The big stories for today, tomorrow, the coming months are going to involve public sector services and workers. We are and (and where will be) debating the number of public sector workers, the wages of these people and the cost of their benefits? Likely we will keep on the present track of pointless, mean spirited and increasingly bizarre accusations and celebrations. This is a distraction. The real issue is that wages have not kept up with costs. Private sector workers are left with stagnant inadequate wages and have to buy their own benefits. Public sector workers have held onto to their benefits while earning similarly inadequate and stagnant wages. Thus, we can either raise wages or we will continue losing the middle class. Decades of stagnant wages have created anger and segments of the middle class are now turning on each other. If the Great Depression was defined by the song, 'Brother Can You Spare a Dime', the Great Recession may be dancing to the martial drumbeat of Brother You Can Spare a Dollar.

If we looked around with an eye to reality -- passé -- we would notice an exciting irony. Many of the harshest critics of public sector employees are well paid and dubiously qualified public employees -- elected officials. The assault on the public sector is paid for with tax dollars and oodles of borrowed money. Attacking government and public sector workers is largely undertaken by public employees. This might be an area where real savings could be achieved? Of course I know this is not in the offing. Just thought I would throw it out there, like the gratuitous Charlie Sheen references to follow.

Poring over the valuable information assembled by the Bureau of Labor Statistics (BLS) might inform discussion. On March 2011, The BLS released EMPLOYER COSTS FOR EMPLOYEE COMPENSATION. This report has tiger blood in its veins and Adonis DNA. It is not bi-polar it is bi-winning. Maybe that is Charlie Sheen not the BLS report? Either way, it is worth a read. It actually looks at what state and local employees earn and compares this to private sector workers of various types. The data does just what we are all doing with little but prejudice and political agenda as guide.

Public sector employees perform pretty different tasks than private sector employees. This makes comparison crude and dangerous. Then again, that is just what we have all been doing and will continue to do. There is a lot to be said for the value of informed guestimate- especially as an alternative to raving guess.

The BLS report offers the following wise caution:

Compensation cost levels in state and local government should not be directly compared with levels in private industry. Differences between these sectors stem from factors such as variation in work activities and occupational structures. Manufacturing and sales, for example, make up a large part of private industry work activities but are rare in state and local government. Professional and administrative support occupations (including teachers) account for two-thirds of the state and local government workforce, compared with one-half of private industry. BLS 09 March 2011 Release Employer Costs for Employee Compensation

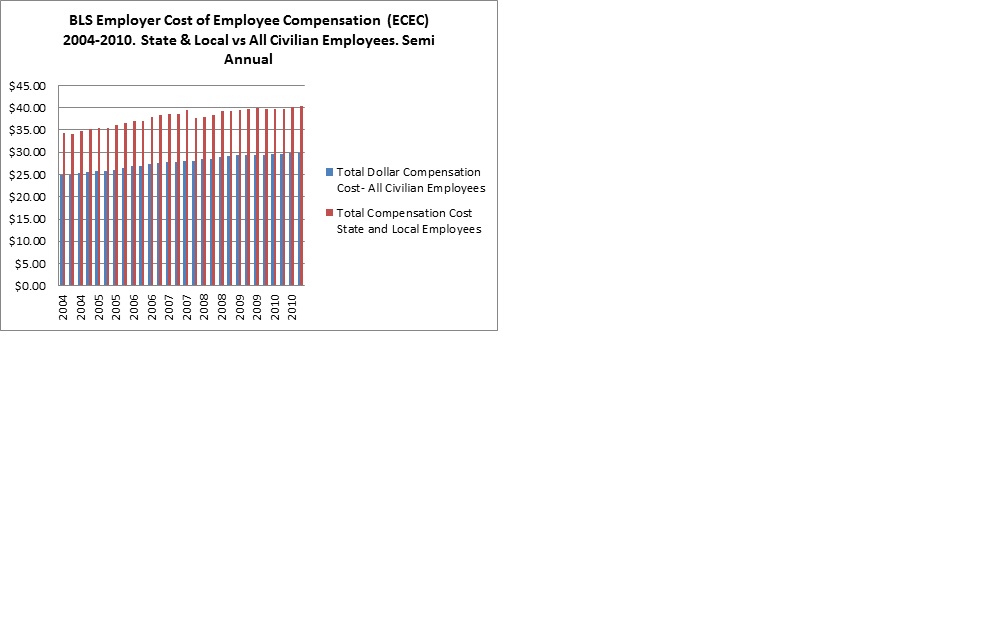

This acknowledged, there is much of value in the report. State and local employees earn a bit more than private sector employees. They also tend to have more education and more seniority. The average state and local employee earned $26.42 per hour in wage and salary at the close of 2010. The average private employee earned $20.71 per hour in December 2010. Private sector workers, on average, earned 78% of the hourly wages of public sector workers. If we look at total compensation the numbers look much more divergent. Total compensation includes the cost of benefits as well as wages and salaries. Here the differences are larger. State and local workers earned an average of $40.28 per hour in total compensation. In the private sector the average for total compensation was $29.72. In total compensation private sector average workers earned 73% of the average state and local workers. Here we should pause and remember that this is employer cost and not what these workers get paid. We only see the dollars in our paychecks; we don't get paid accounting estimates of the value of the benefits that we get.

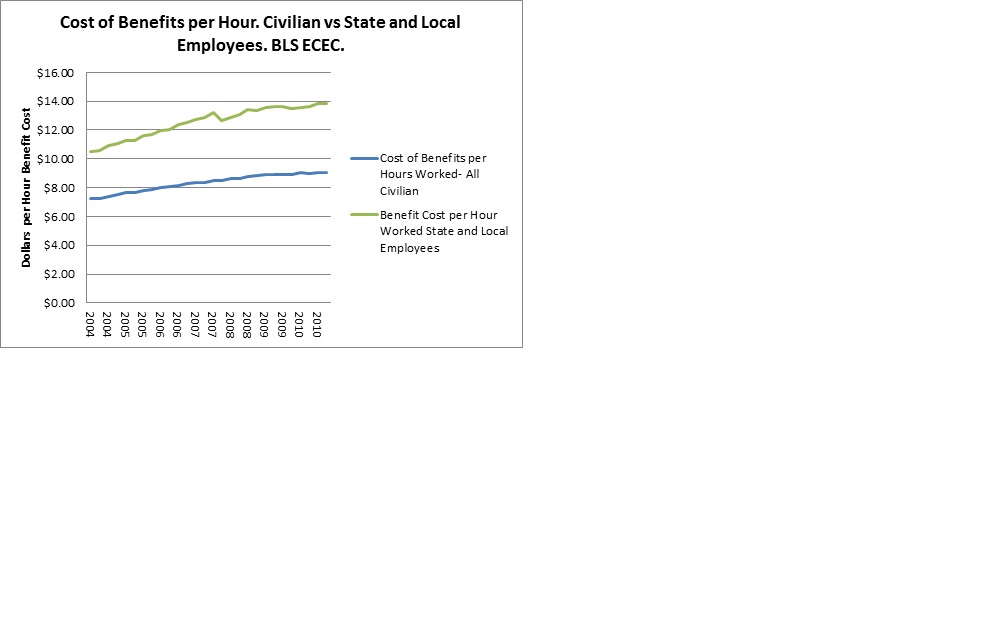

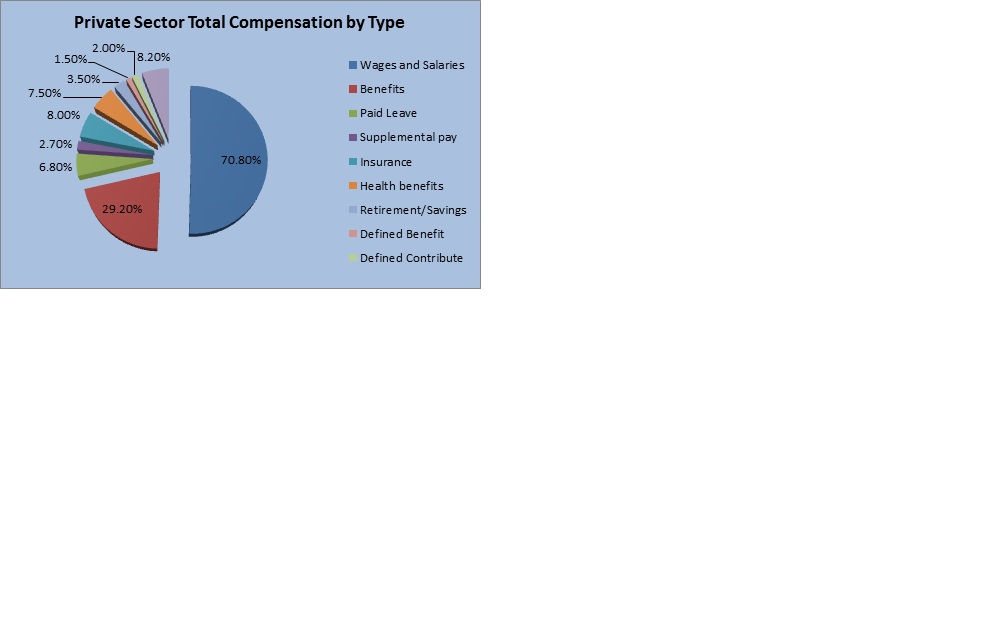

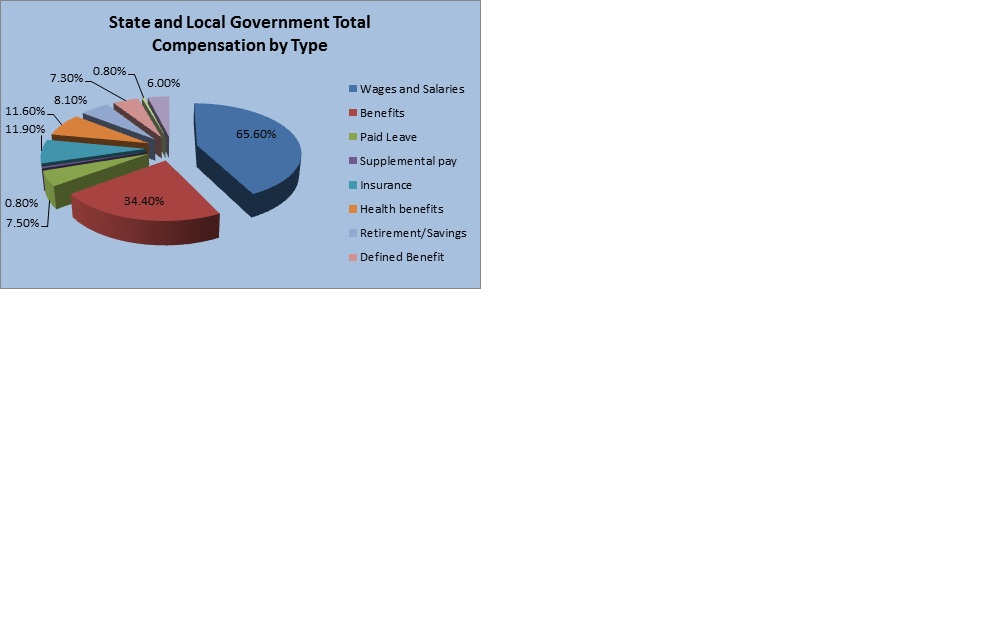

Where do compensation differences come from? Vastly different jobs, educational levels, qualifications and past struggles are the great decider. Benefits explain much of the difference. Paid leave, more generous health and pension benefits create the impression of higher pay and the reality of higher cost. 34% -- over a third -- of state and local worker compensation comes in the form of benefits. Private sector employees, particularly in the service industry, have poor benefits and low wages. Benefits cost $9.02 an hour on average in the private sector and $13.86 an hour on average for state and local employees. Average private sector employees cost only 65% as much as average public sector employees when benefits are included. This is where much of the anger comes from.

The high cost of health insurance and the underperformance of pension investments over the last decade explain the difference between average public versus private compensation. Public employees still have guaranteed benefit pension plans. The cost of these plans varies with investment returns. Employers assume the risk of poor asset performance. In defined contribution plans, 401K types plans, future retirees assume the risk of poor performance. If wages are stagnant and matching of employee contribution is cut or eliminated- differences loom large. Likewise, if we experience a 10 year period with no real appreciation in equities- we just did- differences in pension cost and generosity balloon.

Health insurance costs have risen very rapidly. State and local workers are not paying most of the rising cost of health insurance. Their employers assume these costs in more cases as their health plans pass fewer costs onto those enrolled. Public sector workers have traded less wage growth to be off the hook for poor equity market performance and rising health care costs. Private sector workers are on the hook. This works for the private sector if wages rise more than costs. This works better for the public sector employee if costs rise more than wages.

Wages are stagnant but health insurance and pension costs are rising. Private sector workers are left to buy these with increasingly inadequate wages. Public sector employees are more likely -- at least until recently -- to have negotiated benefits. Thus, the real differences are created by stagnant wages across the board and rising costs. Segments of the middle and lower classes are left to attack each other while ignoring the wage issue.

When we consider the merits of the present system and how to proceed, we are actually debating what to do about low investment returns and high healthcare costs. If we slash benefits to public sector workers -- and their numbers -- we are denying services to all in anger about healthcare cost and investment returns. This does nothing for private sector workers. It reduces services and likely places further downward pressure on their benefits. Why? If the best benefit packages get slashed what do you think is the likely trend for benefits in the private sector? A few decades ago private sector workers had more generous health and pension benefits. These were lost. Does anyone think they will come back if public sector workers see their benefits slashed?

Behind all the anger and drama is a social debate as to whom to blame and charge for investment returns and health care costs. Wages, public and private, have been largely stagnant in real, inflation adjusted terms, for decades. State and local workers have seen their benefits rise to over 34% of total compensation. These benefits' costs have grown faster than inflation and wages have not. Private sector workers have suffered a combination of declining benefits and flat wages. This is really a debate about how to adjust to slow wage growth and rapid cost growth -- particularly medical and retirement costs. We should be discussing how stagnant wages and rising costs are breaking the middle class and causing people to turn on each other.

There is no dime in singing, Brother You Can Spare a Dollar.