At Climate Week New York we launched our fourth annual global carbon pricing report. Each year we ask major multinationals who disclose to their investors and business customers through CDP if they are applying an internal price on carbon, and how they are using this to better manage climate-related risk and reduce carbon emissions.

As our report this year highlights, investors are asking companies to disclose this information to help them ascertain risks in their portfolios: a company using an internal price on carbon provides investors with some comfort that they are prudently planning for a world of carbon regulations.

What are companies like Shell, General Motors, Goldman Sachs and Microsoft doing to manage climate risk?

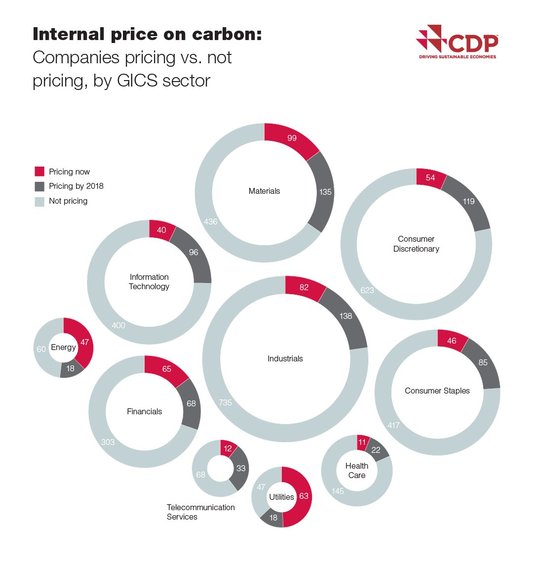

Our carbon pricing report found that more than 1,200 companies - 23% more than last year - are now using an internal carbon price or planning to adopt one.

The use of an internal carbon price by companies is a fairly new phenomenon. Four years ago just 35 companies disclosed they were using one, though it appears to be heading towards a new norm of behavior to manage risk in capital markets. Given this rapid adoption it is not surprising that companies are using this tool in a range of different ways: from testing business strategies against future scenarios, such as Shell; as a real investment hurdle like ENGIE; and even to drive investment towards climate-aligned corporate goals, be it an emissions reduction target, an energy related challenge, or the creation of a new low-carbon product line, like Microsoft.

Close to 150 companies are embedding a carbon price deep into their corporate strategy. These companies are using it to deliver on climate targets, whether it be an emissions or energy related target or to help foster a new line of low-carbon products and services. They report that it helps by providing an incentive to reallocate resources to emission reduction investments, can be used for creating a business case for R&D investments and, by assigning a financial value to both emitted and avoided emissions, it helps reveal hidden risks and opportunities.

Over 40 major multi-national companies with a combined market cap of US$1.5 trillion have disclosed tangible business benefits to us - from shifting investments towards energy efficiency measures, low-carbon initiatives, energy purchases and the development of new low-carbon product offerings. A very positive sign given this tool is relatively nascent. Companies in the energy and utility sectors were most heavily represented in the results. Others include technology companies like Microsoft, or the Swiss Pharmaceutical Novartis and carmakers such as Nissan and General Motors.

The number of companies disclosing they are in the process of adopting an internal price is increasing. There has been a considerable jump especially in Mexico, Brazil, India and Japan, as well as in the US.

What is driving the race to price carbon?

There are a number of drivers, including the growing momentum post the adoption of the Paris Agreement - which we expect to accelerate with its forthcoming ratification - and China's impending carbon market. Novartis disclosed it has adopted a US$100 a metric ton carbon price to help it identify projects that will most cost effectively reduce greenhouse gas emissions. Saint-Gobain, SUEZ and Anglo American all use an internal carbon price to stimulate R&D into low carbon technologies such as fuel cells and construction materials.

Some of the businesses we talk to set a carbon price to inform future investment decisions. The French utility Engie disclosed it had decided to abandon new coal projects in 2015 in a belief that a carbon price will steadily be established across the world, and that coal fired plants will be adversely affected in the future. Societe Generale has saved €13 million on overheads by pricing carbon over a three-year period. TD Bank and Royal DSM are now pricing internally to underscore strategic shifts towards low-carbon operations and products.

Investors are also driving the carbon pricing agenda. They want to understand the inherent risks they are running in their portfolios in light of the changing landscape and are keen to ensure businesses are responding to a low carbon future. Jack Ehnes, CEO at CalSTRS takes climate change very seriously and is using CDP data to hold companies accountable to disclosing and managing climate risk and demonstrating they are preparing for a low-carbon economy.

The Taskforce on Climate-related Financial Disclosures (TCFD), established by Mark Carney and chaired by Mike Bloomberg, is considering recommending companies disclose forward looking risk against scenarios. Doing so against future deemed carbon prices is clearly one such way investors can assess potential future exposure.

However some 500 companies in high emitting sectors still do not have or are not considering a carbon price. We believe these companies are potentially at risk from having a too short business planning horizon given how fast climate change issues are moving.

Some multinationals are starting to lead the way, but this time next year we expect to see carbon pricing be the new normal across markets globally. After all, with China's adoption of a nationwide carbon pricing scheme expected before the end of 2017, every major corporation and investor will have a carbon price somewhere in their supply chain or portfolio. The question is whether they understand how they will be exposed to this and are they prepared?

Read the full CDP 2016 Carbon pricing report here.