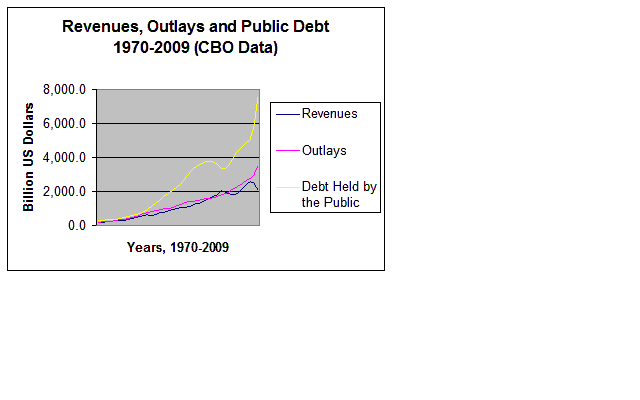

You are going to hear a lot about budgets, deficits, and debt between now and November. The Massachusetts Senate election, State of the Union and aftermath catapulted this on again, off again, discussion back onto center stage. Many believe that budget deficit and national debt discussions are conservative talking points. This is a sense that there is always enough money for every groups favored plans and it is just a matter of pushing for it. Neither of these common suppositions are accurate or productive. The US has been on an unsustainable budget course since the 1980s. There have been dramatically better and dramatically worse years for budgets. However, we have seen revenues lag expenditures and expenditure growth outrun revenue growth for a long, long time. The above graph makes this very clear. The Federal Government can't do it all and we certainly can't do it all with present revenues and expenditures.

You are going to hear a lot about budgets, deficits, and debt between now and November. The Massachusetts Senate election, State of the Union and aftermath catapulted this on again, off again, discussion back onto center stage. Many believe that budget deficit and national debt discussions are conservative talking points. This is a sense that there is always enough money for every groups favored plans and it is just a matter of pushing for it. Neither of these common suppositions are accurate or productive. The US has been on an unsustainable budget course since the 1980s. There have been dramatically better and dramatically worse years for budgets. However, we have seen revenues lag expenditures and expenditure growth outrun revenue growth for a long, long time. The above graph makes this very clear. The Federal Government can't do it all and we certainly can't do it all with present revenues and expenditures.

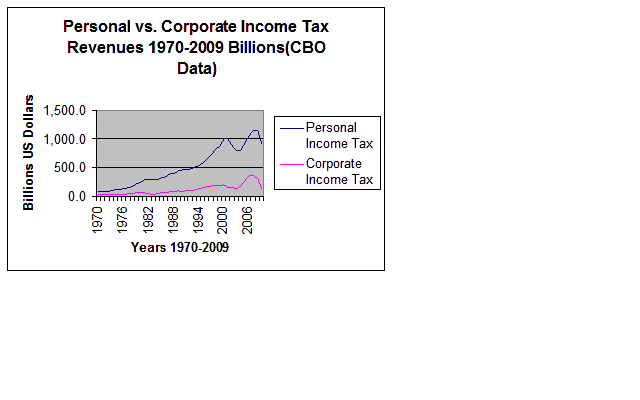

In the last year we saw a massive decrease in corporate tax revenues and a decline in personal income tax revenues. 2009 witnessed a $166 billion decline in corporate income tax receipts, a 54% fall in revenue from US corporations. We saw a $230 billion decline in personal income tax receipts, a fall of 20%. At the same time, outlays increased. The Federal government increased its spending by $530 billion in 2009, an 18% increase in outlays. This is how it is supposed to work in any recession, let alone as serious a downturn as we have seen through 2008 and 2009. The government is supposed to nationalize pain to allow households and firms to stabilize and recover. The problem we have is that this is how our economy functions nearly every year--boom and bust alike. The above chart makes clear the constant growth in the public holding of national debt. Our national debt doubled 4 times since 1970. We had doublings of publicly held national debt between 1970-1978, 1978-1984, 1984-1991, 1991-2008. The Congressional Budget Office (CBO) is forecasting another doubling between 2008 and 2013. Clearly we are on a dangerous track.

The constant rise in our national debt has been allowed to go on for several reasons. Democrats and Republicans have both aggressively added to the debt, piling up deficits when in office. Each of the parties has sacred cows they protect while striving to score points with the public by suggesting we slaughter and eat the other party's sacred cows. All of this always appears under the banner of saving taxpayers and our economic future. The US government has historically been able to borrow nearly limitless money at very low interest rates. This has made it possible and relatively affordable--for now--to not deal with mounting budget problems. We have to make choices and push our taxing and spending into line with our national priorities, revenues and spending. This will require major changes, sacrifices and uncomfortable decisions.

The extremely low interest rates in 2009 allowed the US to pay only $187 billion in net interest on past debt, 5% of total spending. It is cheaper and more dangerous to borrow very short term. We have done this. Shorter loans are cheaper and so we have been borrowing very short term. This means we have to constantly return to debt markets and borrow more. Thus, we need to choose policies that our creditors approve of. The other way we have kept payment low is even more ominous. We have kept payments low by constantly borrowing to repay old debt. This is rollover finance at its worst and has institutionalized a process of kicking the can down the road. In 2009 and 2010 we will actually be borrowing to repay debt and also to pay interest on past debt. This is particularly problematic. From February 9-11, 2010 the US government will sell $81 billion in Treasury Securities. Across the next 10 months the US Government will have to sell over $2 trillion in IOUs. China ($790B), Japan ($757B) and oil exporters ($187.7B) already hold $1.7 trillion of the $3.6 trillion in US Treasury Securities held by foreign entities. At some point, possibly this year, creditors will demand higher rates to keep buying all these IOUs. All this borrowing and all this short term borrowing allows lenders to constantly weigh in on our policies and economic choices. As creditors get weary or disapprove of policies, our debt issues will start looming larger than they do today.

This requires a second look at all the sacred cows grazing our commons. We need a real budget overhaul. This has not been seriously proposed by either party recently. Freezing non-defense, discretionary spending is not going to alter the landscape. The tax increases suggested for individuals earning over $200,000 and joint filers earning over $250,000 will return us to imbalance levels before the Bush tax cuts. While this will help a little, even adding the increase in the Capital Gains Tax will move only a small way. The military budget needs to be open for discussion as do more far reaching new tax proposals. Budget deficits and debt are not Republican or Democratic concerns. Our budget issues impact us all and have become a global issue.