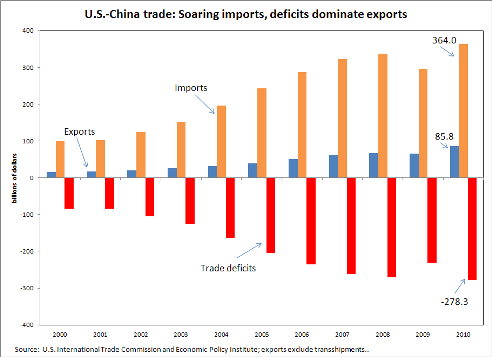

An April 7 column in the New York Times Economix blog highlighted the rapid growth of U.S. exports to China, which look impressive in isolation. But this is a biased and one-sided view -- exports have been overwhelmed by the growth of U.S. imports from China and the bilateral trade deficit, as shown in the graph below. When trying to assess the costs and benefits of the U.S./China trade relationship, counting only exports is like judging a baseball game by only counting runs scored by the home team. It might make you feel good, but tells you nothing about who is winning or losing the game.

Properly measured, U.S. imports from China were $364 billion in 2010, vs. domestic exports of only $85.8 billion (excluding transshipments of goods from other countries), for a trade deficit of $278.3. Even when goods made in other countries are included with U.S. exports, the deficit in 2010 was $273.1 billion, substantially more than estimates reported by the Times ("$180 to $250 billion").

A sizable share of U.S. exports to China is raw materials used to produce goods that are re-exported back to the United States. Four of the top six industries producing exports are waste and scrap products, semiconductors, resins and synthetic rubber and fibers, and basic chemicals.

Sectors such as cash grains (the top export commodity) and waste and scrap support very few U.S. jobs. Such trade may be good for U.S. multinational companies (MNCs), but provides few benefits for the domestic economy. Overall, the large and growing trade deficit with China has displaced millions of U.S. jobs, most in the manufacturing sector which has lost 5.5 million jobs since 2000.

The Economix report relies on data published by the U.S. China Business Council, a trade association representing MNCs doing business in China. These firms have profited enormously by outsourcing production to China. China has subsidized these firms through massive currency manipulation, which reduces the costs of their exports by 25 to 40%, and by pouring tens of billions of dollars into subsides of products like steel, glass and paper products.

U.S. MNCs should not be allowed to dictate U.S. trade policy. The U.S. needs to get tough and demand that China and other currency manipulators revalue their currencies and end other unfair trade practices. Nibbling around the edges with a WTO case for one sector and import surge protection for another will not get the job done. The U.S. should start by threatening to impose large tariffs on all U.S. imports from currency manipulators.