A recent investigation from the Better Government Association took a deep look into pension spiking in Illinois and the impact reforms have had on the controversial practice.

While laws have been enacted to deter pension spiking -- a practice in which public employees nearing retirement are awarded pay raises to boost pension payouts -- taxpayers continue to be saddled with artificially inflated pension costs.

Since the Illinois General Assembly's passing of a 2012 law that gives municipalities three years to fully fund added retirement benefits that result from pension spiking, more than 450 government entities now owe nearly $29 million to the Illinois Municipal Retirement Fund, the BGA found.

To be sure, retirees collect money according to rules set by the government employers. Proponents of the state law say it provides much-needed transparency in the pension accounting process and is leading to governments changing their exit package policies.

'It is bad pension policy to pay large sums of money to people retiring, which, in turn, boosts their pensions,' IMRF Executive Director Louis Kosiba said via email. 'By spiking salaries to enhance pensions, the costs to the employer [and] taxpayer are increased. . . . Spiking is antithetical to both the design, goal and spirit of these plans.'

IMRF is the taxpayer-supported pension fund that covers many suburban and Downstate government employees in Illinois.

The amount these municipalities are on the hook for range from as little as $5,000 to more than $4 million, according to the BGA's analysis.

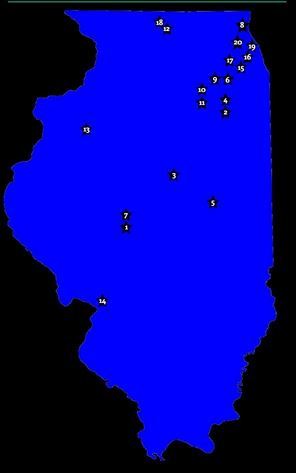

This map shows where pension spiking costs are the highest:

Check out 10 of the suburban and downstate government entities that are paying the most in pension spiking costs:

20. Deerfield School District 109 - $204,424

19. Village of Winnetka - $226,986

18. Winnebago County - $227,363

17. Marquardt School District 15 - $229,144

16. Park Ridge School District 64 - $255,041

15. Village of Lombard - $298,344

14. Madison County - $371,725

13. City of Galesburg - $383,316

12. City of Rockford - $390,360

11. Fox Metro Water Reclamation District - $413,716

Check out the 10 government entities that are paying the very most in pension spiking at Reboot Illinois.

- Weird Illinois: 15 of the strangest landmarks you can find throughout the state

- Thirty-seven of the best towns in Illinois to raise a family

- Newsweek ranks the top 30 high schools in Illinois

- Top 10 public and private Illinois colleges with the highest graduation rates

- Want to tell your elected officials what you think of the state of government in Illinois? Use our Sound Off tool

Sign up for our daily email to stay up to date with Illinois politics.