Picture this: You're lying in the dark with a broken leg. Somebody comes by every couple of days to give you water and a little food, but you're wasting away. Suddenly a figure appears holding a candle. In the flickering light we see Tim Geithner's face. "Hey, there!" He says. "Do you realize that if we hadn't acted so promptly, both of your legs would be broken? Good news, huh? Why, you might even be dead without us."

Why didn't you fix it right the first time, you ask.

"That would have been expensive," he says, "and we didn't think there was the political will for that. We recognize more must be done, and we'll ask Congress to take care of it. But look at what we have done."

Geithner's been chosen to bear the Administration's economic message, which is an unenviable task. The White House is going to have change that message, and the policy behind it. Yes, things would have been much worse if they'd done nothing at all to fix the economy. But that's setting the bar a little low, isn't it? They can't change the past, so the fact that they should've asked for a bigger stimulus in the beginning can't be altered now. Still, they can learn from that mistake by being more forceful this time. They need to tell us what it will really take to fix the mess we're in, and then be willing to take their case directly to the public.

Geithner wrote an editorial for the New York Times that reflects everything that's wrong with the Administration's thinking. Their proposals are weak tea, and the messaging is political strychnine. Geithner's piece is entitled "Welcome to the recovery", although the White House is wisely insisting today that they didn't pick the headline. They even claimed that the editors' choice of title was "sarcastic." (I hope they've considered the implications of having an editorial from the Secretary of the Treasury provoke public sarcasm from the editors of the New York Times.)

The White House reportedly wanted to call Geithner's piece "The Case For the American Economy," but that isn't much better than the editors' "sarcastic" title. There have been so many "Mission Accomplished" comments on the Internet about this editorial that you'd think Geithner delivered it from an aircraft carrier.

Not that we're singling out Geithner. Barry Ritholtz is right to point out that this op-ed probably met with great approval in the White House, since it gibes perfectly with the Administration's overall messaging. That's what scares me. Their political game plan for the economy is what Terry in On the Waterfront might have called "a one-way ticket to Palookaville."

Here's what scares me even more: This is an Administration that seems more eager to accept the political reality than to try changing it. According to reports, Larry Summers and others knew the initial stimulus it offered was too small. That means it gave in without a fight on the work that needed to be done.

This may be our moment of greatest political opportunity to do something meaningful about what has become a structural recession (or depression) for millions of Americans. Either Geithner and the rest of the Administration really believe what he writes, or they don't think they can get more and don't want to try. Either way, this historic moment may pass without decision action and Presidential leadership. The consequences will be dire if that happens.

After noting that we face levels of long-term unemployment not seen for more than half a century, Geithner says "we must do more to ensure that (unemployed Americans) have the skills they need to re-enter the 21st Century economy." Shorter version: Goodbye, American manufacturing. Does the Administration really think we're going to work our way out of long-term structural unemployment with training alone? How many fifty-six year old former auto workers does the White House think will be hired in Saginaw, or Flint, or Detroit, once they finish that course in website design?

And let's be clear: That's where the ,jobs would have to be. With 19% of US mortgages underwater (14.7 million in total), a lot of people aren't going anywhere. Their "negative equity" totals $770 billion. That's a lot of money not helping to fuel the recovery (or being saved). The mobile workforce, once the engine of American prosperity, is starting to look like a thing of the past.

The current official unemployment rate (which fails to count a lot of people) is 9.6%. Private employers added 42,000 jobs last month. If we need 13,000,000 jobs to get us to 6% unemployment (which would have been unacceptably high fifty years ago), here's what that means: At the current rate of job growth, without a government jobs program, it will take more than twenty-five years to reach 6% unemployment. Obviously trends can and do change, but that's the environment in which the White House is sending this message.

Try making "the case for the American economy" to an unemployed American with no job prospects who's struggling with an upside-down mortgage -- or, for that matter, to her family, neighbors, and friends. For them she's a warning sign, a reminder that they could be next.

Adds Geithner: "American families are saving more, paying down their debt and borrowing more responsibly." Actually, they're terrified. The Michigan Consumer Sentiment index plunged again in July as job fears and other economic insecurity undermined the nation's sense of security. While some Administration-admired economists have long wanted to "scare" Americans into healthier savings ratios (Mission Accomplished!), an increased savings rate is not the healthy sign it would be under other circumstances. Americans do need to increase their rate of saving, but they need to do it to plan for retirement. This looks more like a deer-in-the-headlights panic that will undermine spending, impede the recovery - and win votes for the opposition party.

Consumer confidence is one of the factors hurting small businesses. But the business owners' confidence is low, too, leading to reduced investment and hiring. That's exactly the effect we don't want. The Wells Fargo/Gallup Small Business Index, which tracks six measures of small entrepreneurs' expectations, is the lowest it's been in seven years of operation:

This survey matches findings from the National Federation of Small Business and other sources. And small businesses aren't just facing reduced demand and long-term fears. They can't get access to the loans they need, either. "Major banks ... are stronger and more competitive," write Geither. "... (O)ur banks are better positioned to finance growth." But they're not doing it. As rational actors, they can't be expected to do it when speculation is so much more profitable. Geithner touts the success of TARP (with numbers that only tell half the story), but TARP recipients are actually stingier with their loans than other banks.

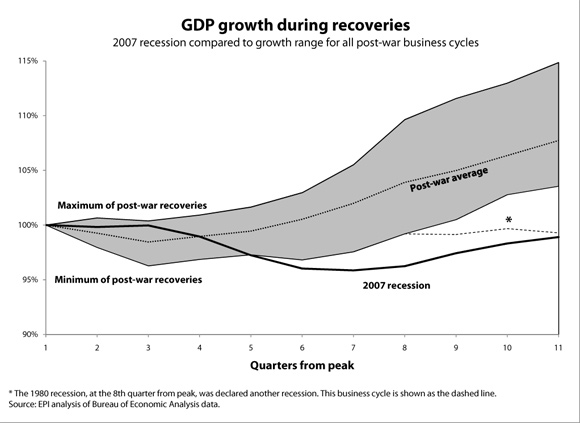

Try making a case for that economy. "We are on a path back to growth," says Geithner. This graph, from Meteor Blades' excellent roundup of economic indicators, says otherwise:

This may read like a hit piece on the White House and Geithner, but it's not. They can and must do better, for the good of the country as well as for their own political futures. They have the ability and the resources to do that, but it will take a fundamental shift in their thinking. How? First, they have to recognize that they're not going to get much recognition for their accomplishments as long as things are this bad. It may not be fair, but life is rarely fair. They must make their case forcefully, laying out stronger job and stimulus proposals. They must demand more banking reform which shuts down the casino, ends too big to fail, and gets banks back into the lending business. And they must draw a clear line between themselves and their opponents. We hear that both Geithner and the President will slam Republicans later today, but for that strategy to work they need to offer a clear alternative. The cheerleading-while-handwringing approach reflected in this editorial isn't it.

We'll take them at their word that they never intended to say "welcome to the recovery." But instead of making "a case for the American economy," they should be making "a case for fixing the American economy." Until they do - and it includes more than just tinkering at the edges - they and the country will both face continued job insecurity.

_______________________________________________________________

Richard (RJ) Eskow, a consultant and writer (and former insurance/finance executive), is a Senior Fellow with the Campaign for America's Future. This post was produced as part of the Curbing Wall Street project. Richard also blogs at A Night Light.

He can be reached at "rjeskow@ourfuture.org."

Website: Eskow and Associates