America's over-reliance on consumer spending helped create the mess we are in. To finance our spendthrift ways, we borrowed more than we could afford. We also saved less than necessary and bet that rising home and stock prices would make up the difference. In addition, our willingness to consume more than we produce led to unhealthy imbalances with nations like China.

Well, guess what? The latest data reveals that America is more dependent on the consumer than ever.

Last Thursday, the Commerce Department's Bureau of Economic Analysis (BEA) revealed that personal spending in August rose 0.9 percent, its biggest monthly jump since 2001. Reports suggest the increase stemmed from stepped-up purchases of durable goods like cars, aided by Washington's cash-for-clunkers scheme, as well as aggressive back-to-school promotions by nervous retailers.

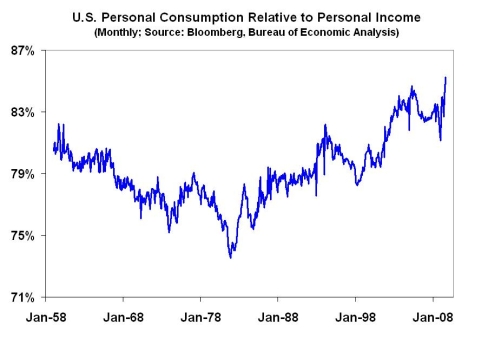

The BEA also announced that personal income -- the sum received from all sources, including wages, government transfer payments, and interest -- rose a more subdued 0.2 percent. While the result beat Wall Street's expectations, the gap between the two data points helped to highlight an unsettling development.

More specifically, the relationship between the two has diverged to the point where personal spending is now at a record high relative to income, surpassing the level seen at the pre-financial crisis peak of housing bubble-induced euphoria.

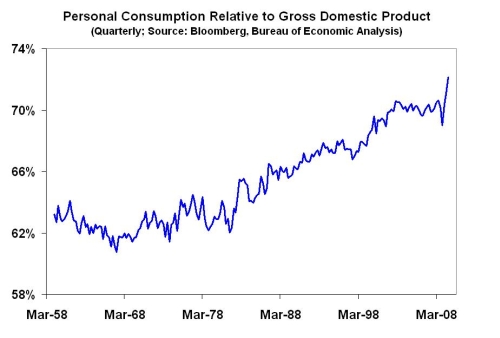

Other data paints a similarly troubling picture. Personal consumption relative to gross domestic product (GDP), the sum total of U.S.-produced goods and services, has also hit a record. Based on estimated data for third quarter GDP, the consumer now accounts for around 72 percent of output, a far cry from the 50-year median of 64.5 percent.

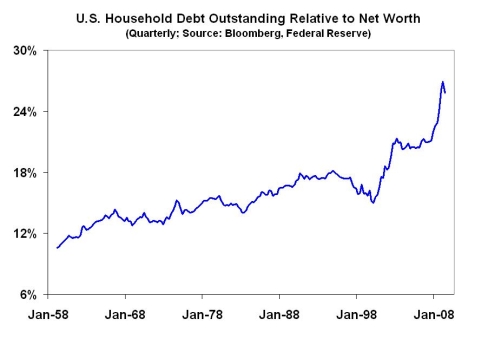

That might not be so bad if the consumer was in better shape than he (or she) was in the past, but various data indicate that is not the case. For example, although household debt relative to net worth is marginally below the second quarter record of 26.9 percent, it is still two-thirds higher than its long-term average.

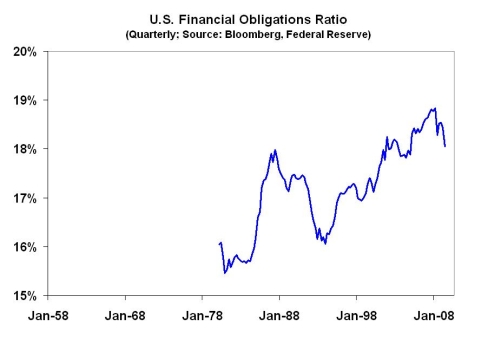

Another series also shows that households remain stretched, despite some improvement from the record highs seen in the spring of 2008. According to the Federal Reserve, Americans devoted just over 18 percent of their monthly disposable personal income -- the amount left over after income taxes -- to debt, auto lease, rental, homeowners' insurance, and property tax payments in the second quarter.

Aside from the fact that the median average of the Financial Obligations Ratio (FOR) since 1980, when the Fed started keeping tabs on it, is 17.3 percent, or less than we have now, the current measure is above the range that prevailed prior to the accelerated lift-off in housing prices following the 2001 recession.

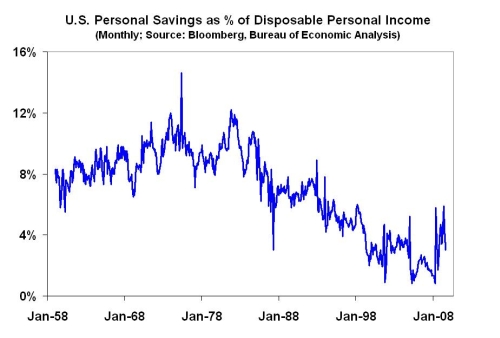

And while the personal savings rate is no longer scraping along at the unsustainably low levels we saw in the middle of the current decade, at 3 percent it is still less than half of its long-term median and well below the more "normal" levels of 8-10 percent that were commonplace since the Great Depression.

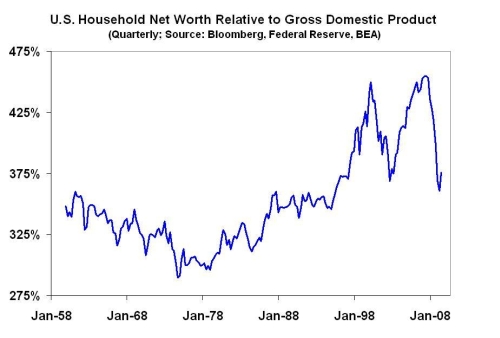

It doesn't help, of course, that severe declines in stock prices and property values have undermined what economists refer to as "the wealth effect," which helped power a measure of past spending. The fact that American's net worth relative to GDP has fallen back to more normal levels while debt loads have remained high is not at all reassuring.

This doesn't even take account of other developments that suggest the health of the consumer is seriously at risk. Along with data released this past week, which revealed that a growing number of Americans are losing their jobs, being forced into foreclosure, and filing for bankruptcy, recent research also highlights the fact that income inequality has hit an all-time high.

In the end, none of this bodes well for an economy whose fortunes are (still) so closely tied to the spendthrift ways of the U.S. consumer. In fact, once the man in the street figures out that, despite the sorry state of his finances, he is the one that is being counted on to rescue the economy, that's when the real trouble will begin.