On Wednesday, the Senate Democratic Policy Committee, which I chair, held the first in a series of hearings that will explore how to accelerate the creation of new jobs in America.

Senate Majority Leader Harry Reid (D-NV) has asked Assistant Majority Leader Dick Durbin (D-IL) and I to lead an effort by the Democratic Caucus to develop legislation that will create jobs as soon as possible. The hearing Wednesday was one of the first steps in gathering information we will use to draft that legislation.

The Senate, of course, is currently grappling with the issue of health care reform, and that is certainly a very important matter. But the Obama Administration also inherited a huge financial mess, and the unemployment rate now exceeds 10 percent. For Americans who are out of work, there is no more immediate, burning question than, "Where do I find a job?"

There is no government program that can substitute for a good job that pays well. A key function of government, however, is to create conditions that help businesses grow and hire new workers. That is particularly true of small businesses, which have created nearly two-thirds of all new jobs over the last 15 years.

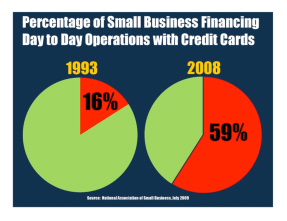

But let me give you an alarming statistic. In 1993, only about 16 percent of small businesses relied on credit cards to finance their day-to-day operations. This made sense, because credit cards are one of the most expensive ways of obtaining financing.

But according to the National Association of Small Business, by April of this year, nearly 60 percent of America's small businesses used credit cards to help finance their day-to-day operations. This essentially means that these small businesses can't get credit any other way. And a business that is relying heavily on credit cards to stay afloat is very unlikely to be thinking about hiring new employees.

How did we get to this point?

Last year, our country was gripped by a financial crisis the likes of which had not been experienced since the Great Depression. Major banks were in peril of going under, and they dramatically scaled back their lending. Many small businesses, which depended on a steady and reliable flow of credit to finance their operations, suddenly had that life blood choked off.

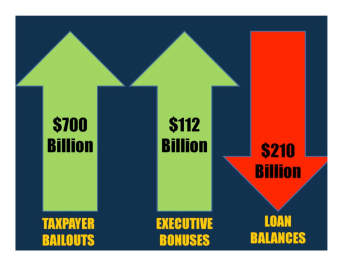

In the middle of that financial crisis, the Bush Administration asked and received authority to use up to $700 billion in taxpayer dollars to keep these major banks from going under, and to put them on a footing where they could resume lending businesses large and small.

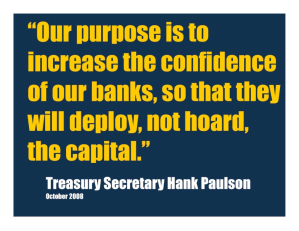

In fact, when he asked for the money, then-Secretary of the Treasury Hank Paulson said that "our purpose is to increase the confidence of our banks, so that they will deploy, not hoard, the capital."

Once the TARP funds had been authorized, Secretary Paulson injected these funds directly into the banks.

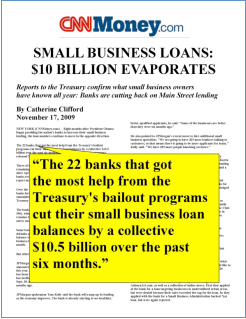

But according to a Treasury Department report released in mid-November, the 22 banks that have receiving the most funding through TARP program have actually cut their collective small business loan balances by $10.5 billion over the last six months.

In fact, the Federal Deposit Insurance Corp. reported last month that U.S. bank loans fell by $210 billion - the biggest drop since the FDIC started keeping records in 1984.

What's especially outrageous is that a lot of these banks are announcing that they will pay tens of billions of dollars in bonuses to their executives, at the same time that they are cutting back lending. The six biggest banks in the country, all of which are TARP recipients, are reportedly planning to pay their executives $112 billion in bonuses in 2009.

So, in sum, this is the situation we are facing with our banks, especially the largest banks:

Clearly, there is something wrong with this picture.

I, for one, had serious reservations about the TARP program from the beginning. One of those reservations was precisely that there was no guarantee that in exchange for being rescued, banks would resume lending.

That was why I opposed that program in the Senate.

But regardless of whether one supported or opposed the TARP program, we should all be equally insistent that any financial institution that has been bailed out should in turn work to help solve this credit crunch.

Our country has a lot of profitable, creditworthy small-business owners. They stand ready to create new jobs right away, and the only ingredient that is missing is affordable credit to expand.