By Jennifer Fitzgerald, PolicyGenius contributor

If you Google the question, "How do I choose the right health insurance plan?" you'll find a lot of general information. But what you won't find is tactical advice. You won't find a simple "hack" for health insurance for the person who doesn't want to spend days researching and creating detailed spreadsheets.

If that's what you're looking for, you've found it. I've boiled everything down into an easy checklist, but read on for an explanation of the shortcuts you can take in this process.

Before the Affordable Care Act (ACA), there was no easy way to shop for a health insurance plan. But the ACA has standardized health insurance marketing, which makes it easier to compare plans "apples-to-apples." So now you can get right to it in just two steps:

1) Decide what level of plan you want

The ACA has neatly categorized all health insurance plans into four metal tiers: bronze, silver, gold and platinum. Every plan across all tiers covers all the essential health benefits; what differs is the cost-sharing between you and the insurance company. So how much should you spend?

If you make less than $40,000 per year and don't have health insurance through your employer, you may qualify for a subsidy. See if you qualify. If you do, make sure you apply for the subsidy when you create an account on your state's ACA marketplace site.

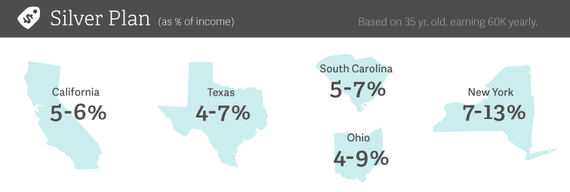

If you don't qualify for a subsidy, aim to spend around 5 percent of your annual gross income on health insurance premiums. That's how much consumers spend, on average, on health insurance according to the government's Consumer Expenditure Survey. It's also short enough of the government's "unaffordability threshold" of 9.5 percent (which is a good benchmark for this exercise) to give you room to cover your share of the non-premium expenses under any health plan (deductibles, co-payments and co-insurance). In most states, spending 5 percent of your income on health insurance premiums will also land you squarely within range for a silver plan. We looked at the range of costs for a silver health plan for a 35 year-old making $60,000 per year and calculated the percentage of income that would represent:

For most people, a silver plan is a good choice. We've steered most of the consumers we've helped into a silver plan. By design, silver plans will have a higher deductible (which is what keeps premiums lower). Silver plan deductibles will typically run between $1,000 and $3,000 per year (although there might be silver plans available with a higher deductible). Remember that a deductible is the amount of health care expenses you're responsible for, per year, before your health insurance kicks in. Make sure you have enough in savings set aside to cover the deductible -- which could come at you in one lump sum, if, for example, you end up in the emergency room with appendicitis.

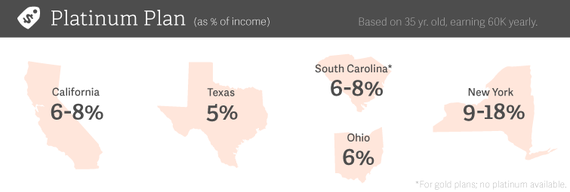

If you have a health condition that requires you to use more health care services, then consider a gold or platinum plan. These plans cost more in terms of premium, but pay for more of the costs when you actually use care (i.e., with lower deductibles, co-payments and co-insurance). And in most states, a platinum plan (the highest level) may not cost significantly more than a silver plan. For the same 35 year-old making $60,000 per year, we looked at the range of costs for a platinum health plan and calculated the percentage of income that would represent:

2) Decide which insurance company you want to go with

Once you've narrowed down your decision to a metal level and price point, now you have to pick among different insurance companies. This is where we've seen anxious and super detail-oriented consumers go down a rabbit hole. Here's a better way: come up with your 5 "deal-breaker" questions and do a bit of research among the insurance companies. You can learn how to do that online and over the phone in this article. Expect to spend about a half hour researching per insurance company. Here are some common deal-breaker questions:

- If you have must-keep doctors, confirm whether they're part of the insurer's network. Rule out the plans your doctors don't work with.

- If you have must-take expensive prescription drug, confirm whether the insurer has that drug in their formulary (i.e., their covered list). Rule out the plans that don't cover the drug.

- If the thought of needing a referral every time you see a specialist stresses you out, rule out the plans that require this.

- If the thought of speaking to insurance company people on the phone stresses you out, check out the insurer's website and mobile apps. Rule out the insurers that don't meet your standards for online self-service.

This invites the question: is there an easy way to compare the quality of different insurers? Short answer: no. The National Committee for Quality Assurance does evaluation and accreditation of health plans. But, these aren't comprehensive. And lack of accreditation isn't necessarily a bad thing: it could just mean the insurer hasn't applied and paid for the accreditation process (which is opt-in, not mandatory). And if two plans you're considering are both accredited, then it's not helpful for deciding between the two.

You might also see starred ratings of insurance companies on your state's marketplace. You should confirm how the ratings are developed. Are they objectively applied by an independent or government agency, or just aggregated customer reviews (like you'd see on Amazon)? A good rule of thumb when it comes to customers' starred ratings is that they're indicative, not definitive. Unless there's some calibration of the ratings, they're probably apples and oranges. What might get 5 stars in my book might only get 3 stars in your book. So don't go by the starred ratings alone.

If you don't have any deal-breaker questions, or can't be bothered with homework, then you, my friend, are a low-maintenance health consumer. Just pick a plan in the price range and metal tier you've selected. If you're not satisfied, you're only locked in until next January when open enrollment starts again. And remember that the ACA has eliminated most of the blind spots that got folks into trouble. The important thing is to pick a plan and get covered. As I've previously written about, not having any health insurance is a huge gamble with your health and your finances.

There you have it. For your reference, we've boiled down this information into an easy checklist.

Do you have any tips or shortcuts for health insurance shopping? If so, we'd love to read about them in the comments!