More than 12 million homes entered the foreclosure process between 2007 and 2012 (according to RealtyTrac). One out of every five homes (21.5%) are still underwater in America, with $628 billion of negative equity (source: CoreLogic). Americans are carrying $11.34 trillion in debt; student loan debt is almost a trillion (source: New York Federal Reserve Bank).

Seventeen percent of borrowers are more than 90 days delinquent on their student loan debt. When compared to the borrowers in repayment, the percentage rises to one-third.

Would you have purchased a home in 2006 if you knew that the average returns of real estate are less than 5% a year?

Would you have focused your studies on science, technology, engineering and math if you knew that more than three million STEM jobs were available during the Great Recession?

Would you diversify your nest egg better if you knew that 20% of the leading blue chip index was bailed out during the Great Recession?

Would you have tapped your retirement plan to pay bills if you knew that money was yours to keep no matter what (even in the worst case scenario)?

Would you purchase solar panels if you knew that the payback time was down to 4-7 years if you live in a sunny state?

Would you rather adhere to a Thrive Budget or struggle to survive and feel buried alive in bills?

If you knew that annual rebalancing was the key to returns on Wall Street, in today's slow growth economic cycle, would you have let all your gains ride during the last two recessions?

Would you have purchased that McMansion if you really understood the costs of energy, taxes, upkeep and insurance?

Are you aware that you are taxed on the difference between the short sale price and your mortgage (your phantom income), and that in 2013, the IRS is forgiving that debt? (Meaning that 2013 is an important year to decide whether or not to short sale, take advantage of a deed in lieu and/or restructure your mortgage and debt.)

We are wary of used cars salesmen, but how conscious are we of the fact that almost everything we buy is sold to us by a commission-based broker who wins when they convince us to buy more than we came to purchase?

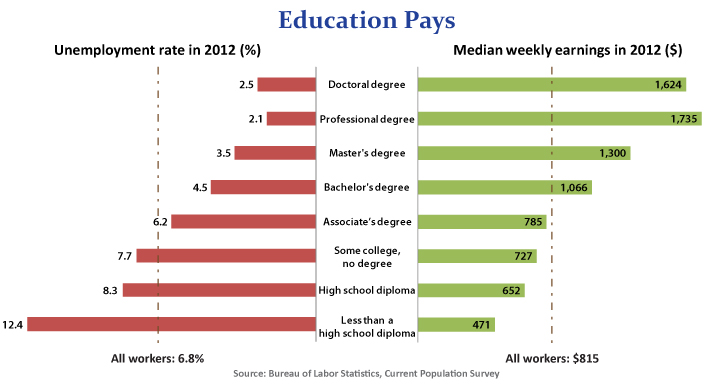

Would you have gone to college if you knew that that high school dropouts earn one-third the income as those with advanced degrees and are six times more likely to be out of work? (College loans are typically "good debt," though you want to do everything within your power to keep the debt as low as possible -- through scholarships and grants, and even considering junior college for the first two years of study.)

Financial literacy is the best gift.

For yourself.

For those you love.

For your teens.

For your retired parents.

For your college students.

For your friends.

For your mother this Mother's Day.

That is why I wrote my new book, The ABCs of Money. And that is why TD Ameritrade Chairman Joe Moglia wrote the forward to the book.