This year, thanks to a few tweaks to the tax code made by the IRS, you can contribute more to your retirement. The money invested today, that grows at a modest 5 percent, will be worth four times as much in 30 years (e.g., $10,000 turns into $40,000). Find out what you can do now to maximize the growth of your nest egg.

Keep contributing to your IRA

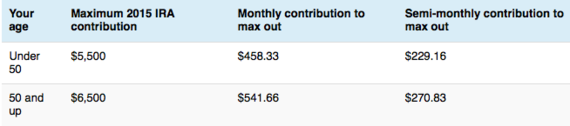

This year, the IRS did not change the contribution limits for individual retirement accounts (IRAs). You'll still be able to contribute up $5,500 to an IRA, or up to $6,500 if you are age 50 and up.

The best way to simplify the contribution process is through automated transfers. To max out an IRA, you should schedule recurring monthly contributions of $458.33. Schedule these transfers the day after your paycheck comes in -- the transfer should be $229.16 per biweekly pay period.

For those ages 50 and over, the monthly contribution should be $541.66, while the semi-monthly contribution should be $270.83.

Don't miss out on the chance to contribute to your IRA. If you don't do it by April 15, 2016, you lose the opportunity for this $5,500 (or $6,500) to grow until retirement.

IRA CDs are a safe bet

In 2014, the S&P 500 rose about 13 percent, which is a very nice gain. But as many savvy financial advisors would preach, when your high-risk investments start to make gains, it is also wise to put more money into low-risk investments.

After stocks and bonds, certificates of deposit (CDs) are one of the better options as a very safe way to save for retirement because they are similar to savings accounts -- except that you're not supposed to touch the money for a certain period of time -- and they're insured by the FDIC. When you open a CD in an individual retirement account (IRA), you get the tax advantages of of the retirement account.

Currently, Ally Bank, CIT Bank and Synchrony Bank are examples of a few banks that offer some of the best IRA CD rates. For instance, you can get a 2.20% APY on a 5-year IRA CD from Synchrony Bank (minimum deposit of $2,000). Ally Bank is currently offering a bonus of up to $500 when you open an IRA.

For the short-term, however, it isn't wise choice to invest in IRA CDs that mature in the next one or two years because interest rates are very likely to rise in the next year as the U.S. economy improves. By locking in your money in a short-term CD rate now, you're stuck watching increasing IRA CD rates for everyone else.

So, what you should do is either go with a long 5-year IRA CD, or consider a bump-up IRA CD, which offers a one-time increase on your interest rate. Ally Bank and CIT Bank offer these types of IRA CDs if you are worried about rising interest rates.

Save more through your 401(k)

According to Vanguard, one of the largest mutual fund companies in the U.S., the median 401(k) balance was just $31,396 in 2013. As you can see, many people are slacking with their retirement contributions -- don't be one of them.

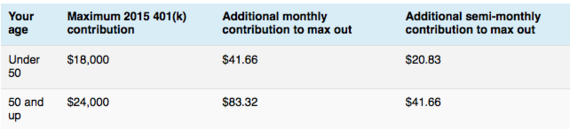

In 2015, the IRS increased the contribution limits for your company's 401(k) plan to $18,000, up from $17,500. If you are age 50 or older, you can actually contribute up to $24,000 to your 401(k) this year, up from $23,000 last year.

The increase may not seem like much now. However, that extra $500 or $1,000 could grow to become much more by the time you retire. Assuming an annual return of 5 percent over 30 years, that $500 would become $2,161 while that $1,000 would become $4,322.

If you're thinking about maxing out your 401(k) this year, you'd have to contribute an additional $41.66 per month, or $20.83 per biweekly pay period. For those age 50 or older, that's an additional $83.32 per month, or $41.66 per semi-monthly pay period.

Need a better incentive to contribute to your 401(k)? Remember that your company will probably match your 401(k) contributions (which is equal to free money), so take advantage of it.

New limits on IRA rollovers in 2015

An IRA rollover often involves taking out the money from one IRA -- you get a check for that money -- and deposit it into another IRA.

Starting in 2015, you can perform only one rollover from any IRA in a 12-month period. Previously, you could make one rollover per IRA in a 12-month period.

The previous rule allowed people to pull money from one IRA to use for personal purposes (e.g., a home down payment). Then, they'd use a rollover from another IRA to cover the first rollover. That the loophole, which created penalty-free and interest-free loans from one's retirement savings was abused -- hence the new rules of just one rollover per IRA in a 12-month period.

If you're not trying to cheat the system, the rule change should be no reason to be alarmed. You can still transfer money from one IRA to another as long you never touch the money. This can be done by a "trustee-to-trustee" transfer, which you can perform an unlimited number of times.

Use these types of transfers to consolidate those old 401(k) plans from past jobs that you've ignored for so long.

Such transfers are also great for those IRA CDs that you might have with different banks. When an IRA CD matures, you can move it to a regular IRA where you tend to have a larger selection of investments.

Simon Zhen is a writer for MyBankTracker. Follow him @SimonZhen.