I received a call from a woman who had a tragic event in her life, which completely changed her income status overnight. Her husband passed away unexpectedly (and before his time), and she inherited a million dollars from the life insurance policy. She called me and said, "As soon as I pay off $100,000 in debt, I want you to help me budget and invest the rest of the money."

"Hmmm," I said, "So, you want to strip yourself of millionaire status and then ask me how to help you get there again."

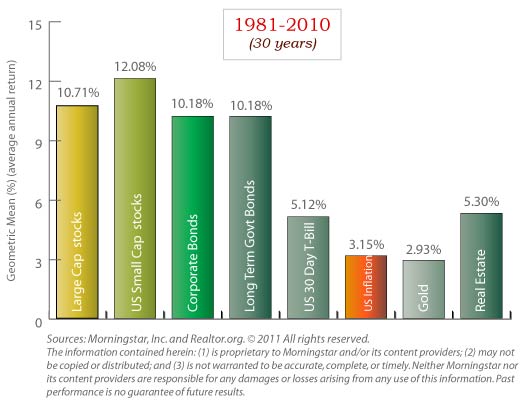

A millionaire thinks quite differently. A million dollars to a millionaire is a chance to earn 10% annual gain - which is $100,000. In the millionaire's mind, the first year's gains pay off the debt, and you get to keep the million in principal to earn another $100,000 the following year. If that were your sole "income," then you would live off of the $100,000 annual gains, keep the principal in tact, and your "job" would be to figure out how to earn 10% annual gains, while keeping the risk factor to a minimum.

Below are 10 Golden Rules about wealth, including why you must start the daily habit of paying yourself first now - even before you pay down your debt or pay any bills at all.

1.Tithe to yourself first- not the bill collector.

2.Keep a percent equal to your age SAFE.

3.Diversify your stock holdings.

4.Diversify your assets.

5.Never loan money to relatives or friends.

6.Startups are not investments.

7.Never let relatives or friends manage your money.

8.Underweight distressed industries and overweight hot industries.

9.Rebalance at least once a year.

10.Trust no one. Verify everything.

And Here's Why, How, When, etc.

1.Tithe to yourself first - not the bill collector.

Your 401K, IRA, Health Savings Account and other "retirement" plans are your chance to start living a rich life now. Increased assets provide you with all sorts of freedom, including lower interest rates on loans, better credit profiles, higher assets to debt and more. This money is also protected from your own tendency to throw it down the drain of bills and retail therapy and from the liens of anyone whom you owe money to. Even in the worst case scenario -- bankruptcy, foreclosure, etc., your personal retirement fund is protected. (Remember OJ?) You have an obligation to yourself and your family first, even now, even if you are underwater on a mortgage or have credit card debt. I'm not saying to ignore your bills. I'm saying to focus on your fiscal health first because no one is going to take up a collection for you if you lose your job, have health issues or decide to retire.

2. Keep a percent equal to your age SAFE.

If you were 50 during the Great Recession and you kept a percentage equal to your age safe, plus 20%, your maximum losses would have been 15%. Not losing is winning in a recession. Stocks and bond funds are not safe, and many bonds are vulnerable these days (think Greece), particularly those where the underlying corporation or municipality is carrying too much debt. Learn more about how to get safe in the articles, "Are Bonds Safe?" and "What's Safe?" from my NataliePace.com ezine.

3.Diversify your stock holdings.

Read You Vs. Wall Street, particularly page 92, to see an example of an easy-as-a-pie-chart nest egg strategy that has worked in bull and bear markets for more than 12 years now -- through the Dot Com Recession and the Great Recession and the bull runs in between. Select just 10 diversified funds and you can easily see and capture your gains each year. Six of the 10 funds should be diversified by size and style and four funds should be hot industries for that year. Be sure to avoid the Bailouts to maximize your returns!

4.Diversify your assets.

Be an and person. Own your own home and stocks and bonds and a little gold and then start thinking about other low maintenance, low risk, cash positive, hard assets that can earn a 10% annual gain. Now might be a great time to purchase income property, or a car wash, or a dry cleaners, or a mini-mall with some essential, recession-proof service, like a grocery store, anchoring it.

5.Never loan money to relatives or friends.

Read the "Don't Be Famous and Bankrupt" chapter from You Vs. Wall Street for details. You don't want to be the bank of the family and you certainly aren't in a position to evaluate these "loans" based upon merit or the probability that the loan will be repaid. Look at your spending in the harsh light of reality. It might be charity (so give the money). It might be fun or educational (so spend the money, if you wish). But it's rarely a loan or an investment that will pay you back - even if you are promised equity in a startup with the potential to become the next GroupOn.

6.Startups are fun or charity - but not nest egg investments.

If you are an actor/waiter or a singer/secretary or an author/executive, you might wish to invest (spend) every spare dime on your CDs, books or actor reels. If you lost a job, you might have taken a seminar telling you how easy it is to self-publish a book and start your own consulting business. The truth is that most startups fail. If they make it to cash positive, that's great, but in the meantime, you're going to spend a lot of time and money. On the other hand, no matter what your passion project is (and why not have a passion project!), if you invest 10% of your income in a tax-protected retirement account, and that 10% earns a 10% gain, you'll have more money than you earn in seven years and your money will make more money than you do, within 25 years. That kind of wise investing will generate a whole lot more money to film that American Idol video, or to fund your own book tour, or to take a year off to audition for toothpaste commercials.

7.Never let relatives or friends manage or invest your money.

According to a 2006 FINRA.org study on investment fraud, 70 percent of victims made an investment based primarily on advice from relative or friend. Interview your money managers as if your life depends upon it because your lifestyle does. There are 12 questions to use when interviewing your financial partner candidates in You Vs. Wall Street.

8.Underweight distressed industries and overweight hot industries.

AIG, GM, Bank of America, JP Morgan and Citigroup were all part of the Dow Jones Industrial Average, meaning that the former leading blue chip index was really the bailout index. Not surprisingly, the DJIA earned less than half as much as NASDAQ since 2009, with gains of 30%, compared to NASDAQ's 60%. Meanwhile, countries rich in natural resources, like Australia and Latin America, have doubled in share prices since 2009.

9.Rebalance at least once a year.

Rebalancing once a year means that you'll always have enough safe, can capture your gains (increasing your net asset value), can determine which industries are hottest for the year and which industries, countries and companies to avoid, like banking, Greece and Japanese nuclear power plants. Doing this meant that you would have captured most of the Dot Com gains you made in 2000 - before the crash wiped most investors out. You would be rich in real estate gains in 2005 - before the crash. And powered up on clean energy gains in 2007 (when clean energy was the top industry on Wall Street) - before the lights went out on that industry in 2008.

10.Trust no one. Verify everything.

Your bank: Bailed out. Some brokerages: Bankrupt. Others: bailed out. The "experts" failed, with few exceptions. The only experience that counts these days is a PhD is in results. You must check the fiscal health and fine print of any bank, annuity, brokerage account, etc. that you sign up for. In general, the higher the dividend or interest rate, the higher the risk. I recently saw a "Smart CD" that offered 0-9% return, based upon a basket of 10 stocks. It was FDIC-insured, but the deal only offered "principal protection" if the CD was held to maturity (a minimum of five years). If the stocks went South and you needed the dough sooner than you expected, you might receive only dimes (or pennies) on the dollar. That's not a safe investment at all, although the term CD would lead you to believe it was.

If you inherit a million and still have a thousand-aire mindset and lifestyle, you'll be broke in just a few years. If you start out with a few thousand and you follow these golden rules, you'll create prosperity and abundance and the life of your dreams. And that is the only good thing about losing a loved one and inheriting a million dollars.

About Natalie Pace:

Natalie Pace is the author of You Vs. Wall Street. She is a repeat guest on Fox News, CNBC, ABC-TV and a contributor to HuffingtonPost.com, Forbes.com, Sohu.com and BestEverYou.com. As a philanthropist, she has helped to raise more than two million for Los Angeles public schools and financial literacy. Follow her on Facebook.com/NWPace and on YouTube.com/NataliePaceDOTCOM. For more information please visit NataliePace.com.