The Obama administration has promised a new round of tactics to encourage banks to modify more mortgages. These steps include streamlining the modification process as well as threatening that loan servicers with woeful records of modifying mortgages will not only face monetary sanctions but will also be identified publicly by the administration. The goal of naming such transgressors is to try them in the court of public opinion. An approach that is more likely to convince banks to modify the mortgages on their books is to try intransigent banks and servicers in real courts of law. The administration needs to start to rattle the litigation sabers and threaten servicers and banks with the prospect of answering to judges for their failure to modify mortgages on their books.

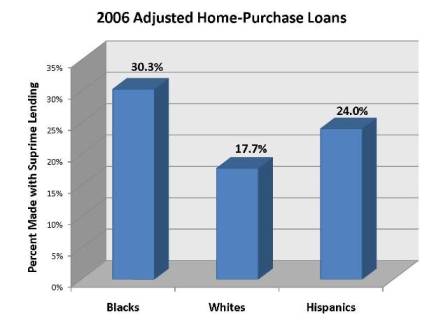

In cases filed by individual borrowers, in class actions, and in lawsuits filed by municipalities and state attorneys general, mortgage lenders large and small have been hauled into court to answer for saddling borrowers with illegal or discriminatory loan terms during the height of the subprime mortgage frenzy. To settle a series of lawsuits filed by 11 states, Bank of America, which had recently purchased Countrywide Financial Corporation (a large subprime lender), agreed to set aside over $8 billion to provide a range of relief to borrowers, including rewriting hundreds of thousands of Countrywide's subprime loans. The City of Baltimore filed suit against Wells Fargo, alleging racial patterns in the bank's lending in that city, and the Attorney General of Illinois recently filed a similar suit, also against Wells Fargo, for alleged racial patterns in lending in that state. Affidavits in the Baltimore litigation alleged that Wells Fargo officials referred to borrowers of color as "mud people" and subprime loans as "ghetto loans". These and other suits alleging discrimination in subprime lending point out that subprime lending often fell along racial lines. In fact, a Federal Reserve study of subprime lending in 2006, which controlled for many factors including income, found that African-Americans were nearly twice as likely to receive subprime loans as whites of similar income (see graph).

Even worse, a recent New York Times study of subprime lending in the NY metropolitan region showed that middle-income African-Americans were five times more likely to receive subprime loans as white borrowers of similar or even lower income.

While these lawsuits are growing in number, and beginning to yield some wins, much more could be done, and recent bank practices around foreclosures and loan refinancing certainly give cause for concern.

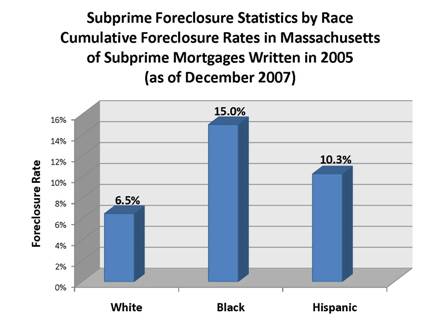

Indeed, racial patterns appear to be replicating themselves in decisions to foreclose or refinance. As shown by the graph below, research by the Federal Reserve Bank of Boston showed that as of 2007, banks holding mortgages in Massachusetts were more than twice as likely to foreclose on the mortgages of African-Americans compared to those of whites.

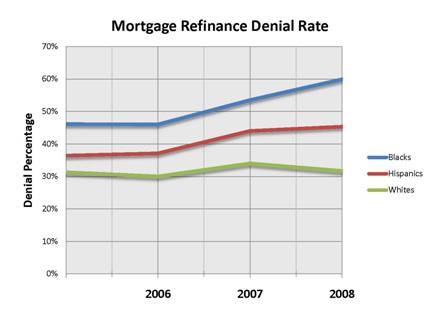

Alarming patterns have also emerged in the decision to approve or reject refinance applications. Lending data from 2008 reveal a growing denial rate for African-Americans seeking to refinance their mortgages at the same time that rate is actually declining for whites.

What does this mean for modifications? The Treasury Department should work with the Department of Justice to determine if there are any viable federal claims against banks that are underperforming in modifying or refinancing loans on their books. Treasury has data on the performance of banks in granting modifications and can begin to analyze that data for racial discrepancies or other potential legal claims. If the DOJ were to file a number of high profile actions against banks and servicers for their modification practices, it might encourage those entities and others like them to undertake more modifications. As of the beginning of September 2009, the federal modification program had generated fewer than 2000 permanent modifications. By way of comparison, Bank of America alone has modified or refinanced almost 50 times that number - nearly 100,000 mortgages - pursuant to the consent decree in the Countrywide litigation described above.

The Administration should use all of the tools at its disposal to pressure banks to modify more mortgages and lower the foreclosure rate. Litigation is a powerful tool that, to date, the federal government has largely hesitated to wield. It's high time it started.