The stock market's plunging as of this writing, as the global economy reels from the destructive consequences of austerity economics. Yet in Washington, politicians are moving full speed ahead in their determination to impose a rigorous new program of... austerity economics.

What's wrong with this picture?

Politicians are finally discussing the country's urgent need for jobs. But they're still determined to push their job-killing spending cuts instead. In a week that marked the 34th anniversary of Elvis Presley's death, it's once again time to sing his old hit:

"We need a little less conversation, a lot more action."

Shock Doctrine America

It's all straight out of the "Shock Doctrine" playbook, where corporate forces use every crisis to cut taxes and impose the failed Milton Friedman philosophy of deregulation and downsized government. This crisis was caused by deregulation and a bank-fueled bubble, adding to government deficits that had been created in large part by the tax cuts Republicans are determined to protect.

What's the Republican response? Even lower taxes and even less regulation. But Democrats are drinking the Kool-Aid too. Austerity rhetoric is flowing on a daily basis from the White House, Capitol Hill, and Wall Street, driving the misguided mission of the Congressional "Super Committee" and its secret deliberations.

Bracket Creeps

This week Michele Bachmann had a crowd sing "Happy Birthday" to Elvis. Unfortunately, it was the anniversary of his death. And Rick Perry tried to steal some of the momentum Ron Paul has gained with his audit of the Federal Reserve (co-sponsored by Bernie Sanders). Unfortunately, Perry did it by criticizing a potentially helpful action -- and by suggesting that it might be appropriate to use violence against its head.

Republicans have officially become the "Happy Deathday" party. And about those taxes ...

"Colonel" Tom Parker, the former carnival who managed Elvis, said in the late 1950s that "I consider it my patriotic duty to keep Elvis up in the 90 percent tax bracket." We had a Republican president back then, we were experiencing a period of enormous postwar growth and prosperity, and the marginal tax rate for the nation's highest earners was 90%.

Today's crisis calls for urgent government spending measures to create short-term jobs and growth, and highest earners in the country pay only 35% in taxes -- if they even pay that. (And hedge fund managers may pay as little as 15%.) Yet the Republicans are calling for brutal spending cuts -- and for lower taxes on the highest earners. Behind closed doors many of them acknowledge that they are willing to consider some "revenue enhancements" -- on the struggling middle class.

Apparently they, and their backers, have forgotten that the wealthy have a patriotic duty to pay their fair share of taxes.

Caught in a trap

Three Senators on the Super Committee just wrote an editorial for the conservative Wall Street Journal entitled "Together We Can Beat the Deficit," that sounds a false alarm about a urgent "deficit problem" -- that doesn't exist.

These misguided Senators even cite the downgrade of U.S. debt by the discredited rating "agency" Standard & Poor's as if it were a legitimate assessment by a knowledgeable organization, ignoring the recent reaffirmation of of U.S. creditworthiness by S&P's main competitor, Moody's. Their editorial reaffirms the misguided mission of their committee, with only the thinnest rhetorical nod in the direction of jobs and growth.

And they're the Committee's Senate Democrats.

Sens. John Kerry, Patty Murray, and Max Baucus wrote that "the shockwaves that roiled financial markets after the downgrade was a condemnation of Congress's inability to address the unsustainable trajectory of our current fiscal policies."

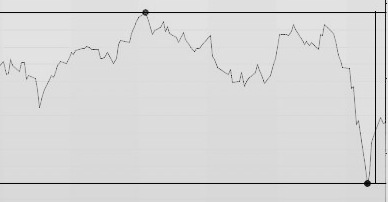

Let's take a lot at the Dow Jones over the last six months:

Remember when all the pundits and politicians were bemoaning the fact that "Washington" couldn't "get its act together" and cut spending? That's the period on the leftmost three quarters of the graph -- the one where the curve goes up. Remember when everybody started saying that maybe they really were going to get their act together and do a deal? That where it goes down.

The vertical black line is when S&P issued its downgrade, on August 5. Does it look like that pronouncement sent "shockwaves that roiled financial markets"? Actually, they went up. The lowest point on this chart, represented by the right-hand dot, was on July 31/August 1. That's when Washington announced its big spending-cut deal.

It's plain that the markets hate austerity economics and couldn't care less about the downgrade. As for investor confidence, Treasury bonds are doing just fine, thank you very much. (Or is that thankyouverymuch?)

Why wouldn't the markets hate austerity plans? They've been a disaster in Europe, as Robert Reich explains. The Super Committee's been charged with making cuts that would affect the next decade's government spending. But government debt during that period is by no means a serious problem, as Dean Baker and James Kwak have documented.

So we'll ask again: the political obsession with government debt?

3.5 Billion Lobbying Dollars Can't Be Wrong

Kerry, Murray, and Baucus claim that "Standard & Poor's downgrade of America's credit rating was an unprecedented wake-up call for those who have for too long acted as if overheated rhetoric and dysfunction in Washington has no consequences for Main Street and working families."

Simply put, that's nonsense. The downgrade has had no effect on Main Street or working families. Why does Washington have such an irrational -- and bipartisan -- fixation on spending cuts? Maybe it's because lobbying firms spent more than $3.5 billion in 2010 and are probably spending even more this year. The largest corporations benefit from reduced government spending, which eases pressure to raise their tax rates and close loopholes. It reduces the political pressure to raise taxes on their overpaid senior executives, too.

"Too big to fail" banks are now bigger than ever, and nearly 40% of corporate profits go to the non-productive financial sector. So cuts in government spending don't interfere with their productivity, and a stagnant domestic economy doesn't need to interfere with their profits.

"Don't procrastinate," says the Elvis song, "Don't articulate." It's good to hear all the talk about jobs, but for tens of millions of unemployed or underemployed Americans, that's all it is: talk. "It's getting late, and I'm getting upset waiting around."

Promised Land

The president is scheduled to announce his jobs policy after Labor Day. But he has also said that he will proposed a budget-cutting proposal that goes well beyond the cuts the Super Committee is charged with finding, $4 trillion rather than a total of $2.5 trillion under the recent deal. Unless that's an 11th-dimensional chess move designed to free up $1.5 trillion in job programs, which seems unlikely, he's making a tragic mistake. (And even if it is, he's encouraging the wrong-headed economic fixation on debts that got us in this mess in the first place.)

What would a rational economic plan look like? It would first invest in a strong short-term program to create jobs and economic growth. It would address the systemic problems in our health economy, problems which threaten to bring a crushing cost burden on both public and private budgets in the next fifty years. That means reigning in the for-profit health sector.

A smart plan would also provide massive relief to American homeowners, many of whom were hoodwinked by their banks into acquiring three-quarters of a trillion dollars in total debt for nonexistent real estate value. Eliot Spitzer has some excellent ideas for how to go about it.*

Bachmann led a crowd in singing the Elvis hit, "Promised Land." That's the song where people "won't let a poor boy down." Any rational and humane economic program needs to protect services for lower-income Americans, who will immediately spend any assistance given to them. That will stimulate the economy, too.

Washington needs to drop its fixation on premature and misguided spending cuts. Until it does, Americans gazing at the White House and the Capitol Dome will be forced to conclude that common sense -- like Elvis -- has left the building.

* I do have one quibble with the Spitzer piece, and that's the idea of appointing GE CEO Jeff Immelt as a jobs czar. GE shipped 13,000 to India and another 5,000 to Hungary, Mexico, or China. On the other hand, the GE jobs that have stayed in the US are unionized and have excellent benefits. That's good, but I suspect their are better potential job czars out there.