Economic fear grips millions of American families. We are afraid of the recession that has arrived and the economic changes that have been taking shape. We are afraid for our absolute and relative performance. Unemployment, credit restrictions, rising food and energy costs are on our minds. Falling house prices and our position in the world economy lurk in news stories and our collective understanding. The business of America has become business, particularly multinational business. Multinational enterprises (MNE) employ one in five Americans in the private sector. These firms and their brands employ us, represent us around the world and dominate our public spaces and communications. Through advertising, billboards, political lobbying and public information campaigns they sell us food, clothing, news, opinion, politicians and sense of the broader world. The ten most profitable firms, 2008 Fortune 500, earned $179 billion in profits in 2007 on $2.069 trillion in earnings. The Average 2007 earnings of the 10 largest US MNE on the 2008 Fortune 500 List is $207billion. Another way to see this number is that the revenues of the 10 largest firms were equal to 15% of US GDP in 2007.

For the past several years the speed and size of de-linking between the American Macro-Economy and our leading multinational enterprises (MNE) has been dramatic. The mirror image of this is the growing link between our MNE and other economies. I believe this is reshaping domestic and world economic growth. US, Japanese, Euro Zone MNE investment, sourcing, growth and operational decision are moving opportunities, profits and incomes around the world. Foreign firms also employ more Americans, directly and indirectly, each year. Dominant firms have been a significant engine dragging the national wagon. Lately our leading firm's are dragging more of "their" macro wagon and proportionally less of our macro wagon. De-linking and new linking between leading firms and national economies is reshaping the world rapidly. The American employment, economic and opportunity landscape moves with the changing ties between economies and firms. Figure 4 illustrates the meteoric rise of foreign earnings over the last several years.

Engine reduces ties to wagon: America's Relative Position in the World

A look at the growth in off-shore operations of US MNE and their affiliates reveals a reduction in the portion of US firm's activity in the US. Even during the boom years for domestic profit growth, 2003-2007, US MNE increasingly looked off-shore for expansion. Our firms are a rising share of their economies. Leading firms, driven by profitability and growth concerns, are shifting their attentions and investments offshore. This has been heralded as a wise plan for risk reduction and earnings growth for years. It has become common wisdom that internationally active firms should and will outdo their less global competitors. Like all economic prophecies, this one is self-fulfilling. We now live in a global economy and compete for jobs, sales, profits and technology through the same firms. Us and them, is increasingly a game of where the same firms grow operations and report income. The newest data from the Bureau of Economic Analysis (BEA) suggests this trend has been accelerating since 2002.

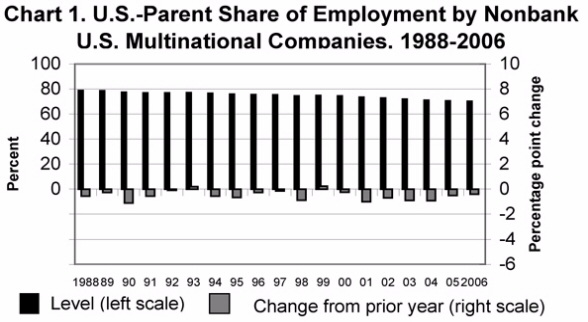

Worldwide employment by U.S. multinational companies (MNCs) increased 3.3 percent in 2006, to 31.3 million workers, following a 1.4-percent increase in 2005. Employment in the United States by U.S. parent companies increased 2.7 percent, to 21.9 million workers, following a 0.8-percent increase. The employment by U.S. parents accounted for almost one-fifth of total U.S. employment in private industries. Employment abroad by the majority-owned foreign affiliates of U.S. MNCs increased 4.7 percent, to 9.4 million workers, following a 3.0-percent increase. BEA News Release 17 April 2008. Summary Estimates for Multinational Companies.

The most recent BEA release indicates rapid foreign growth. There is every indication that this trend accelerated since 2006. The US Dollar has fallen and foreign economic growth has been higher than domestic growth. Our firms and consumption are woven deep into the fabric of global growth. In fact they are weaving much of the fabric and we are buying it. The newest patterns suggest changing international economic circumstances. Deregulation, new technology and openness have created a single global economy defined by vastly divergent national performance and position. The various and evolving firms, states and trends in the global economy de-link, re-link and shift constantly. Like members of a single economic family, siblings and parents age, grow, shift relations and change. Ultimately all are interdependent, some times more obviously and other times more subtly. Success and failure are visited on firms, regions and industries. We can argue over where or what will rise and fall. Arguing against interconnectedness is absurd. The profound trend has been one linking MNE growth to developing economies. The US remains the world's single largest national economy and market. We bought and borrowed so much we retained our place in the center of the great game. Falling credit, Dollars and economic growth is beginning to question that position. This may be behind much anxiety.

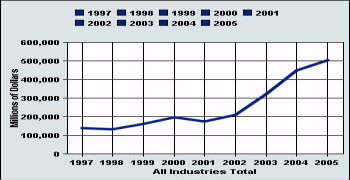

MNE foreign profits rose by over 7.5% across 2007 and now account for more than 1 in 3 profit dollars by S&P500 firms. Another way to see that involves thinking about the other $2 of $3 that our leading forms made, here. OECD, World Bank, IMF and bank consensus forecasts suggests that foreign GDP and profit growth will be significantly above US for the next few years. Thus, a future of dramatic shifts in linkage is nearly assured. The unease Americans feel is likely a combination of concern over our present and near term economic performance coupled with a growing anxiety over our place in a changing world. Figure 1 graphically illustrates the growth in foreign income.

U.S. Direct Investment Abroad, Majority-Owned Foreign Affiliates, Net Income Aggregate Totals for (1997-2005). Figure 1

Figure 2 (Chart 1 BEA Summary Estimates for Multinational Companies) reveals the trend in US employment to be the mirror image of growth off-shore. MNE, or MNC as the BEA calls them, have been decreasing their share in US employment.

Figure 2

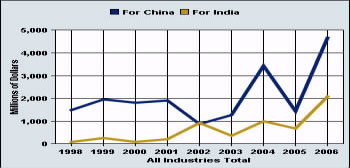

The trends in growth onshore and offshore are hard to miss. There has been a rapid rise in the non-US share of MNE growth. The more rapid growth in offshore activity seems correlated to declining hiring in the US. A sharp decline in US consumption is now universally predicted. This should further reduce American focus by leading firms. The rapid increase in foreign investment, especially in India and China, is likely to rise in proportional terms, see figure 3. New direct and potent links between US firms and foreign growth constantly appear. In other words, partial de-linking of US MNE and the American economy will continue. Our firms, our economy and their economies are all in this together, ever more together. Our place in the mix is shifting. China and India have been particularly popular investment destinations. Thus, their positions are in flux with our economy.

U.S. Direct Investment Abroad, Capital Outflows Without Current-Cost Adjustment By Country (Major Countries) for (1998-2006)

Figure 3

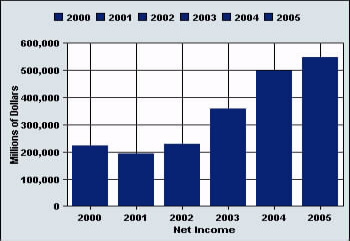

U.S. Direct Investment Abroad, All Foreign Affiliates, Net Income

Aggregate Totals for (2000-2005)

Figure 4

Engine Slows: The Global Economy

MNE remain largely based in The US, EU and Japan. These firms face three sets of growing problems. First, there are intensifying protectionist sentiments around the world. Home markets are full of essential consumers who are angry and blame MNE for weak employment and earnings growth. Export host nations are filled with growing nationalism artfully exploited by local politicians and domestic competitors. Profit conditions are under pressure around the world. Resource shortages, basic material price spikes and nationalism are placing great pressure on all who import energy, food and materials. Food, energy, basic material and transport costs are spiraling out of control. Export restrictions and protectionist opposition to imports are mounting simultaneously. All of this is to say, the world is becoming more protectionist just as MNE become more dependent on long and vulnerable supply and demand chains. This suggests the MNE driven developing nation growth is imperiled by US and EU weakness and the likely reactions to it. We may be in this together but, a shrinking portion of the world's population seems to feel that way. The US is no exception.

Second, rising prices of food and basic materials mean rising wage pressures and capital costs. For millions of Americans food and energy costs are rising rapidly as the economy slows. Rapid currency shifts and cost increases disrupt and alter price structures and profit expectations. Prices rise as Dollars lose value and others compete for resources. Long deferred wage demands grow as food costs rise, energy costs soar and inflation emerges. This places growing pressure on households and businesses, here and abroad. Low cost labor, cheap materials, free trade and easy credit made for a great MNE growth and profit period. Third, the end of the long credit glut is creating harder to come by and more expensive credit. The next few years will see more cautious financing extended at greater cost. American consumers will be pinched by rising food, energy and currency adjusted costs. So will American MNE. This means strapped buyers of products and higher costs for firm borrowing. Developing world consumers are being pressured by food and energy costs. All are vulnerable to the health of MNE balance sheets. All three risks to MNE translate into a slowing in the engine of global growth.

The twin risks involve loss of position in the world economy and a slowing world economy. Both look likely to confront America across the next few years. Thus, much anxiety makes sense. Like the global economy that is shaping this reality, the slowdown is likely to be shared, if unevenly. These basic circumstances seem absent from debate and response planning.

Here and abroad skittish publics face higher costs and increased insecurity as the global economy slows and opportunity shifts. Americans and their MNE will be at the center of the changes. Anger at loss of position and reduced purchasing power is already building. Many will be tempted by us versus them thinking. The anxiety driving people's anger makes perfect sense. The sense of insecurity makes sense. Blaming others and ignoring the basic dynamics of the global economy is both unwise and unlikely to produce beneficial change. In order to move forward toward building a prosperous and vital American future, we need a real handle on what is and has been driving change.