Destitution means extreme poverty, something that separates the third world from the first. When people are homeless or hungry, they are said to be destitute. Does destitution exist in the United States, still the largest economy in the world? It certainly does, and on a large scale.

According to Lauren Bush, the founder of FEED, an organization that provides meals for needy children and families, "49 million Americans are food insecure. This means one in six people does not know where his or her next meal is coming from." These people clearly live in extreme poverty. Are they unemployed? Most of them are not. The 2015 Economic Report of the President reveals that out of a labor force of 156 million, fewer than 9 million were jobless. In other words, more than 40 million workers go partly hungry in America, which has a GDP of over $17 trillion.

The Economic Report also shows that poverty is now the worst in over 50 years. What about America's middle class? A Bankrate.com survey commissioned last December concludes that 62 percent of Americans, a vast majority, have mere $500 of cash in checking or savings accounts. Thus, few realize how bad things have become in the United States, where destitution, poverty, hunger and a struggling middle class stalk the land.

All this, of course, is the havoc caused by the Great Recession that started in December 2007 and was declared over in mid-2009. Meanwhile, the rich have gotten richer as never before. According to Berkeley Professor Emmanuel Saez, "Top 1% incomes grew by 31.4% while bottom 99% incomes grew only by 0.4% from 2009 to 2012. Hence, the top 1% captured 95% of the income gains in the first three years of the recovery."

Monopoly Capitalism

Why are the super-rich getting richer and others including the middle class getting poorer? The answer will surprise most of you. The real culprit turns out to be government policy since 1981 that fosters monopoly capitalism and creates debt in the economy. Monopoly or crony capitalism is a system dominated by giant firms that charge high prices, pay low wages and extract huge productivity from their employees. High productivity generates high production or supply, whereas low wages create stagnant demand. With supply constantly exceeding demand, there is overproduction that either leads to layoffs or few entrants to the labor force are hired. Thus the real reason for high unemployment or sluggish recovery is a relentless rise in the wage-productivity gap generated by monopoly capitalism.

However, joblessness not only hurts the workers but also irks the politician, especially the one interested in re-election. Few incumbents wish to face an unemployed electorate. Their jobs are also in jeopardy in times of rising joblessness. They then have two choices: either follow policies that raise wages to the level of growing productivity or do something else that raises demand to the level of supply. Unwilling to raise the minimum wage regularly and thus offend monopoly capitalists who finance their election campaigns, they adopt debt-generating policies. Ever since 1980, the Federal Reserve has slashed interest rates to lure people into debt, so that consumers raise their spending not out of a wage rise but out of increased borrowing. Federal deficits and debt have also risen for the same reason. This way demand increases artificially to match the ever-growing supply. Those laid off are then recalled to work and the incumbents retain their cushy positions of power.

Debt and destitution coexist in the third world; now they also do in the United States of America.

Debt and Inequality

The debt generating policies, however, make the super-rich richer. This is how the process works. All production is divided between capital income (or profits) and labor income. Thus,

Profits = GDP - Wages

However, if some goods remain unsold, then

Profits = GDP - Wages - Unsold Goods

because the value of unsold goods lowers profits dollar for dollar. Through debt-creating policies, politicians ensure that consumers and the government borrow enough money to eliminate overproduction. In other words,

Consumer Borrowing + Government Budget Deficit = Unsold Goods

Thus, debt creation means that unsold goods become zero; this way profits rise by the amount of borrowing in the economy. As a simple example, suppose GDP equals $100, wage income is $60 and unsold goods are worth $10. Then

Profits = 100 - 60 - 10 = $30

However, if unsold goods vanish as consumers and the government spend an extra $10 out of their borrowing,

Profits = $40

The point is that debt-creating policies followed by the government, including the Federal Reserve, primarily benefit the 1 percenters whose incomes soar from rocketing profits. This analysis explains what Professor Saez has observed: "Hence, the top 1% captured 95% of the income gains in the first three years of the recovery."

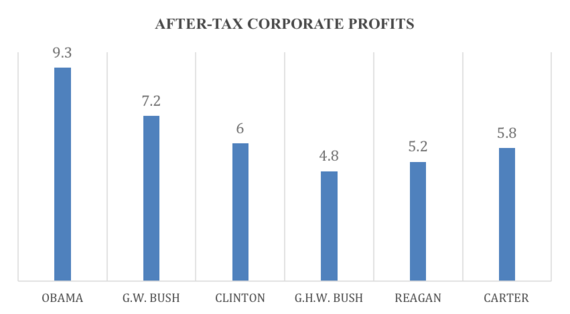

During the six years of the Obama administration, federal debt has rocketed by over $8 trillion, even exceeding the rise under President George W. Bush. So it should not be a surprise that the profit share of GDP has been the highest under President Obama in a generation, as shown in the graph below.

Source: Ravi Batra, End Unemployment Now: How to Eliminate Joblessness, Debt and Poverty Despite Congress, Palgrave/Macmillan, 2015, and The New York Times, April 4, 2014 (also see my website)

However, the ultimate cause of rising debt and poverty is monopoly capitalism, because monopoly capitalists control wages on one side and the government policy on the other. So the only way to eliminate poverty, unemployment and even the debt is to generate competition for the industrial giants. This the president can do without recourse to our slow-moving Congress by using some existing laws. For instance, he can ask the FDIC to start a "bridge bank," create competition for banking giants and bring the interest rate on credit card debt down to 5% from the current range of 15 to 30%.