On Sunday, March 15, 2015, the U.S. hit the debt ceiling. Treasury Secretary Jacob Lew began employing what he calls extraordinary measures to pay government bills on Monday, March 16, 2015. Secretary Lew has urged Congress to raise the debt limit, again, as soon as possible. Click here, if you would like to read the full letter from Secretary Lew to John Boehner, which was also sent to all of the members of Congress.

As of today, there has been no official response about the Debt Ceiling from House Speaker John Boehner. Senate Majority Leader Mitch McConnell has repeatedly stressed that there will be no default on the debt. Speaking on CBS' Face the Nation on March 8, 2015, McConnell said, "The debt ceiling will be handled over a period of months. The Secretary of the Treasury has a number of what we call tools in his toolbox. I made it very clear after the November election that we're certainly not going to shut down the government or default on the national debt."

Both parties are aware that the American economy has benefited from Washington keeping debt out of headlines and absent from the American dialog. Therefore there is a strong rationale for raising the Debt Ceiling again, without any hoopla.

Last year, on February 11, 2014, a last-minute backroom deal was struck, which was great for Wall Street. Before the deal, the Dow Jones Industrial Average dropped over 800 points. After the Debt Ceiling was lifted, the Dow rallied to all-time highs.

However, last year's deal certainly doesn't mean that this Debt Ceiling vote will go through as easily. When the Debt Ceiling was raised on February 11, 2014, Boehner relied on the Democrats to get the Bill through the House. Only 28 Republicans voted to temporarily raise the Debt Limit. The House vote was 221 to 201. The Senate passed the Temporary Debt Limit Extension 55 to 43, with 2 abstaining votes. All of the Nays were Republican; all of the Yeas were Democrat and Independent.

The current Congress has a clear Republican majority. There are 245 Republicans with 188 Democrats in the House, and 54 Republicans, 44 Democrats and 2 Independents in the Senate. Even if 28 House Republicans side with Democrats, the Republicans still have a majority vote of 217/216.

Mitch McConnell sums up the Republican stance on the debt at the top of his economic growth page. According to McConnell:

We need to face that fact that we don't have the money. It is not an American value to borrow from others to pay for programs we don't need and can't afford. And it is not an American value to put off tough decisions because you refuse to say no to things you want. If there's any good news in this debate, it's that we're finally beginning to talk about how much to cut in this town instead of how much to spend. But we're going to need more people to join the fight. We'll need Democrats to join us. Above all, we need a President who gets it.

The current U.S. debt is $18.2 trillion. The current-dollar GDP in the U.S. is $17.7 trillion. In fact, the U.S. debt is the highest in the world and the debt to GDP ratio is on par with Western Europe. PIIGS+ countries get more publicity because they have to borrow money on the open market. In the U.S., we've been borrowing from ourselves through "intra-government debt," i.e. state debt, Social Security, from the Federal Employees retirement funds, Medicare and Medicaid, Disability and Unemployment and other "smaller trusts."

*Portugal, Italy, Ireland, Greece and Spain.

How Long Can Treasury Secretary Lew Pay Bills Using "Extraordinary Means?"

April tax revenue will keep the checks flowing for a few more months, so there may be a lot of back room negotiations going on without any real headlines now through summer. According to the Congressional Budget Office, the Treasury should be able to pay bills through October or November. There are a lot of moving parts to the equation, however, so the CBO warns that we could run out of dough before or after those months. Ignoring the problem for too long would definitely sound the alarms. The rest of the world will start taking notice if a deal is not reached by (or before) September.

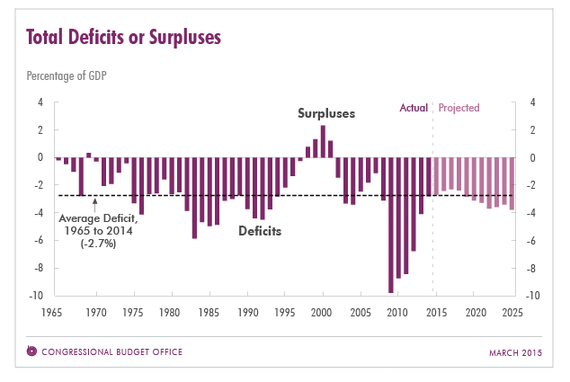

Here's another interesting chart. Since 1970, the only time that the U.S. did not run a budget deficit was under the Clinton Administration (and one year following Clinton's second term).

We should have until September before the Debt Ceiling debate starts making headlines again. If there is a backdoor deal, there will be an uneasy calm, and relief, on Wall Street. If the debate heats up, then volatility is likely to roil the markets.