national health care system and no public transit. You might think this would move us into productive discussion regarding what we are and are not spending on. Don't be silly.

Over the last few weeks we have learned that we must cut our deficits and address our debt. We have also learned that the best way to do that is to cut taxes -- particularly on the most affluent -- and increase spending -- as long as we don't accomplish anything with the additional spending. So we must cut estate taxes -- on struggling middle class families with between $2million and $5million estates. We must pay people not to work but, never hire them to perform needed tasks, develop skills and feel better about their situation. For those out of work for 99 weeks or more, we have nothing to offer. To others waiting to run out of help, you have 13 months of torturous waiting for labor market recovery. We know this is the way forward because this is what our leading lights in Washington are fighting about in celebration of the holiday season. We know this is the way forward because we have been doing exactly this and we all agree that it has failed. Confused? For what it is worth, so am I.

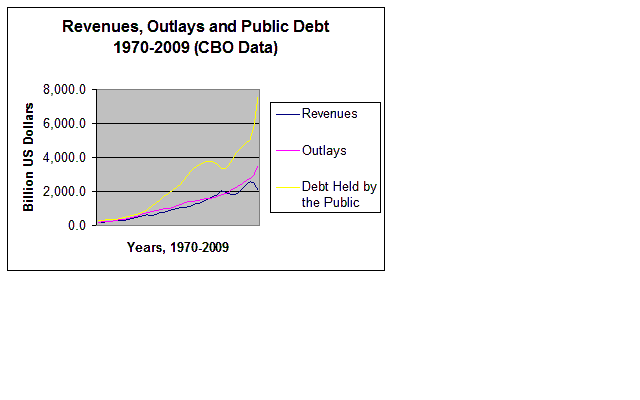

A look back to move forward seems overdue and valuable. The below chart from the Congressional Budget Office (CBO) suggests that everyone and no one is well founded in the recent budget and stimulus debates.

Source: CBO

The outlays, spending, of the Federal Government have been rising since the end of the last millennium. The revenues have been falling over the same period. It is clear that more revenue and less spending are required. Of course, the exact opposite is in the offing as you read this. We are nearing a compromise decision to tax less and spend more. Why? Because Congress and the Administration agree that budget balancing is paramount these days. This is the kind of scenario that inspired the title of this blog. The fact is that we are spending well above long term average levels and taxing well below them. Somehow, this has resulted in a debate between advocates of spending more and advocates of taxing less. Our debate is dominated by those who read the above drop in tax revenues as a sign we need more tax cuts. We have been doing tax cuts. It didn't work as advertised. Others are sure we need to spend more. We have also clearly been doing that. It also didn't work. If it is broken, don't fix it. If it didn't work last time, let's do it again. Beyond satire?

The below chart form the Congressional Budget Office offers a nice look at the issues.

The next question is how do we reduce spending and increase revenue? How do we reduce our spending and increase our revenues without damaging our already frail and inadequate economic growth? How do we move toward balance without making dangerously high inequality worse? It would appear that we will be doing this by increasing our budget deficits and national debt as we redistribute wealth upward. As of Early December 2010 the US Treasury has set a single year debt issuance record. We have sold more IOUs this year than were ever sold before, $2.1 trillion as of 08 December 2010. We are approaching the greatest levels of income inequality in our modern history. In 2009 the top 20 percent of income earners took home 50.3 percent of the total income earned in the US. Thus, the wealthiest 1 in 5 Americans already make more than the other 4 in 5 Americans combined. It would seem that this is a poor time to increase inequality to increase deficits and the debt? If the entire debate were not beyond satire, we would laugh at this absurdity.

The deal being struck by the Obama Administration and Congress will certainly aggravate inequality. Few seem to understand that lowering lower income marginal tax rates returns money to all Americans. Individuals are not assessed tax rates. Income levels are assessed tax rates. Everyone pays the same rates -- subject to deductions -- on each level of income. If one family makes $1million per year and another family makes $40,000 per year, both families pay the same rate on the first $40,000, subject to special programs, exemptions and deductions. If you cut lower income level tax rates, everyone gets a tax cut. Rich people will value the cut less as they make more income. If we cut tax rates on higher incomes, only people earning higher incomes get a tax break. That is the entire point of a progressive federal tax system. Few folks in our recent debates seem to grasp this? This is also why we are redistributing income upward with recent and proposed tax cuts. These cuts are targeted at estate taxes, capital gains taxes and higher income earner tax rates -- these cuts offer nothing to lower income households. We don't and can't know how much these tax rate cuts will cost either. To know what we lose with lower estate and capital gains tax rates we have to know future capital gains. No mere mortal knows those answers.

In summary, what is broken we will make worse. What is not broken we are working on breaking. We will reduce our budget deficit by spending more and raising less revenue in taxes. For the next 13 months we will offer the struggling bottom 60 percent of American households most of the programs and help that have proven dramatically inadequate over the last 2 years. This should work. In addition, we will forfeit hundreds of billions in tax revenue to help the wealthiest wealthy in decades. After all, those who are record breaking rich need more. Last, but not least, it is the Christmas Season and we all care so much about middle class families.