Energy.gov will be hosting a live video chat with Richard Kauffman this Thursday at 2:00 PM ET.

China has become the world's largest producer of solar modules. But did you know that these Chinese manufacturers are using technology breakthroughs developed in the United States?

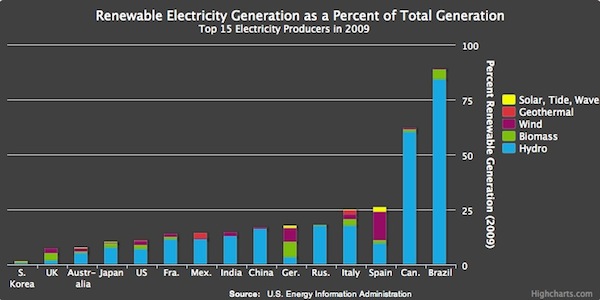

And it's not just China using our technology innovations. Many European countries -- who produce substantially more of their electricity from renewable energy than the United States -- depend on our nation's thriving renewable energy innovation engine, with substantial intellectual property in renewable energy and energy-efficient technology.

For example, Germany produces nearly 20 percent of its electricity from wind, solar and biomass -- more than twice the percentage of the U.S. So there's ample demand for renewables to ensure deployment of new renewable technologies for power production.

Given that the United States is the birthplace to some of the world's greatest clean energy technology, what's the disconnect in our ability to deploy it?

Part of the problem is that we've got the innovation and deployment cart and horse backwards. The PC industry is a good example of this. While the first PCs were very slow and big, the iPad and tablets of today resulted after decades of deployment of computer chips. On a yearly and monthly basis, we have witnessed computer chips become more affordable with even greater performance, largely driven by increased demand through large-scale deployment. In that case, innovation has followed deployment.

However, in renewable energy, we have tended to fund Research & Development projects -- but have not adequately sponsored market development. We keep waiting for breakthrough technology that will achieve cost parity with conventional sources of energy, which is a tall order in an industry where scale of production matters.

Another issue is the way that we finance renewable energy. Contrary to what many believe, a lack of financially attractive returns is not one of the reasons renewable energy deployment has lagged. Imagine this: individuals investing in a publicly traded stock made up of renewable energy. A public market for renewable energy currently doesn't exist. In this difficult economic climate, investors face a choice between investing in volatile stock markets or very low-interest rate bonds.

Meanwhile, renewable energy projects have stable, long-term attractive returns from projects begging for financing. These projects will provide 20 plus years of fixed returns similar to highly desirable bonds for investors.

A typical solar power generation project, with proven technology and a 15-20 year power purchase contract with utility company, likely yields at least 8 percent to an equity investor over its life. For comparison, 10-year Treasury bonds yield just over 2 percent. The sad part is that current rules make it very difficult for individuals to buy shares of stock in publicly traded wind or solar parks. Where other parts of the economy are financed using public stock and bond markets, renewable energy is stuck in an old-fashioned world of private banking and private equity.

Without financial mechanisms to encourage creation of a domestic market, there's no domestic demand for developing these products in the United States. And this means, we're not just missing out on our domestic potential, but we're losing out on a global scale.

Additionally, with a vibrant domestic market, manufacturers would get immediate feedback from consumers, which would inform further innovation, creating economies of scale that would be financially attractive. But failing to support innovative technologies in both manufacturing scale up and in market development will likely mean that technology and manufacturing will take place in other countries, who provide such support.

The good news is that policies can be put in place to address these market failures, and, in so doing, can quickly unleash human and financial capital.

I will be taking your questions on both these obstacles as well as some possible solutions during a live video chat this Thursday at 2:00 PM ET at Energy.gov.

- newmedia@hq.doe.gov

- Tweet your questions to @energy with the hashtag #energymatters or

- Leaving a question for me at Facebook.com/energygov.

Please tune in to Energy.gov Thursday to learn more about how we can ensure the United States takes the lead in the global clean energy race.

To learn more about clean energy innovations from the Energy Department's National Labs, please visit Energy.gov/Commercialization.