It is long past time for Vice Chair Janet Yellen, the nominee for Federal Reserve chair, and Chairman Ben Bernanke to describe the Federal Reserve stimulus hoax and the time bomb the Fed created. These Federal Reserve leaders have supported a policy that rewards banks to keep trillions of dollars idle in excess reserves that banks do not lend to businesses or consumers. They have supported the continuing expansion of this time bomb that could cause rapid inflation and rising interest rates and an economic mess if the bomb explodes rapidly.

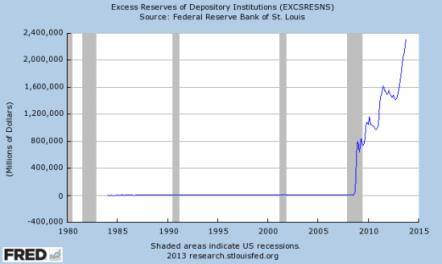

Yellen and Bernanke certainly know exactly what the Fed created and they certainly have seen a diagram similar to the one below from the St. Louis Federal Reserve Bank's data web site called "FRED." The diagram shows excess reserves held at banks. This money is not in private non bank circulation.

The truth is that most of the Bernanke Fed's stimulus began ending in October 2008, one month after the financial collapse. Following many of the comments on stock market TV stations, with pleas to postpone a "taper" of the Fed's money stimulus, the Bernanke Fed's stimulus started sinking five years ago.

The data are overwhelming. From August 2008, just before the financial crisis in September 2008, until September 2013, the monetary base of the country's money supply increased by $2.6 trillion to over $3.5 trillion. That increase was over 4 times its August 2008 amount.

Where did all that money, $2.6 trillion, go? To find out where it went look at the excess reserves in the chart below. Excess reserves were $1.9 billion in August 2008. By September 2013, excess reserves increased by over $2.2 trillion, 1,180 times the August 2008 amount. By September 2013, excess reserves constituted 83.8 percent of the monetary base. Only 16.2 percent of the increase in the monetary base is circulating as currency or required reserves behind private sector deposits. The banks are not required to hold excess reserves, but Fed officials voted to give them a reward for holding the excess reserves. Excess reserves are not part of the 10 percent reserves that banks are required to hold behind customer deposits.

The St. Louis Federal Reserve chart depicts the immense bubble in excess reserves Bernanke and Yellen support with their votes at the Federal Open Market Committee, FOMC, meetings, the Fed's main monetary policy committee.

Why did this happen? It happened in large part because the Bernanke Fed began paying banks interest to hold their reserves during October 2008. On October 6, 2008, the Bernanke Fed's Board of Governors announced it would begin paying interest on the reserve balances of the nation's banks, major lenders to medium and small size businesses, and lenders to consumers.

An excellent economist at the St. Louis Federal Reserve wrote in its March\April 2009 publication: "first, for the individual bank, the risk-free rate of ¼ percent must be the bank's perception of its best investment opportunity."

After a deep depression, the Federal Reserve raised reserve requirements in 1937, a terrible mistake. Milton Friedman and Anna Schwartz asked a question about this similar malpractice: "why seek to immobilize reserves at that time?" The economy went back into a deep depression. The Bernanke Fed's 2008 to 2010 policy also immobilizes the banking system's reserves reducing the banks' incentive to make loans. (See my blog: "Malpractice at the Bernanke Federal Reserve," September 13, 2010.)

What about the $2.2 trillion in excess reserve that I call a time bomb? If short-term interest rates rise above 3 percent, the Fed may have to pay perhaps 3 percent interest on excess reserves to keep the time bomb from exploding into the economy as the banks invest in more lucrative income earning assets. Paying 3 percent interest would send $66 billion to the banks if the banks held $2.2 trillion in excess reserves (plus an additional amount for required reserves on deposit accounts, also called transactions accounts).

Given the concentration in banking, it is doubtful that most of this money would go to depositors, as Milton Friedman expected if there was a highly competitive banking industry. Much of the money would be a gift to bank stockowners.

Since six of the nine directors at each of the twelve Federal Reserve district banks are elected by the banks in the respective districts, some Fed officials might find it desirable to continue to increase excess reserves and the gift to bank stockowners. Some Fed district bank presidents have spoken about reducing the stimulus. For example, the president of the Kansas City district Federal Reserve Bank, Esther L. George, has been voting against the stimulus at the FOMC meetings.

One interesting part of the stimulus hoax is that it holds the Federal Reserve's short-term interest rates down near zero as the Federal Reserve buys $85 billion in Treasury and mortgage securities every month. It is likely that the near zero target could be achieved with much smaller Federal Reserve purchases. However, the time bomb in excess reserves may explode if inflation increases causing interest rates to rise. The Federal Reserve's near zero interest rate target produces tremendous misallocation of resources and severe hardship for those whose income depends on fixed interest securities.

The Federal Reserve officials should gradually stop paying interest on excess reserves and reduce the monetary base to offset any large reductions in excess reserves as the banks buy more income earning assets, such as loans to businesses and consumers. First, the Fed officials, Vice Chair Janet Yellen, the nominee for chair, and Chairman Ben Bernanke should explain to the public and the Congress that the taper began years ago in October 2008. Now the $2.2 trillion in excess reserves that is no longer circulating in the private non-bank sectors are a time bomb that could cause rapid inflation and higher interest rates if the bomb explodes rapidly.