Did you know that you are a trust fund baby? You probably don't realize that the expression "trust fund baby," slang for people who have had money put in trust for their economic security, applies to you, but it does.

Money held in trust is especially valuable because it cannot be reached by creditors. If you are delinquent on your credit card payments, a portion of your salary can be garnished -- deducted from every one of your pay checks and paid directly by your employer to your creditor, without your permission. All the creditor needs is a court order. But that is not true if the income comes from money held in trust for you. That money is beyond the creditor's reach. That is true of your trust fund, as well.

What is this trust fund of yours? Social Security. Your Social Security benefits are held in trust for you. Like other trust fund income, the money paid to you when you claim your Social Security benefits is shielded from creditors. Let a credit card company go to court to try to get a portion of your Social Security benefit. The case will be thrown out immediately.

Financial institutions and other creditors can seize your wages and bank accounts with a court order. But, like other trust income, these institutions cannot seize your Social Security trust fund benefits. Your Social Security is beyond the reach of all your creditors. All your creditors, that is, with one shocking exception. One entity, designed to protect you, can grab your Social Security if you owe it money. That entity is the federal government.

Since 1996, thanks to the Debt Collection Improvement Act, the federal government now has the power to garnish a portion of your Social Security benefits for the repayment of federal student loans, Veterans Administration home loans, food stamp overpayments and the like. And our government has been making use of this new power. Let's look just at student loans.

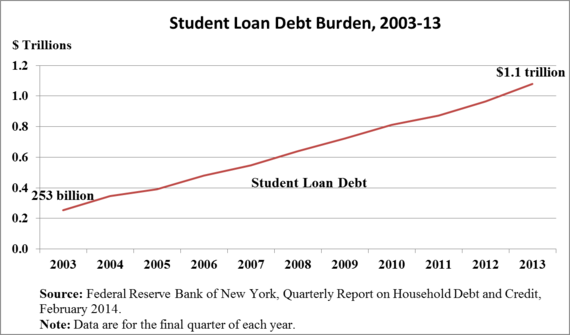

The nation is facing a student loan crisis. When once young adults could emerge from college with manageable debt, now they are often saddled with enormous debt. Indeed, nearly one out of two millennials, those born between 1980 and 2000, carries student debt. The amounts owed to creditors for student loan debt is skyrocketing, as the following chart shows.

Many see student debt as a young person's problem, but it affects all generations. People ages 65 and older owe $18.2 billion on student loans. People ages 75 and older owe around $2 billion on outstanding student loans. As the population ages, the amounts owed by those age groups are increasing rapidly.

Some of this debt is decades old, incurred when those older people sought higher education or retraining for themselves. Some is the result of co-signing loans to help their children and grandchildren. About 90 percent of nongovernment student debt -- loans made by private banks or other private financial institutions -- must be co-signed and the co-signers are generally parents and grandparents.

It doesn't matter how good the reason for the loan or how dire the burden; if the loans can't be paid off, they will follow you into retirement, and literally, to the grave. Student debt cannot easily be discharged in bankruptcy, despite great hardship.

Student loans owed by seniors are much more likely to be in default than student debt held by younger Americans. In 2013, for example, twelve percent of federal student loans held by those aged 24 to 49 were in default. In contrast, 27 percent of federal student loans held by those aged 65 to 74 were in default. For those aged 75 and older, the default was more than 50 percent!

That's where Social Security comes into play. If the student loan was made by a private bank or other financial institution, your Social Security is safe. But beware, if the loan is a government loan. A portion of the Social Security benefits you earned can be grabbed without your permission. And it is happening at alarming rates. The number of retirees and people with disabilities who have a part of their modest Social Security benefits seized by the government to pay off student loans has tripled since 2008. 156,000 Social Security beneficiaries are currently having their earned benefits garnished to pay for college debt. And their number is projected to grow dramatically in the future, as the cost of education continues to balloon and the population ages.

Recognizing how vital Social Security is for beneficiaries, the 1996 legislation protected a portion of it. After all, almost two-thirds (64.6 percent) of elderly beneficiaries rely on Social Security for half or more of their income. One-third rely on those modest but vital benefits for virtually all of their income. Consequently, the 1996 law requires the government to leave beneficiaries at least $750 a month ($9,000 a year). Monthly income of $750 doesn't go very far. It didn't go very far in 1996, and the amount has not been increased for twenty years, since the law was enacted.

It's long past time to overturn the wrong-headed 1996 legislation and restore the protected status of Social Security trust fund payments. That's why, back in October, we joined with our allies to gather 375,000 signatures demanding a moratorium on the garnishment of Social Security benefits, and delivered them to the U.S. Department of Education.

Important members of Congress recognize this wrong-headed policy and are seeking to change the law. Senator Ron Wyden (D-OR), ranking member of the Senate Finance Committee, has just introduced, with seven cosponsors, S.2387, the Protection of Social Security Benefits Restoration Act. This bill would repeal the 1996 legislation altogether, so Social Security benefits could no longer be garnished to repay student loans, Veterans Administration home loans, overpayments of food stamps and other federal benefits.

In the House of Representatives, Congressman Raúl Grijalva (D-AZ), co-chair of the Congressional Progressive Caucus, has introduced, with nineteen cosponsors, the Stop Social Security Garnishment for Student Debt Act of 2015 (H.R. 3967) which would end the power of the government to garnish your Social Security benefits to repay federal student loans. And, in the event that Congress does not do the right thing and end garnishment of Social Security, Representative Ted Deutch (D-FL) has introduced the Social Security Garnishment Modernization Act of 2015 (H.R.3747), which would index the exempt amount, now at $750, to inflation.

These visionary leaders should be applauded and supported. In addition to facing a student debt crisis, the nation is facing a looming retirement income crisis. Too many Americans fear that they will never be able to retire, while maintaining their standards of living. We should be expanding Social Security to address this crisis, not worsening it by garnishing benefits.

An election year is a moment of accountability. I urge those of us who are concerned about the student debt crisis and the retirement income crisis demand that those seeking our vote endorse the Wyden, Grijalva, and Deutch bills. It is time to restore to Social Security the important safeguard available to all other trust fund income and available to Social Security beneficiaries for its first sixty years.

When we created Social Security, eighty years ago, we enshrined in law that Social Security benefits would be inviolable. We earn our benefits as we work and they need to be there for us and our families when and if we become disabled, die, or reach old age. We should be secure in the knowledge that our earned Social Security benefits will be paid in full and on time. Congress should not have treated the people's trust fund differently from all other trust funds and opened Social Security up to any creditor. Now is the time for Congress to step up, admit it was wrong, and correct its mistake.