The S&P 500 is now up about 24 percent, excluding dividends, since the end of 2012. Much of the gains have occurred since the end of the second quarter, a four-month period during which the S&P 500 gained about 10 percent. Given the continued strong gains, we thought it would be interesting to look out how some of the high-flying technology stocks have performed in an effort to determine whether or not there may be some froth building up in stock prices.

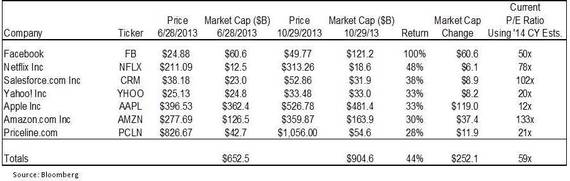

The table below shows the performance of seven technology stocks since the end of the second quarter. As the table shows, these seven companies are up an average of 44 percent over the past four months. During this time period, the market value of these companies has increased by a total of over $250 billion to $905 trillion. The average price-to-earnings multiple (using consensus estimates for calendar 2014 EPS) has risen to 59x, representing a massive premium to the overall market's P/E of a little over 15x.

While the increase in market value of these seven companies is rather stunning in and of itself, we feel we should also factor in the impending IPO of Twitter. Twitter is expected to come public in the near future at a price that would translate to a valuation of about $11 billion. Most expect this IPO to be "hot," which means the price on the first day of trading could rise significantly higher than the expected range of $17-$20. While Twitter is small compared to the likes of Apple and Amazon.com, it is somewhat striking that Twitter will soon be valued somewhere north of $11 billion without having earned any money yet. Does this remind anyone of a time period in our not-too-distant history?

At Farr, Miller & Washington, we evaluate companies on an individual basis to determine whether or not their future growth prospects justify the share price. Having said that, we think it is helpful to take a 10,000-foot view from time to time. Without commenting on the individual valuations of any of the companies listed above, we can't help but conclude that optimism with regard to future earnings growth at these seven companies has risen dramatically over the past four months. Has the collective outlook for these seven companies improved to such an extent over the past four months to justify a $250+ billion increase in market value? Has the environment improved 44 percent for these select companies in such a short period of time?

Only time will tell. But for our part, we will remain defensive and invested in high-quality companies with highly visible earnings streams and defensible market share. Now is no time to swing for the fences.