Student loan debt is one of the largest crises facing our nation today. Last year, 71 percent of our college graduates had student loans to pay off, with the average falling a whopping $33,000 in debt for their education. Americans now have more collective student loan debt ($1.2 trillion) than either credit card debt or auto loan debt.

Because of this, millennials are increasingly delaying investments in houses, not buying cars, and putting off starting a family, which cripples our consumer-driven economy. And perhaps most troubling, they are avoiding graduate and professional school programs, such as law and medical school, due to the hundreds of thousands of dollars in debt they are burdened with at the end. If we do not act to make higher education more affordable, the demand for highly skilled jobs will be unmet, and America will lose ground in the competitive global market.

To help address these trends, I, along with 29 original co-sponsors, introduced H.R. 509, "The Student Loan Interest Deduction (SLID) Act." The legislation helps make college and graduate school more affordable by easing the burden of student debt through simple tax breaks for borrowers.

Here are the key provisions of the SLID Act:

1. Doubles the tax deduction for interest paid on student loan debt. Currently, single individuals and married couples paying off student loans are allowed to deduct $2,500 from their taxes. The SLID Act would double the deduction up to $5,000 for singles and $10,000 for married couples. This puts more money in borrowers' pockets and makes student debt more manageable.

2. Eliminates upper income limits on deductions. Currently the tax deduction is phased out for individuals making over $65,000 and married couples making over $130,000, meaning that people with student loans are penalized for earning a higher salary as they advance in their careers. Under the SLID Act, regardless of how much an individual with student loans makes, they would receive the maximum deduction until their entire debt is paid off.

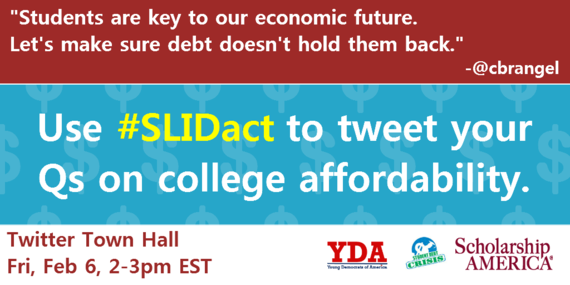

Join me, the co-sponsors of the bill, and a number of advocacy organizations including the Higher Ed, Not Debt Campaign, Student Debt Crisis, Young Democrats of America, and Scholarship America at a Twitter town hall this Friday, Feb. 6, from 2 to 3 p.m. EST, for a conversation about student loan debt using the hashtag #SLIDact.