Prime Membership Rises To 41 Million Higher-Spending U.S. Members

Amazon Hardware Owners Also Spend More

Consumer Intelligence Research Partners (CIRP) released analysis of buyer shopping patterns for Amazon, Inc. (NASDAQ:AMZN) for the January-March 2015 quarter.

This analysis indicates that Amazon Prime now has 41 million U.S. members, spending on average about $1,100 per year, compared to about $700 per year for non-members.

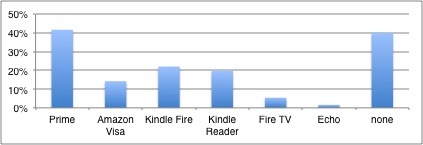

As of March 31, 2015, CIRP estimates that in the U.S., 42 percent of Amazon customers are Prime members, which translates to about 41 million Prime members (Chart 1).

Amazon Prime membership held steady in the March 2015 quarter. We think that the influx of new Amazon Prime members in the holiday quarter of 2014 included an unsurprising percentage of shoppers that did not continue their membership following their 30-day free trial. Given this Prime customer acquisition reality, the net result is in a small increase in members relative to the holiday quarter.

34 percent of Amazon customers in the U.S. own Kindle devices (tablet or e-reader), while 5 percent of Amazon customers own a Kindle Fire TV box or stick, and less than one percent of Amazon customers own an Amazon Fire smartphone or Amazon Echo. Amazon Kindle owners are as productive as Amazon Prime members, spending $1,300 per year compared to $650 per year for customers who do not own a Kindle e-reader or Fire tablet.

Kindle Fire and e-reader owners are by far the largest group of Amazon hardware owners. But as a percentage of the Amazon customer base, that group has plateaued at about one-third of Amazon customers. It will be interesting to see if any of Amazon's newer hardware offerings gain similar customer penetration and correlate with bigger Amazon spending habits, too.

CIRP bases its findings on surveys of 500 US subjects who made a purchase at Amazon.com in the period from January-March 2015. For additional information, please contact CIRP.