The largest, oldest living thing?

Blue whale? Giant redwood? Some kind of deep sea critter? No, no and no. The right answer is the honey mushroom. You'll see the thing growing out of trees in Oregon and Washington. It doesn't look particularly creepy, or at least no creepier than these things normally do.

Except it turns out the individual mushrooms you see aren't separate organisms. They're connected through long underground filaments to such a frightening degree that the vast bulk of the organism lies beneath the soil. The thing you see on the tree beside you is the same living thing that's poking out of a tree way over yonder. The largest known honey mushroom lives in Oregon and it covers a stunning 2,200 acres. It's around 2,400 years old and it's killing the forest above it.

If you want a model for our debt-ridden, Ponzi-ish world, you have it right there. A huge beast that lies largely out of sight and kills what it touches. More than that, it tricks you into thinking that the various problems are discrete -- this mushroom here, that mushroom there -- when really it's all part of the same ugly whole.

Take, for example, the current murmuring about student debts. Average student debts have now reached $25,000. Since 80% of those debts are government-guaranteed (or indeed, issued direct from Uncle Sam's Magic Wallet ), those debts are also our debts. We're on the hook.

And because we have lived through two decades in which debt was never regarded as a problem -- certainly never as a problem to be faced now -- the results are all too familiar: a mountain of liabilities. Just $80 billion in 1999, student debt reached some $870 billion last year. That's $870 billion heading rapidly for the $1 trillion level.

In the case of the subprime market, spiraling liabilities were not matched by a corresponding increase in quality assets. That's why we had the bust. The same thing is true of student debt. (Honey fungus, remember: it's the same thing everywhere.) That increase in liabilities hasn't come about because of a tenfold increase in student numbers or a tenfold increase in tuition quality. On the contrary, as Mark Zandi, the Chief Economist at Moody's Analytics, comments, universities ramp up the cost of what they were providing anyway:

Universities and colleges just raise their tuition. It doesn't improve affordability and it doesn't make it easier to go to college ... Of course, it's very hard on the kids who have gone through this, because they're on the hook. And they're not going to be able to get off the hook.

Data from the Bureau of Labor Statistics show that over the past three decades, student tuition prices have risen at four times the rate of consumer prices generally: 439% instead of 108%.

And with subprime mortgages, who lost out? You may remember that the banks responsible for those crazy loans made out just fine. They got bailouts whenever they needed them. Their bonuses were protected in line with the unwritten 28th Amendment: The federal government of the United States shall not permit any bank or banker to suffer economic loss. The people who suffered were the homeowners. Not just the subprime borrowers, who should never have taken out a loan, but everyone else too. Everyone caught up in a housing bust not of their own making, or trapped in a recession Made in Wall Street, Felt on Main Street.

And it's the same thing here. It's always been the case that taxpayer loans to students were protected through bankruptcy: that is, a student or ex-student could not use bankruptcy to wash away their debts. That provision made sense for two reasons. One, taxpayers deserve protection as well as students. Two, federal loans always had generous hardship provisions which suspended repayments for borrowers encountering financial hardship. The bankruptcy rules were simply the flip-side of those hardship provisions. Tough, but equitable.

Naturally, however, Wall Street lobbyists saw those protections and thought they'd like a slice of that pie. Wall Street wouldn't relax its demands for repayment in case of hardship, but it would like its loans to ride unscathed through any bankruptcy. And in 2005, Wall Street got its way. A rule designed to protect taxpayers and to maintain a fair relationship with the students morphed into something designed to produce a win-win outcome for Wall Street.

But if Wall Street is enjoying a win-win outcome, you can bet your bottom dollar that someone is suffering a lose-lose. And that person is you (if you're a taxpayer) and doubly you if you're a taxpayer who is also a student or recent graduate.

The taxpayer loses because we're guaranteeing far too many of these loans. When students default -- and they are defaulting at terrifying levels right now -- the taxpayer will have to bear the cost.

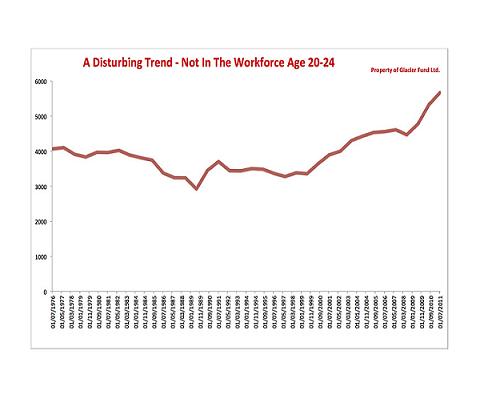

The student loses because the cost of your tuition has been ramped up by universities keen to feed at an ever-expanding trough. Students lose again, because a failing economy is not providing jobs for our young people.

An excellent study by Pew Research documents exactly how the Great Recession is injuring the prospects of our youngest, most energetic people. It's a national tragedy that's only set to get worse.

But let's not make the mistake of thinking that the student debt problem is, well, a problem of student debt. It is and it isn't. It's the honey fungus error again: you think the things are separate, but there's a huge beast lying underground and killing your forest. The problem here is an economy that's become vastly over-reliant on debt and vastly over-protective of bankers.

I'd like to scratch the unwritten 28th Amendment and replace it with a written one of my own devising. The federal government of the United States shall never protect any bank or banker from economic loss. A no bailout rule with no exceptions. A fungicide that could cover an entire country. A fungicide that might, even at this late date, save the forest.

Mitch Feierstein is the author of Planet Ponzi, a short guide to financial madness and the CEO of the Glacier Environmental Fund