It seems like Tax Day has become a symbol of anti-everything. People are protesting about where the money goes or where the money is coming from, who is to credit and who is to blame.

There's also been some noise about where the money isn't coming from - the supposed 47 percent of Americans who do not pay taxes because of their income and use of tax deductions and credits. It has led some to complain about "people who are getting something for nothing."

While convenient for raising the ire of taxpayers, that argument is full of holes. As David Leonhardt wrote in the New York Times, most of these same people also shell out for payroll taxes, capital gains taxes, state taxes and even local taxes. And even if we're just looking at federal income taxes, Leonhardt goes on to cite a Congressional Budget Office study (PDF) that puts that "47 percent" figure down around 10 percent.

But in the something for nothing department, the pundits are leaving out the biggest beneficiaries of all.

Every year, American taxpayers who play by the rules - individuals, small businesses and even a lot of bigger businesses - have to pay a lot of extra "something" because of all the tax dodgers who pay nothing.

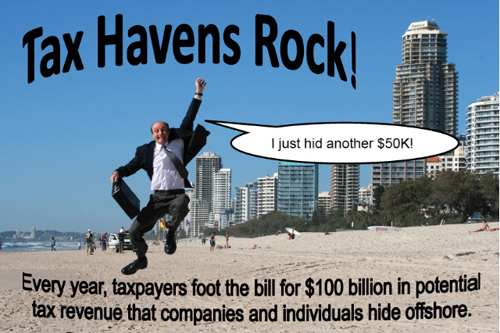

Because of tax dodgers using tax loopholes and tax havens, every year, the United States loses over $100 billion in revenues - that's about $500 for every person that filed their taxes this year. So, as taxpayers head out to the Post Office or get ready to click and file, it's fiscally responsible and in the public interest that they understand who is paying... and who isn't.

And according to a recent Government Accountability Office study (PDF), nearly two-thirds of corporations - that's a lot more than 47 percent - pay no taxes at all. They use a myriad of deductions, credits, and allowances. They get to deduct their business expenses for operating overseas and receive tax credits for taxes they pay to another government to avoid double taxation.

There are also corporations that built up their businesses here in the U.S. and then re-incorporated with sham headquarters overseas to avoid paying their share. They benefited from all of the security, infrastructure, subsidies, and other amenities here and then went abroad to skip out on their responsibilities, leaving the rest of us to foot the bill. Some even manage to get subsidized by the rest of us taxpayers and maneuver a negative tax rate, meaning, we pay them!

A few years ago, Sen. Byron Dorgan (D-ND) put it this way:

"The American People pay their taxes. People who run businesses on Main Street pay their taxes. And frankly, it disgusts me to see corporations decide in their boardrooms that they would like to renounce their U.S. citizenship so they can avoid paying taxes. My feeling is that if they would like to be citizens of Bermuda, perhaps they should rely on the Bermuda navy to protect their assets and I believe the total Bermuda armed forces has somewhere around 27 people."

And what about foreign multinationals that take advantage of our markets, consumer base and infrastructure but then funnel their money overseas? Where's the outrage at that?

For those still unmoved by this veritable laundry list of tax injustice: a number of companies that use tax haven countries - including American Express, A.I.G, Exxon Mobil, Goldman Sachs and Pfizer - were either recipients of taxpayer-funded bailout money or receive lucrative government contracts. In fact, Goldman Sachs, which received a $10 billion taxpayer bailout, managed to get their tax rate down to one percent by citing "changes in geographic earnings mix." And for 2009, Exxon Mobil, which received over $440 million in government contracts, managed to effectively shelter its profits and pay zero dollars in U.S. taxes thus far.

If that's not getting something for nothing, then I don't know what is.

For more on corporate tax dodgers and what they cost us, read the new Tax Shell Game: What Do Tax Dodgers Cost You? from the U.S. Public Research Interest Group

To learn more about the companies who lobby against reformin the tax system, read U.S. PIRG's report, Who Slows the Pace of Tax Reform?