The economic data has clearly been deteriorating over the past couple of weeks. Data tracking activity across multiple sectors of the economy suggest that growth is slowing from the brisk pace reported for the second half of 2013. Economists have been quick to point out that inclement weather across large parts of the country is the primary factor inhibiting growth. But how much of the slowing can be blamed on Mother Nature? Nobody knows for sure, of course, but there is enough reason to believe that the brisk pace of growth recorded in the second half of 2013 will not be sustained in 2014.

Economic growth in the second half of 2013 was the strongest growth since the second half of 2003. The Bureau of Economic Analysis (BEA) reported that the economy grew 4.1 percent in the 3Q13 and 3.2 percent in the 4Q13. These readings were welcome news for an economy growing at an average rate of about 2.4 percent since the end of the recession in June 2009. Investors were heartened, and the Fed felt comfortable enough to begin removing some of its extraordinary stimulus. So are we finally out of the woods and running at escape velocity (ie, requiring no more assistance from the Fed)?

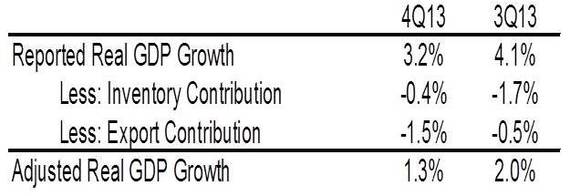

In order to determine whether the 2H13 pace of economic growth is sustainable, we must first examine the drivers behind that growth. The 4.1 percent growth rate in the 3Q was juiced by a 1.67 percent contribution from inventory building as companies replenished stockpiles and anticipated better growth ahead. Of course, these inventories shouldn't really be considered in economic growth until they translate into final sales. Therefore, we make an adjustment to the reported 3Q GDP growth to account for the inventory builds. Absent the inventory contribution, GDP growth in the 3Q would have been just 2.5 percent -- only slightly better than the average pace since the recovery began.

For the 4Q13, the BEA reported GDP growth of 3.2 percent. While this growth rate included a much better contribution from consumer spending, there were still contributions from unsustainable sources. Additional inventory builds contributed 0.42 percent to overall growth. Also, an increase in exports contributed 1.48 percent to the overall growth rate. Somewhat inexplicably, exports rose at an 11.4 percent pace in the 4Q13 -- much faster than the 0.9 percent growth in imports. While a surge in exports would normally be considered a strong positive for the economy, this growth is almost certainly an anomaly. The most obvious reason this rate of growth cannot continue is the recent turmoil in the emerging markets. Ironically, the hoards of cash leaving the emerging markets and the coincident drop in EM currencies are, at least in part, a reaction to the Fed's decision to begin the tapering process. At the same time, Europe remains mired in a sluggish economy too weak to lift the rest of the world. In other words, we can't count on stellar export growth to drive domestic growth in 2014.

Source: Bureau of Economic Analysis

Adding to the aforementioned drags on growth in 2014 (relative to the 2H13 pace) could be a slowdown in the housing market and slower growth in consumer spending. Indeed, it was already apparent in the 4Q GDP figures that higher mortgage rates are beginning to take a toll on the housing market. Residential investment plummeted 9.8 percent in the quarter, causing a 0.32 percent drag on overall GDP growth in the quarter. While mortgage rates have backed up some since late last year, housing affordability remains much lower than the levels that caused a surge in housing activity earlier in 2013.

With regard to consumer spending, we think the 3.3 percent growth rate reported for the 4Q will cool somewhat in reaction to: 1) higher interest rates; 2) a slowing housing market; 3) increased volatility in the equity markets (including emerging market equities); and 4) continued lackluster job and income growth. However, the wild card is consumer credit. An article in today's Wall Street Journal states that "household debt, which includes mortgages, credit cards, auto loans and student loans, jumped $241 billion between October and December to $11.52 trillion." Given that there is scant evidence of robust gains in middle-class incomes, higher spending levels will have to come from increases in debt. But should we be excited that consumers are returning to their old ways of irresponsible borrowing and spending? That's a question for another Market Commentary.

As I said in my speech last week at the University of Delaware: a lot is riding on the level of interest rates, including financial asset valuations (to include stocks AND bonds), housing prices, the funding of the federal government, consumer debt service ratios and the consumer's willingness to borrow for consumption. Indeed, we have argued that the economy is not strong enough to withstand sharply higher interest rates. Given recent developments, we stick with that assertion. With regard to the weaker economic data of late, thus far it seems pretty clear that investors are willing to attribute most, if not all, of the economic slowing to the bad weather. If this turns out not to be the case, you might want to hold on tight and get ready for some volatility.