Prior to being interviewed on a national radio program last week regarding the implications of the fiscal cliff, I read that President Obama had responded to Speaker Boehner's plan of reducing future deficits by $2.2 trillion without raising tax rates as being unacceptable. The president said, "We're going to have to see the rates on the top 2 percent go up, and we're not going to be able to get a deal without it." Mr. Boehner proposed revenue increases by means of eliminating a number of write-offs and exclusions -- most of which apply only to the wealthy. I was reminded of the old expression "six of one, half dozen of the other."

Thinking about the debate, it occurred to me that in spite of this tiresome, nauseating political sparring, the right things are being proposed and discussed. Our national debt has gotten out of control, and our profligate deficit spending has to stop. The problem in addressing it now is that tax increases and spending cuts take money out of a system that is still battling its way out of the depths of a powerful recession. Timing will be tough on this one, but we have to confront it sooner or later.

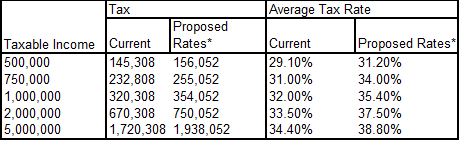

While the semantics of the debate seem purely political, I wondered about the actual implications of an increase in tax rates. Michael Fox is a 41 year old partner at Farr, Miller & Washington and has been here for almost ten years. Michael has his undergraduate degree in accounting and his Masters degree in taxation. He is a CPA, CFA, and CFP, and he is as nice a man as I know. I asked Michael about the dollars involved for highly compensated folks under the president's plan. Michael explained that an individual with taxable income of $375,000 per year currently pays about 27 percent, or $101,500 in federal income taxes. If the top two rates rise to 36 percent and 39.6 percent, respectively, the average rate will be about 28.4 percent or $106,500. Taxes for higher earners are as follows:

Please note that this is a very simplified example and assumes the taxable income is all ordinary income. It does not attempt to account for potential changes in tax rates on qualified dividends or capital gains and also excludes any impact from the 3.8 percent Medicare surcharge on net investment income that will affect individuals with adjusted gross income above $200,000 and couples above $250,000. Keep in mind that state, local, sales, capital gains, real estate and inheritance taxes will also be paid.

The investment landscape remains tricky and fraught with peril. If we don't know what the future tax and regulatory backdrop look like, how can we determine which companies and industry sectors stand to benefit or lose out? Investors are, to a certain extent, flying blind right now. Therefore, it makes most sense to maintain a defensive posture. Investors must, of course, be mindful of the investment risks associated with the fiscal cliff. But they also need to acknowledge the upside risks associated with possible resolution of this issue and an eventual overhaul of the tax code. Investors are simply looking for certainty. Regardless of the specifics, they want a tax code that is both definitive and permanent. While this item may be left off the Christmas list this year, we do believe it will happen eventually.

Multi-national, large-cap companies with excellent balance sheets, reasonable share prices, strong management teams, and dividends make most sense to us for accounts under our management.